The top two cannabis companies in the world have revealed their latest earnings reports and the picture is far from encouraging.

Aurora Cannabis (NASDAQ:ACB) (TSX:ACB) and Canopy Growth (NASDAQ:CGC) (TSX:WEED) both showed significant drops in revenue when they reported late last week. And with those numbers came statements from officials of both companies that they will be making significant shifts moving forward.

Consider this a major turning point for the fledgling legal cannabis industry—when the biggest players in the sector have recognized that doing it all may not be the way the game can be played.

Prioritizing, specializing and carving out a niche will be more practical and profitable.

This is what Aurora Cannabis CEO Miguel Martin said after reporting Q2 results on Feb. 9:

"Profitability is our primary focus. As people look at the impact of [the recreational market] to the [profit and loss statement], closing down our Polaris and Sun facilities are almost entirely connected to what we did in the rec business. The other parts of our business are growing."

Basically, streamlining operations in the adult recreational market will reduce the drag on other parts of the Aurora operation. Aurora is the leading medical marijuana producer in Canada. Sales in that division, according to the latest quarter increased 18%. But its overall revenues dropped 10%.

The company posted a C$75.1 million (US$59.03 million) loss as sales in its recreational cannabis division took a whopping 48% drop.

Shares of Aurora Cannabis jumped in the latter half of last week, going from US$4.16 before the company reported its earnings to a high of US$4.81. They settled back down slightly, closing yesterday at US$4.33, a gain of 3.5% on the day and up 4% compared to the same time last week.

Meanwhile, over at Canopy, media reports quoted CEO David Klein explaining the company plans to concentrate on premium products.

Klein said:

“We're really focused on premium and mainstream [products], understanding that [it’s] going to cost us market share in aggregate. The good news is it's taken us a while to get our production techniques and assets in line in order to produce that high THC but we're starting to see a lot of that hit the market now and we're getting really good response from consumers and budtenders. So we're going to keep driving in that direction.”

Canopy saw an 8% drop in its overall Q3 revenues, hitting C$141 million (US$110.83 million), including a 28% drop in its business-to-business sales. This contributed to its C$67.4 million (US$52.98 million) EBITDA loss.

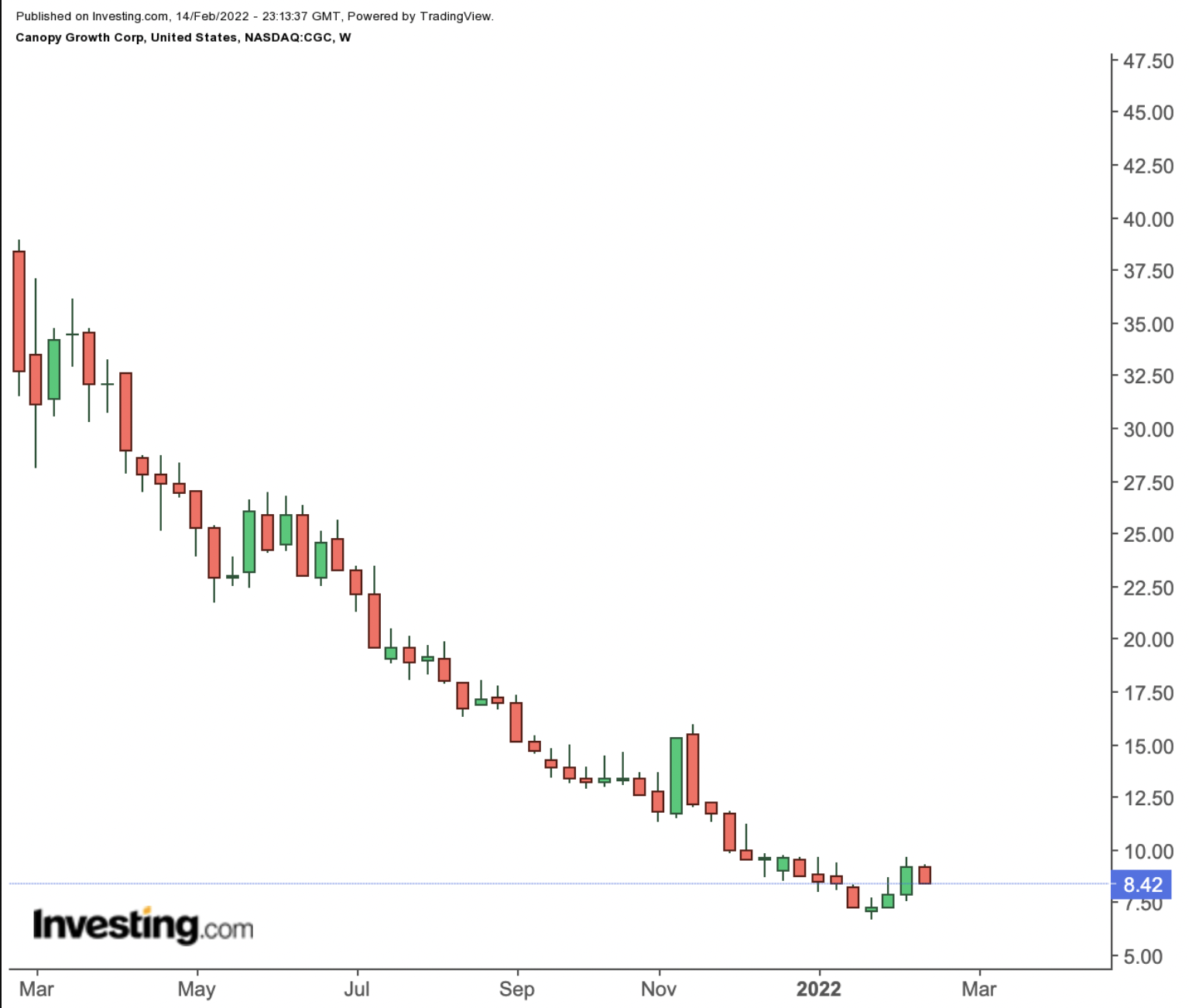

Shares of Canopy Growth went from a pre-reporting close of US$7.67 to hit a recent high of about US$9.42 on Feb. 11. They closed yesterday at US$8.42, down more than 8.5% on the day, but up about 9.5% compared to the same time last week.