The outlook for precious metals has changed quite a bit over the last month. In early July, gold and gold stocks were weak and threatening severe breakdowns below key levels such as $1200 gold and $21 VanEck Vectors Gold Miners (NYSE:GDX). Those moves reversed course and now gold and gold stocks are threatening resistance. The prognosis has turned bullish and with the help of a correcting stock market precious metals could build on their recent rebound.

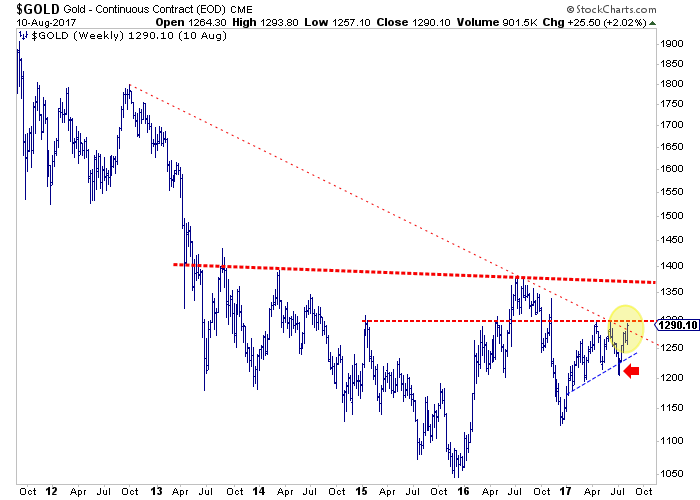

Below we plot the weekly bar chart of gold which is testing critical resistance in the $1290-$1300 area. Gold could close the week at its highest weekly close in 2017, just weeks after breaking its 2017 uptrend. That early July breakdown proved to be a false break as gold has been able to rally back up to resistance. Gold has broken the downtrend line since 2011 but the most important resistance is $1300. With a break above $1300, gold could be on its way to a retest of the 2016 high at $1375.

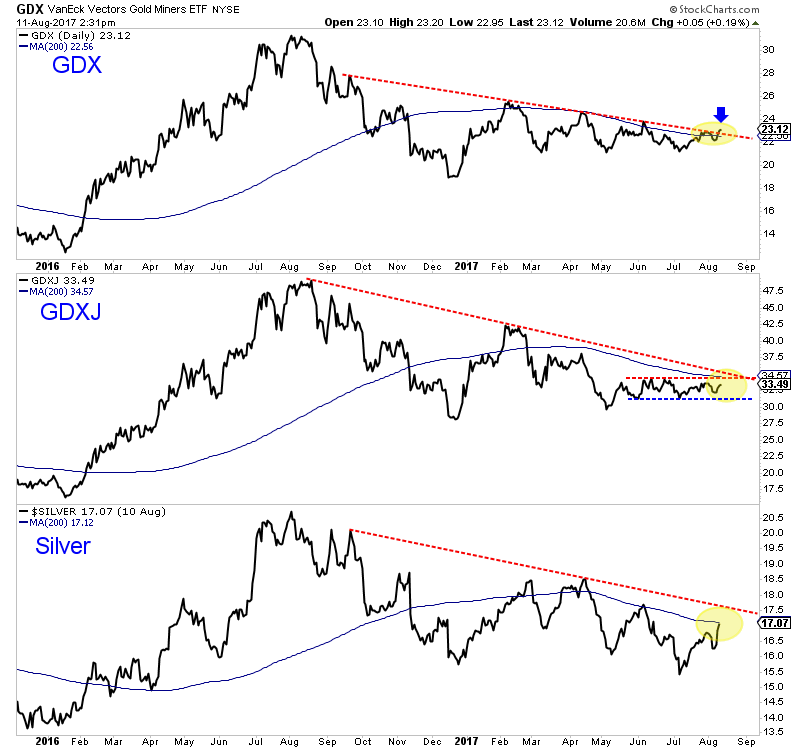

Turning to the miners, we find that GDX has already broken its downtrend and the 200-day moving average. VanEck Vectors Junior Gold Miners (NYSE:GDXJ) faces strong resistance at $34-$35. Silver has a little ways to go before it can break its downtrend line but its relative strength in recent days is quite encouraging.

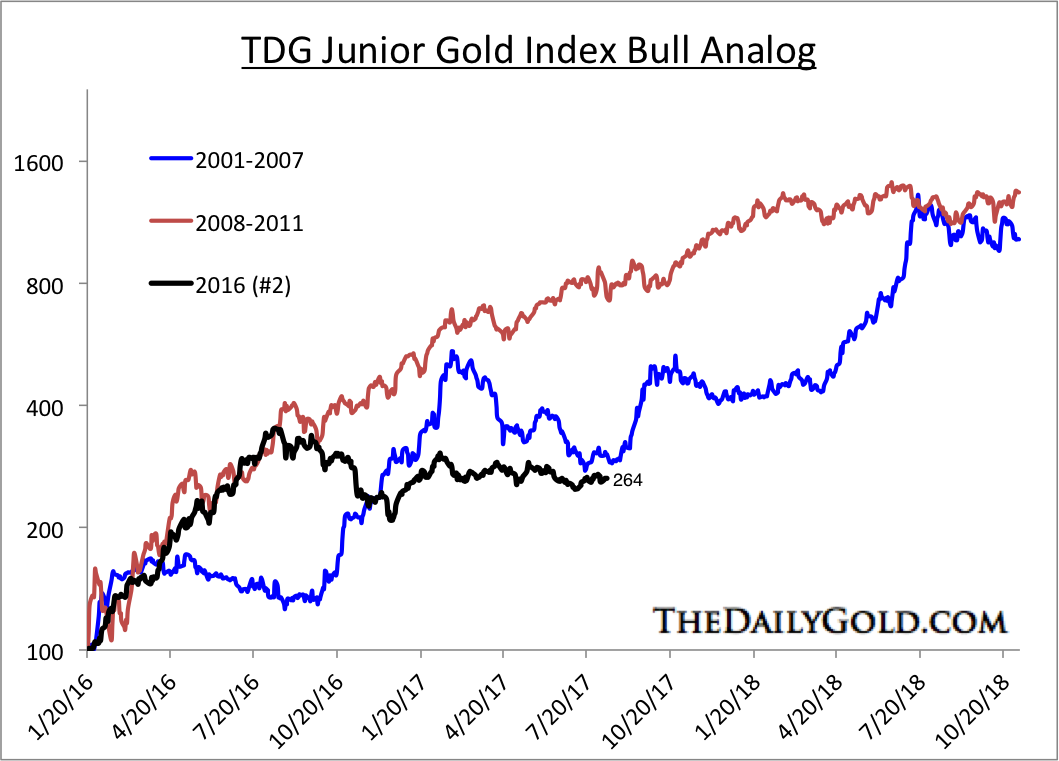

While there are only a few data points in the junior bull analog chart (which is based on our junior indices), it suggests the juniors could be close to starting a new leg higher. If gold is going to rise to $1375 then the juniors would enjoy a good pop. The analog chart shows the significant upside potential in juniors if gold were to clear $1375 and advance towards $1550-$1600.

There are several reasons we have turned bullish. First, precious metals were breaking down in early July yet that reversed course entirely. Gold has rallied back to +$1290 and well above resistance at $1240-$1250. If gold were going to break below $1200 then the rally would have rolled over again around $1240. Second, intermarket activity has turned quite favorable for gold. The US$ index has not made a new low but gold has perked up. Meanwhile, gold is benefitting (as it should) from weakness in the equity market. We think the weakness could continue and drive gold to $1375