This is a repost of the recent Palisade Market Commentary –

This morning, just as I had published my latest macro-piece – ‘Ground Zero’: Will the Dollar Shortage Kick Off The Next Financial Crisis? – I watched the market get whacked.

The Dow Jones Industrial Average collapsed roughly 3.3% – more than 800 points.

But honestly – I wasn’t surprised. This was bound to happen. . .

As ‘real’ rates (adjusted for inflation) begin rising – which finally began a few days ago – the market and economy will start feeling the tightening.

Plus, the longer equities stayed at extremely high levels (seriously over-valued by key indicators), the more ‘tail-risk’ (sudden, random crash) there was.

But something else happened today that’s extremely rare and did surprise many.

Bonds also fell. . .

‘Conventional market wisdom’ says that when stocks suffer a sell-off, it spurs a buying spree for Treasuries and Government bonds as investors rotate into liquid and ‘safer’ assets.

But that didn’t happen today.

“There’s no flight to safety in bonds. That’s a sea change,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group.”

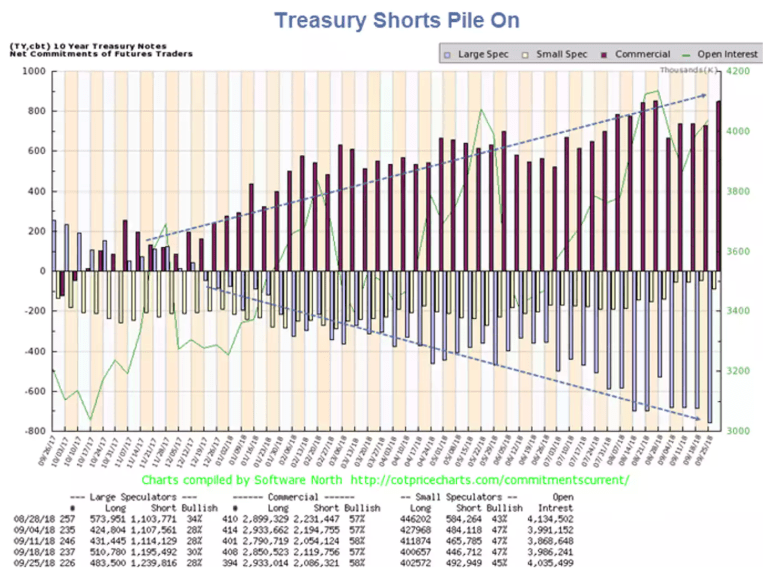

The sharp plunge this afternoon in stocks is also happening as the markets continue shorting bonds at a massive pace.

That means investors are expecting – and betting on – higher yields (to short bonds means lower bond prices – and lower prices mean higher yields).

“But aren’t higher yields good for bond buyers? Won’t investors buy more for the increased interest rate?”

Yes – and no.

Economist Joseph Stiglitz taught us that sometimes – no interest rate is high enough to justify the lending risk.

This is called a ‘Backward-Sloping Credit Curve’ – and I’ll write more about this topic in an article very soon.

But – in short – it means the market doesn’t think the debtors will be able to pay back the bonds at such high interest costs. Thus not worth giving them a loan (i.e. buy their bonds).

We saw this happen many times throughout history when financial panics arise. For example: in the late 1990’s Asian Contagion and with Greece in 2010.

But It’s also happening today in places like Italy and the Emerging Markets.

I’m not saying this will happen in the U.S. (at-least anytime soon). But it’s important to think about, especially when everyone touts how safe and secure bonds are.

But – back to earlier today. . .

This rare trade – falling stocks and bonds – is a signal that there will be more selling ahead. And to expect increased volatility (the VIX surged 45% today).

Not even the U.S. dollar was ‘secure’ enough during this crash.

So what was?

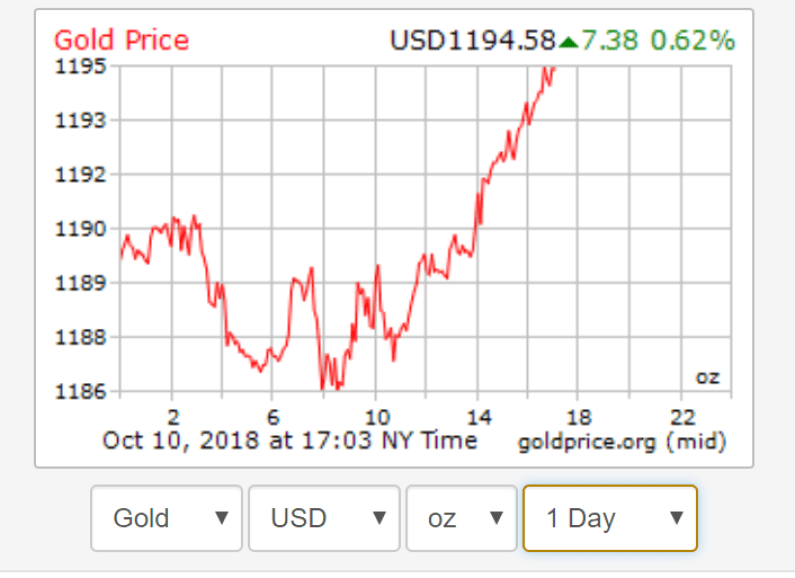

Well, gold – it was a safe asset for investors today.

