Ashland Global Holdings Inc. (NYSE:ASH) announced the completion of its acquisition of a composites resin manufacturing facility from Reichhold Holdings International B.V., in Etain, France. The addition of Etain facility reinforces Ashland’s foothold in the European composites market.

The acquired facility makes unsaturated polyester resins (UPR), which is used in various end markets including construction and transportation. The Etain technology in wind energy applications and automotive will enable Ashland to supplement the extensive composites product portfolio in Europe and provide support to both existing and new customers.

Reichhold said that the divestiture was an integral part of achieving the closure of its earlier announced merger with Polynt.

The acquired business, along with the existing facilities of Ashland in Finland, Poland and Spain, positions the company well to deliver improved customer service and also support growth opportunities across Europe, moving ahead.

Ashland recently closed the acquisition of Pharmachem Laboratories, Inc., a leading provider of quality ingredients to wellness and health industries and high-value differentiated products including flavor and fragrance houses.

The strategic buyout offers substantial growth opportunities in high-margin end markets. It will also help the company to strengthen existing businesses with advanced processing formulation and knowhow. Moreover, it will fortify Ashland’s foothold in the fast-growing nutraceutical end markets and open up opportunities within flavors and fragrances.

The company is expected to leverage its extensive sales channels, global application labs and technical service networks to accelerate Pharmachem’s growth.

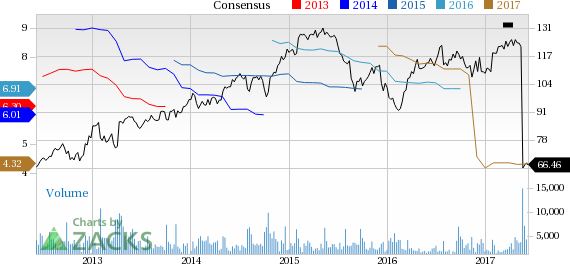

Ashland’s shares have declined 45% in the last three months, underperforming the Zacks categorized Chemical-Specialty industry’s gain of 2.6%.

In the fiscal second-quarter earnings call, the company announced that it witnessed year-over-year growth in sales and volume of Specialty Ingredients, as well as sales growth of Performance Materials and volume growth in Composites segments. Within Ashland Specialty Ingredient (ASI), it is driving volume and sales growth in majority of key end markets, including Personal Care. Moreover, within Ashland Performance Materials (APM) segment, both Intermediates and Solvents (IS) and Composites have raised prices to partly mitigate the impact of inflation in raw material prices in the second half of fiscal 2017.

However, a strong dollar and escalating cost of raw materials acted as deterrents in the fiscal second quarter. Ashland expects a combined impact of roughly $14 million for the second half of fiscal 2017. To minimize the impact of incremental expense, the ASI team has been working on strategies to reduce costs and implement price increase moving ahead.

Ashland currently carries a Zacks Rank #3 (Hold).

Other Stocks to Consider

Some better-ranked companies in the basic materials space include Huntsman Corporation (NYSE:HUN) , ArcelorMittal (NYSE:MT) and The Chemours Company (NYSE:CC) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Huntsman has expected long-term earnings growth rate of 7%.

ArcelorMittal has expected long-term earnings growth rate of 11.6%.

Chemours has expected long-term earnings growth rate of 15.5%.

3 Stocks to Ride a 588% Revenue Explosion

At Zacks, we're mostly focused on short-term profit cycles, but the hottest of all technology mega-trends is starting to take hold...

By last year, it was already generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. See Zacks' Top 3 Stocks to Ride This Space >>

Ashland Global Holdings Inc. (ASH): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

ArcelorMittal (MT): Free Stock Analysis Report

Original post