Just as no news is good news, the resilience of an overheated market is viewed as a sign of strength. The cryptocurrency market bounced after the pullback that began last week. The desire to make quick profits at the expense of the market decline came to the forefront. Investors opened positions, buying assets at a steep discount. As a result, the crypto market came close to a total capitalization of $2.1 trillion again as we approached the end of the business week.

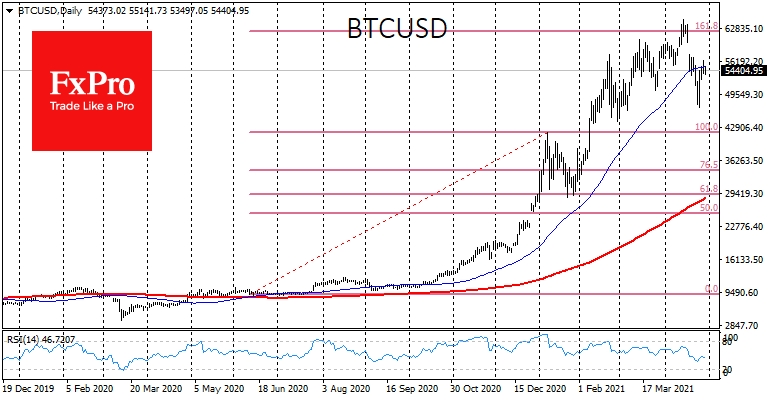

Nevertheless, there is cause for alarm. Despite Bitcoin's ability to hold at relatively comfortable price levels for crypto market participants, the technical analysis points to a problem. The daily charts show that bitcoin's recovery bounce lost momentum as it approached the 50-day average. Earlier, the decline in the price accelerated sharply when it fell below this line, and now the bulls are failing to return the rate higher, which looks like one of the first signals of increased bearish sentiment. Falling below the 50 SMA for the first time since September might be the harbinger of a prolonged correction. In the meantime, the coin keeps balancing on comfortable price levels.

The launch of the Bitcoin-ETF was supposed to be another hypothetical factor supporting the positive background in the crypto market. However, the U.S. Securities and Exchange Commission (SEC) postponed a decision on the proposed VanEck ETF until June. There are currently 10 applications to launch the ETF, and the regulator needs more time for a comprehensive review. Thus, the SEC is taking its past approach to assessment, dragging out the timeline as much as possible.

CoinMetrics has summed up the impressive performance of cryptocurrencies. Investing $100 in Dogecoin100 days ago would have earned you $2,742. The average transaction size on the Bitcoin blockchain over the past 100 days was an impressive $30,000. The Ethereum blockchain is moving toward PoS, but at the same time, the hash rate on the network has increased by 89% in the last 100 days. As a result, we've seen a new surge of activity from miners who have bought all video cards on the market.

An important sign that the altcoin season is heading towards its highs may be the Bitcoin dominance index, which has fallen below 50% for the first time in 2 years, currently at 48.8%. On the one hand, this is a positive sign indicating broad demand for crypto assets. But on the other hand, it could indicate that Bitcoin is already too expensive for most investors, who are instead jumping on the bandwagon and buying altcoins in the expectation that their dynamics will overcome the overheated bitcoin.

All of this is similar to the situation in early 2018, which preceded the prolonged "crypto-winter". By many indications, the crypto market may indeed have passed its peak rally and excitement, and right now, the bears are accumulating the strength to take control of the situation in order to finally reverse the trend in the crypto market.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

As Bitcoin Is Stuck In A Correction, Investors Put Their Faith In Altcoins

Published 04/29/2021, 10:57 AM

As Bitcoin Is Stuck In A Correction, Investors Put Their Faith In Altcoins

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.