- SanDisk merging into WDC for a price tag of $19 billion.

- Revenue grows nearly 3%.

- SSD attach rate on enterprise notebooks seen rising to 39% in 2017.

SanDisk Corporation (NASDAQ:SNDK) exceeded expectations in 1Q2016 as the company benefited from a strong SSD demand during the quarter. Expansion into enterprise SSD space also offers an attractive trajectory to future growth. SanDisk is on the verge of being acquired by Western Digital Corp (NASDAQ:NASDAQ:WDC) for $19 billion.

What do SanDisk’s expansion efforts and pending acquisition mean for the investors? This SanDisk analysis article examines the issues. But first, here is a quick recap of SanDisk’s 1Q2016 earnings results, which could be the company’s last financial report before it merges into Western Digital.

1Q2016 summary

SanDisk Corporation (NASDAQ:SNDK) posted adjusted EPS of $0.82 in 1Q2016, a strong increase from $0.62 in the corresponding quarter a year earlier and a comfortable beat of the consensus target of $0.55.

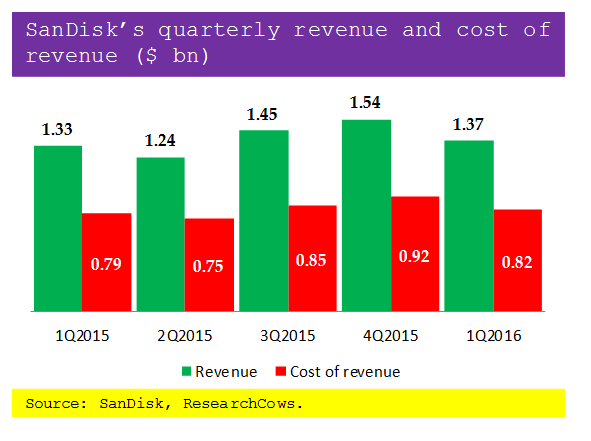

Revenue reading of $1.37 billion rose 2.5% YoY and topped internal guidance of $1.18 to $1.25 billion. The consensus estimate called for revenue of $1.22 billion for the latest quarter.

The strong gain in bottom-line was attributed to lower expenses as the company encountered lower merger and operating costs compared to a year ago.

The chart below shows SanDisk’s revenue and cost of revenue for the last five quarters:

What’s exciting about?

- Acquisition by Western Digital

The latest earnings report (1Q2016) could be SanDisk Corporation (NASDAQ:SNDK)’s last before it become a part of Western Digital. The companies struck a $19 billion buyout deal late last year. Western Digital is betting that SanDisk will enable it to expand scope and diversify operations in the memory market at a time when the semiconductor industry is consolidating.

As for SanDisk, the deal will provide fresh funding that the company can use to improve its product innovation efforts and fend off increasing competition in its industry. The management also viewed selling the company as a strategic move to maximize value for shareholders in the face of semiconductor industry consolidation.

The merger of SanDisk and Western Digital is expected to close in 2Q2016. If the deal goes through, SanDisk shareholders are in for an attractive payout. But if the deal fails, all will not be lost because SanDisk is in the process of retooling so that it can fuel topline growth and maximize profits. There is also $185 million in breakup payout in favor of SanDisk if the deal falls apart.

- OEM partnerships

To fuel sales and bring stability to its business, SanDisk has come up with a strategy whereby it is seeking out direct partnerships with OEMs for the supply custom memory solutions. So far, SanDisk counts Apple Inc. (NASDAQ:NASDAQ:AAPL) and Nvidia Corporation (NASDAQ:NVDA) among its custom memory customers. Having these well-known brands on board could generate favorable network effect for SanDisk in the custom memory market.

With Apple, SanDisk is supplying custom memory components for iPhones and for Nvidia the company is supplying custom memory for Tegra 4 tablets. Nvidia could be a particularly important OEM partner for SanDisk considering that the company is desperate to stave off competition from Advanced Micro Devices, Inc. (NASDAQ:NASDAQ:AMD) by using its own line of hardware to promote its GPUs.

- Enterprise SSD potential

The advancement in technology has helped to lower the cost per GB for SSD products and the lower costs are fueling the demand for SSDs in enterprise environments. Trends such as BYOD are also helping boost SSD adoption in enterprise. The one particular area that is seeing strong SSD attach rate is the notebook market. According to SanDisk’s own estimates, SSD attach rate for both business notebooks will increase to 39% in 2017 from 16% in 2013.

Given its product innovation track record, SanDisk Corporation (NASDAQ:SNDK) looks well-placed to take advantage of the strong demand for enterprise SSD.

- Strategic acquisitions

SanDisk is sparing no effort to enhance its play in the SSD market. The company is using acquisitions to complement its internal SSD efforts. SanDisk’s recent SSD-themed acquisitions include Fusion-io, for which it paid $1.1 billion in cash to add to its portfolio. The acquisition of Fusion-io added key SSD technology and scope to SanDisk.

The other’s other recent SSD-facing buyouts include Pliant Technology, SMART Storage Systems and FlashSoft. Through these acquisitions, SanDisk has been able to benefit from technologies that would have possibly taken it years to develop internally.

What’s worrying about SanDisk?

- Tough competition

Memory industry has become increasingly competitive in the recent times. SanDisk Corporation (NASDAQ:SNDK)’s problems in the traditional NAND memory market compounded following Micron Technology, Inc. (NASDAQ:NASDAQ:MU)’s acquisition of Elpida, which boosted its share of the market.

Competitive pressure is also intense in the emerging SSD market. In that market, SanDisk is battling competition from established player and new entrants such as Seagate Technology PLC (NASDAQ:NASDAQ:STX).

- Dangerous revenue concentration

SanDisk depends on a small group of customers for a significant portion of its revenue. For example, top 10 customers contributed about 44% of 2015 revenue. Although revenue concentration in 2015 improved from 48% in 2014 and 49% in 2013, the concentration is still a cause for concern.

When a company depends on a small group of customers for a significant portion of its income, there is always pressure to impress those customers. But that can lead to lower profits as margins are squeezed to offer favorable pricing. Moreover, a loss of a high-profile customer can cause significant growth disruption or even trigger the exit of other key customers.

- Cumbersome business model

SanDisk Corporation (NASDAQ:SNDK) generates a significant portion of its revenues and profits from license fees and royalty agreements. While these arrangements ensure a steady flow of revenue and makes planning easier for the management, they also pose risks. For example, when license and royalty agreements have run their course, renewal usually goes through a long process and can create a huge certainty in the company’s growth plan.

- Business cyclicality

Semiconductor industry is quite cyclical. While SanDisk is already used to the cyclicality of its industry and can plan well for the foreseen deep in sales, sometimes things deteriorate beyond expectation, thus throwing a monkey wrench in the works for the management.

Shareholder returns

SanDisk Corporation (NASDAQ:SNDK) typically returns value to shareholders through shares repurchases and dividends. For instance, the company recently distributed $1.44 billion to shareholders in the form of dividends and repurchases.

Takeaway

Whether SanDisk Corporation (NASDAQ:SNDK) ends up merging with Western Digital or retains its independent life, investors are poised to win in the end.