This time, the Chinese government is putting pressure on cryptocurrency miners and investors through commercial banks and financial institutions: clearing, payments and cryptocurrency insurance are under a ban. Despite foreign registrations, the biggest Chinese crypto exchanges have reduced the list of services, and the crypto market has shrunk by $1 trillion in two weeks.

The leader of the Chinese market is Huobi with $18 billion worth of daily trading volumes, the second is OKEx. Given the issues at hand, Huobi has stopped providing leverage to new users “from several countries and regions” – for which read, China; and OKEx has closed its crypto trading pairs with the yuan, starting from Monday, 24th May. Huobi with its 8th by capacity mining pool in the world is closing access to the residents of continental China. The Chinese negativity has triggered a cryptocurrency sale with a subsequent conversion of stablecoins into yuan, which caused 12% volatility in USDT/CNY. While Chinese traders were trying to sell their cryptocurrencies and get yuan , while it still was possible; Western investors were buying the devalued coins. Glassnode reports that the whales (10,000 to 100,000 BTC) bought 123,588 BTC during the downfall. The buying was mainly going in the U.S. as Bitcoin was trading with a premium of $3,000 during the fall, compared to other crypto exchanges.

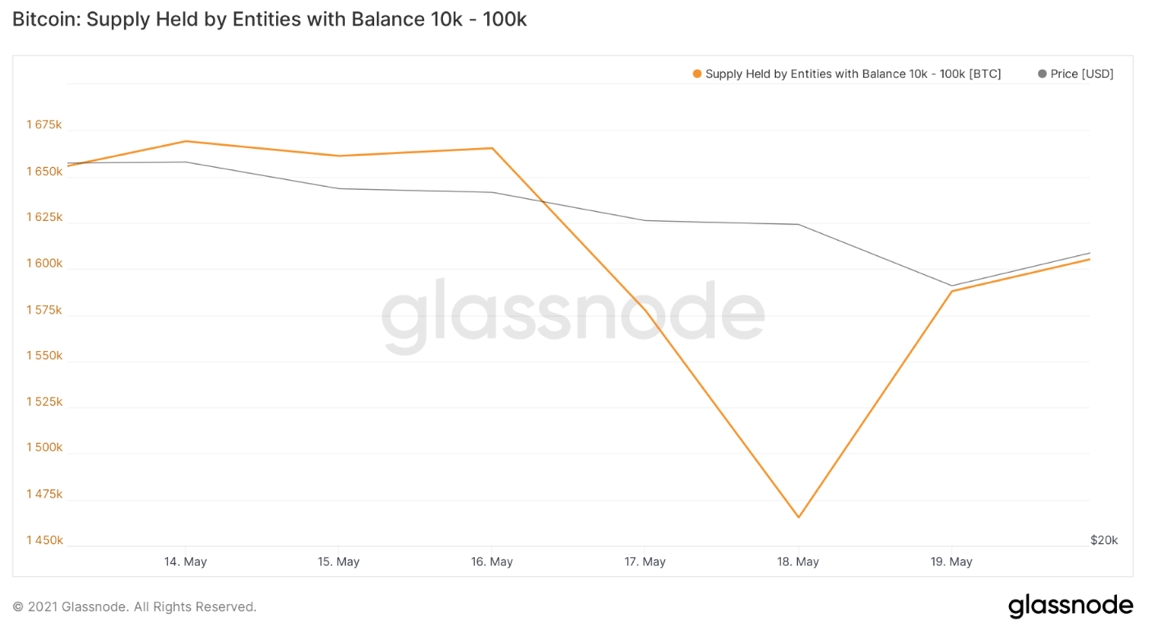

The Chinese negativity has triggered a cryptocurrency sale with a subsequent conversion of stablecoins into yuan, which caused 12% volatility in USDT/CNY. While Chinese traders were trying to sell their cryptocurrencies and get yuan , while it still was possible; Western investors were buying the devalued coins. Glassnode reports that the whales (10,000 to 100,000 BTC) bought 123,588 BTC during the downfall. The buying was mainly going in the U.S. as Bitcoin was trading with a premium of $3,000 during the fall, compared to other crypto exchanges.

China accounts for around 50% of the world’s hashrate and 60% of perpetual future contracts volumes. Another series of persecution of miners and investors can cause global changes in the structure of the world’s crypto finances.

In early November 2020, the Director of National Intelligence John Lee Ratcliffe wrote an address to the SEC Chairman Jay Clayton suggesting allowing American companies to compete with China in the field of digital currencies. Possibly, in the near future the USA will lead the way in terms of hashrate and cryptocurrency trading volumes.