It didn’t soar – but it caught bids when most everything else tanked. Clearly there was interest.

And with the traditional safety plays not working how they usually do – investors will look for other choices and safe bets that will do well instead.

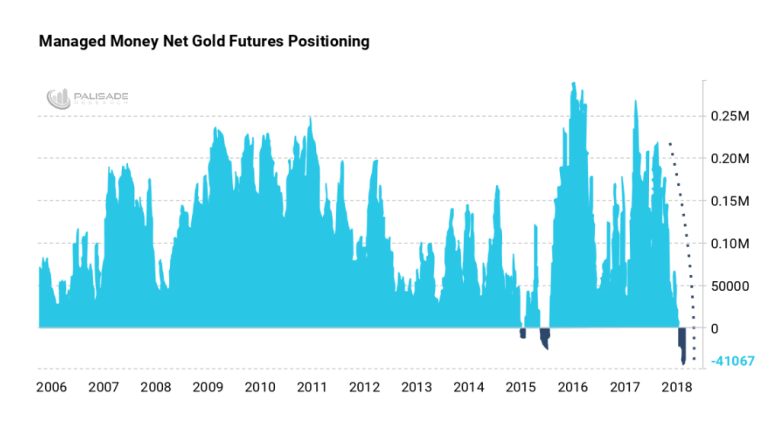

Now, throughout the last few months – we’ve seen the GLD (NYSE:GLD) (gold) being brutally shorted at record amounts (which was only kicked off from a strengthening dollar and increased tightening by the Fed).

Don’t be surprised to see Hedge Funds and managed money start rushing to unwind these short bets.

Now that they see traditional ‘safe’ trades not working – they don’t want to risk suffering huge losses when the price of gold rallies.

Remember, when you end a short position – you must ‘buy it back’ (known as buy to cover) to close it out.

This added demand from ‘buying to cover’ will push prices higher – causing a ‘reflexive’ rally for gold.

And the higher gold goes, the more the record shorts get squeezed out. This pushes it even higher as they close out even more. And soon a nice feedback loop takes hold as the markets perception of gold turns bullish (i.e. reflexivity).

I wrote about this record short gold topic and why it matters in early September (click here to read). All this (and more) is why I think gold will outperform sooner than later.

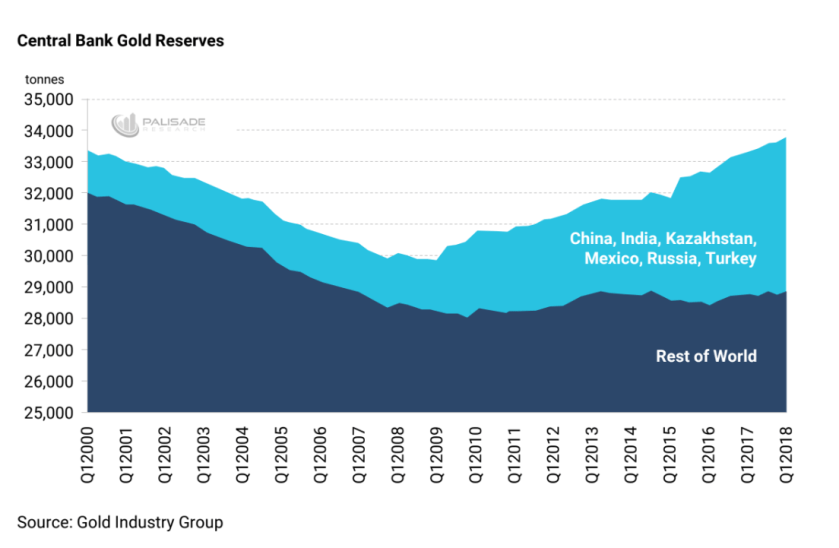

I still believe that with ‘peak gold’ production ending and worldwide Central Bank buying (read our piece here), there’s a sturdy ‘floor price’for gold here – and going forward it’s an asymmetric opportunity (low risk – high reward).

For instance – think about it this way. . .

If gold’s held its own against a strong dollar, tightening Central Banks, and higher ‘real’ yields – imagine how well it will do when the dollar weakens and Central Banks resume easing to stimulate growth.

Today was a harsh – yet interesting – day for traders.

Let’s stay focused and see what happens going forward.

With Mr. Market starting to act ‘unconventional’ and as global liquidity dries up – expect volatility to surge and other ‘safe’ assets like gold to come into favor.