After a solid start to the year—and a torrid 2014—REITs have really stumbled of late. With bond yields rebounding off of their lows and Fed Chair Janet Yellen slowly moving in the direction of raising short-term rates, investors seem to be having second thoughts about the sector.

Their fears aren’t completely unwarranted. Higher bond yields should, all else equal, push down the prices of bond substitutes like high-dividend REITs. So, if you’re buying REITs today, you have to have a fairly benign forecast for bond yields.

In my Dividend Growth model, about 25% of the portfolio is invested in equity REITs, so this is not a hypothetical question for me. As an outsized portfolio position, as go REITs, so go my Dividend Growth model.

Let me be clear: I do not see Janet Yellen raising short-term rates more than 0.25% to 0.50% over the next 12 months. In fact, even a modest hike may be too ambitious unless the economy perks up. Consumer spending has sagged for two consecutive months and lower gasoline prices have yet to translate into higher consumer spending. And the core inflation measure that the Fed tracks, which excludes energy and food, is up about 1.3% in the 12 months through January…significantly below the Fed’s 2% target. Unless something fundamentally changes in the next few months, Yellen will err on the side of keeping rates low.

Meanwhile, I think we’ve already seen the big move in longer-term Treasury yields for the year. The 10-year yield might drift to 2.4%-2.6% by the fourth quarter. But I don’t expect it to push much past 3.0%-3.2% for the remainder of this decade. High demand for fixed income from retiring Boomers and from foreigners escaping even lower yields at home should keep a lid on yields for a long time to come.

Bottom line: The big upward move across the yield curve that REIT investors dread is still several years away.

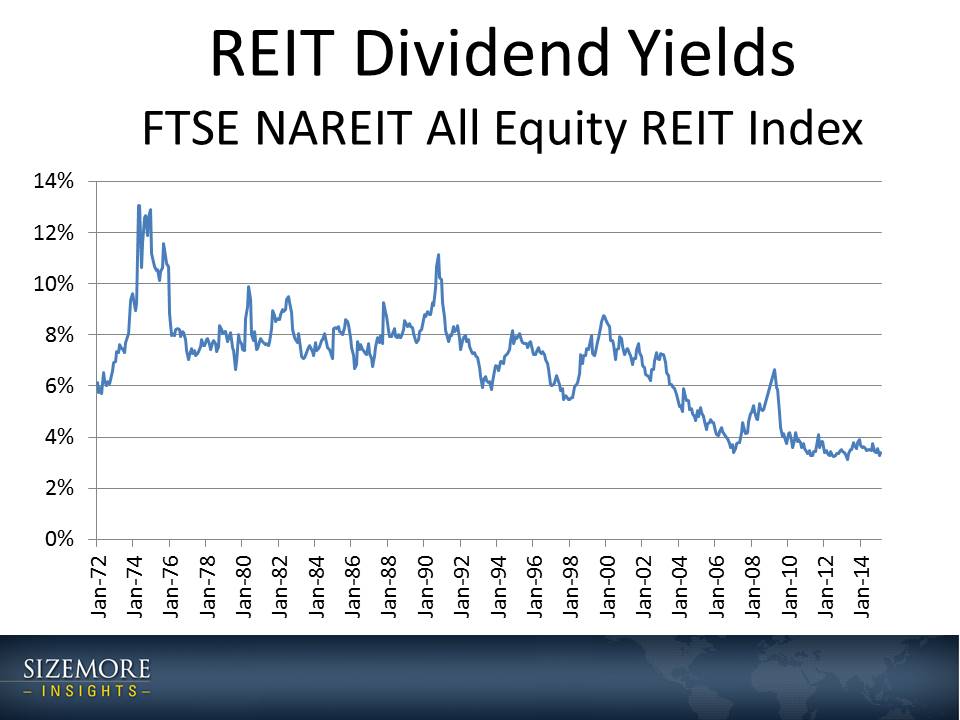

And the good news here is that, despite the run-up in REIT prices last year, we still have a moderate margin of safety in place. The FTSE NAREIT All Equity REITs index, a broad benchmark used to track the REIT sector, sported a dividend yield of 3.41% as of the end of February. That looks low relative to the 7%-8% yields that were typical in the 1980s and 1990s, but it’s about on par with the average yields that have prevailed since 2006, excluding the October 2008-March 2009 crisis-induced yield spike. And the spread above the 10-year Treasury yield, at 1.4%, is not out of line with the average of the past decade.

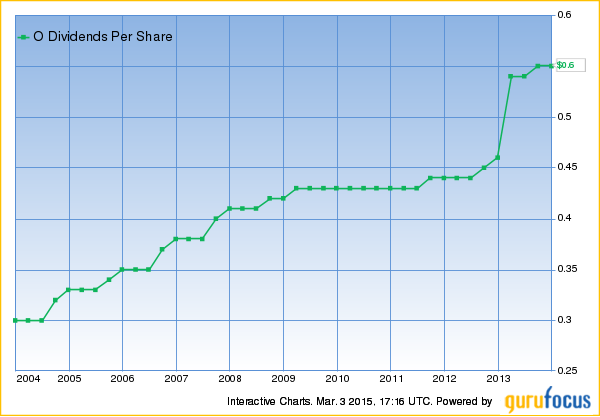

And most importantly, REITs—unlike bonds—do not have fixed payouts. If managed well, their dividends grow over time. Let’s consider Realty Income (NYSE:O), the blue chip of the triple-net REIT space and one of the Dividend Growth model’s longest-held holdings.

Over the past 10 years, Realty Income has raised its dividend at a 5% annual clip. That’s very solid for a company whose business model is about as exciting as watching an English cricket match on TV. But the consistency goes beyond that. With its most recent dividend hike in January, Realty Income has boosted its monthly dividend 79 times in the past 20 years and in 70 consecutive quarters. And as a result, Realty Income was rewarded with membership in the exclusive S&P High Yield Dividend Aristocrats Index.

As much as I like Realty Income as a long-term holding, there is a price at which I would no longer be interested. If Realty Income’s yield dropped below 4%, I would stop buying new shares, and if it dropped much below that I would consider selling and taking profits. But at today’s current yield—4.5%—I still consider Realty Income an exceptionally attractive holding in a diversified income portfolio.

Disclosures: Long O.

Charles Lewis Sizemore, CFA, is chief investment officer of the investment firm Sizemore Capital Management and the author of the Sizemore Insights blog.