Forex News And Events

Unsurprising Fed Minutes

The FOMC minutes did not hold many surprises, but served to highlight the growing division among policymakers. It is said that the decision to hold off rates was finally made by Janet Yellen. Yet, it appears that several policymakers indicated that raising rates “relatively soon” would be a good thing. The likelihood of a rate hike has not moved much and is now topping at 68%.

We believe that the Fed will raise rates in December in order to save credibility and that nothing more will happen next year. Indeed, normalization rates are several years overdue. We remember the Fed claiming that it would raise rates when unemployment fell 6.5%. This level was reached in April 2014. On top of that, US core inflation has been above the 2% inflation target for almost a year. Actions speak louder than words and we cannot qualify Fed’s actions as hawkish.

From our vantage point, the rationale behind the Fed holding off rates is the massive debt owned by the US government and the fact that higher rates would increase the charge of this debt. Increasing rates 0.75% would still keep debt manageable. The Fed must pay this price to salvage its credibility. Currency-wise, at the moment, the dollar keeps on strengthening and we should see the EUR/USD breaking 1.1000 in the short-term. The American elections are now the new market focus.

Asia Back To Driving Markets

After a brief hiatus Chinese data has come roaring back into focus. Soft data from China increased speculation that global growth is unstable. In US terms, China September trade surplus widened $41.99 bln against $53 bln eyed, with exports falling -10% y/y, imports -1.9%, while a positive read was expected in both cases. However, Chinese commodity imports surged. The result of the weak data was quickly felt across financial markets. Regional equity markets indices and US stock futures fell and global yields reversed their bullish momentum. The weak data indicated that the PBoC will maintain its loose monetary policy and sustain its gradual trade, weighted by RMB deprecation. China's aggressive pursuit of a weaker currency policy will likely generate a deflationary impulse felt in the west, while providing additional conjectural support to the dovish Fed member’s decision not to hike rates.

Elsewhere in Asia, pressure mounts on Thailand's financial markets in the wake of King Bhumibol Aduleyadej’s death. In addition, there are mounting security concerns as the police issue fresh warnings of a bomb plot. There are also increasing concerns that probability of social instability will increase. Over the past tumultuous decade, the monarch has provided a moderating influence to a significantly divided political environment. The stock exchange of Thailand's (SET Index) fell 3.20% today, which culminated in a -11% drop since last week. THB continues to be sold across the board, as USD/THB climbed to 35.87 (below yesterday 35.90 high), off nearly 4% since Oct. 3. Given the political uncertainty, we expected USD/THB to trade higher, our near-term target is 36.

The Risk Today

Peter Rosenstreich

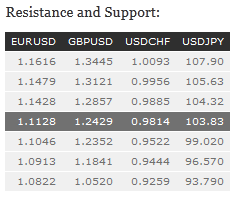

EUR/USD keeps on weakening towards support given at 1.0952 (25/07/2016 low). Key resistance is located far away at 1.1352 (18/08/2016 high). Further decline is favoured. In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD's sell-off continues after last Friday's flash crash. Resistance stands far away at 1.2620 (declining trendline) then 1.2873 (03/10/2016). Support base is now building from 1.2090 (11/10/2016 low). Expected to show continued downside pressures. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY is ready to head back higher. The ongoing momentum is mixed despite the pair being in a short-term uptrend channel. Hourly support is located at 102.81 (10/10/2016 low) and 100.09 (27/09/2016). We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is consolidating but remain on a bullish momentum since September 15. Hourly resistance at 0.9950 (27/07/2016 high). Support can be located at 0.9733 (05/10/2016 base) then 0.9632 (26/08/2016 base low). Expected to see continued increase. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.