The number of exchange-traded funds (ETFs) with thematic offerings continues to grow. These funds typically focus on a wide variety of asset classes, industries or market capitalizations, ranging from commodities to bonds, foreign exchange (forex), artificial intelligence (AI), financial technology (fintech), genomics, robotics, consumer staples, real estate, social impact and space.

There are currently well over 2,000 ETFs in the U.S., illustrating just how crowded the fund space is becoming. According to recent metrics, the largest ETF issuer in the U.S. is BlackRock, which has "managed assets amounting to approximately $2.1 trillion." Next in line are Vanguard, State Street, Invesco and Charles Schwab. These institutions offer a wide range of funds that could appeal to many individuals. Other smaller issuers, such as ARK Investment Management, also continue to make headlines.

As the number of retail investors who shift some of their portfolios to funds increases, we can expect new funds, especially with a thematic focus, to continue to come to the market. Advances in technology, changes in society, emerging climate issues, the increase in wealth worldwide and developments around COVID-19 have been behind the ETF themes that have become popular in the past several quarters.

However, an exciting theme does not always mean a successful investment vehicle. Therefore, as always, potential investors would need to do considerable due diligence before committing funds to new or established funds. Today, we introduce two new ETFs that deserve further research.

1. Franklin Exponential Data ETF

Current Price: $24.53

52-Week Range: $21.93 - $27.60

Expense Ratio: 0.50% per year

The Franklin Exponential Data ETF (NYSE:XDAT) invests in businesses that are at the center of big data, or as the Research Data Alliance (RDA) states:

"The large volume of data – both structured and unstructured – that inundates a business on a day-to-day basis.... Big data can be analyzed for insights that lead to better decisions and strategic business moves."

All charts powered by TradingView

XDAT provides access to firms that focus on data infrastructure, data analytics, as well as the innovative data applications in areas that range from AI to machine learning, virtual reality, software-as-a-service (SaaS), consumer spending habits, health care and advertising.

Recent research by Maryam Farboodi of the MIT Sloan School of Management and Laura Veldkam of Columbia University highlights:

"Big data technologies, like machine learning and artificial intelligence, are prediction algorithms... Much of the data firms use for these predictions is transactions data. It is personal information about online buyers, satellite images of traffic patterns near stores, textual analysis of user reviews, click through data, and other evidence of economic activity. Such data is used to forecast sales, earnings and the future value of firms and their product lines."

Put another way, analysis of big data could lead to increased profits for commercial businesses. It could also be used by governmental organizations to advance citizen and social services as well as to potentially increase their power. Therefore, we are likely to witness further growth in the use of data in many aspects of personal and professional lives.

XDAT, an actively managed ETF, started trading in January 2021. It is a small fund with about $2.3 million in assets. Its benchmark is the Russell 3000 Index, from which fund managers identify companies they believe are positioned to capitalize on the exponential data theme.

In terms of sector allocations, Interactive Media & Services have the highest weighting (28.88%), followed by Systems Software (20.60%) and Application Software (14.65%). Among the leading names in the roster are Facebook (NASDAQ:FB), Pinterest (NYSE:PINS), Google's parent company Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Snap (NYSE:SNAP) and Twilio (NYSE:TWLO). The top 10 stocks comprise close to 40 of the fund.

Since its inception in January, XDAT is down about 5%. As the new earnings season gets under way, many of the names in the fund are likely to be volatile. Interested investors might regard a decline toward the $20-$21 level as a better entry point.

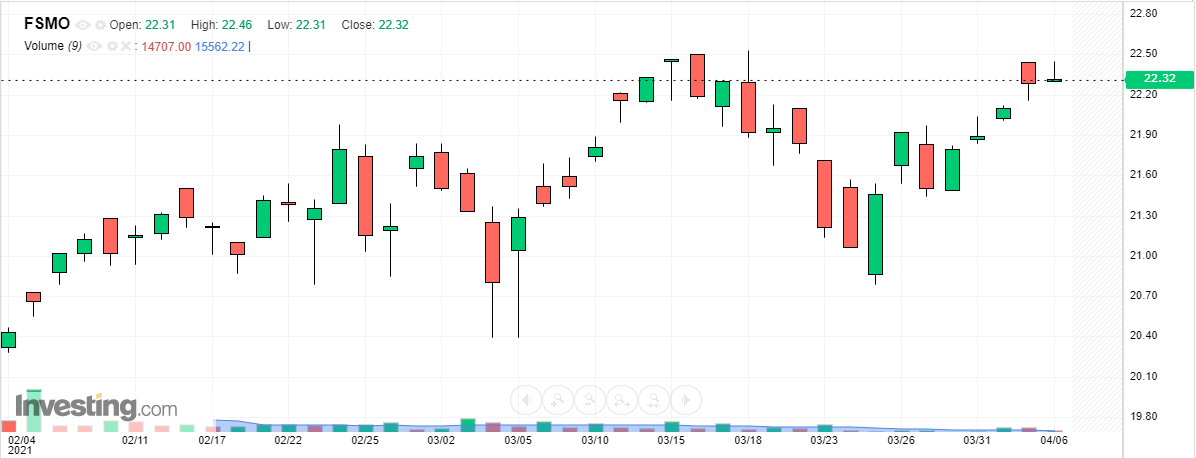

2. Fidelity Small-Mid Cap Opportunities ETF

Curent Price: $22.32

52-Week Range: $20.29 - $22.54

Dividend Yield: 0.18%

Expense Ratio: 0.64% per year

The Fidelity Small-Mid Cap Opportunities ETF (NYSE:FSMO) is another actively managed ETF. It started trading in early February 2021. It gives exposure to global firms with small to medium market capitalizations.

We recently covered this space, emphasizing the potential for growth for such domestic businesses. FSMO might be of interest to readers wanting to add several non-U.S. companies to their portfolios. Currently, about 10% of the holdings come from outside the U.S.

As a non-transparent fund, FSMO releases its holdings once a month. Its benchmark index is the Russell 2500 Index. According to the last disclosure, the top 10 stocks make up close to 14% of net assets of about $16 million. In terms of sectoral breakdown, industrials have the largest slice (17.84%). Next in line are consumer cyclicals (17.55%) and financial services (17.44%).

Among the leading names are the manufacturer of power generation equipment Generac (NYSE:GNRC); Tapestry (NYSE:TPR), which designs luxury accessories and lifestyle collections; flooring manufacturer Mohawk Industries (NYSE:MHK); Signature Bank (NASDAQ:SBNY); and Five9 (NASDAQ:FIVN), which provides cloud software for contact centers.

Since its inception two months ago, FSMO has returned about 10%. We believe the fund deserves to be on your radar.