Sterling rallied in early trading on Friday, showing signs of finding its footing after reaching multi-year lows on Monday. The British currency was lifted by better than expected retail sales and inflation data earlier in the week and by news of Jeremy Corbyn’s plan to prevent a ‘no-deal’ Brexit.

Positive Data

On Thursday, the UK Office for National Statistics (ONS) reported that retail sales rose by 0.2% in July, beating analyst expectations and raising hopes of a third-quarter economic recovery. This news came on the heels of Wednesday’s ONS data showing that the Consumer Price Index (CPI) rate of inflation increased to 2.1% over July, above the Bank of England's 2% target.

Labor Party Plan

On Wednesday, opposition leader Jeremy Corbyn laid out his plan to prevent Prime Minister Boris Johnson from leading the United Kingdom to a 'no-deal' Brexit. Johnson has stated his commitment to delivering Brexit “do or die” on October 31st, despite dire warnings of the consequences of a disorderly exit. The Labour Party leader reached out to political leaders for support in a vote of no confidence in the government. In the event of success Corbyn would take over as caretaker prime minister, allowing him to delay Brexit and call a general election. Corbyn wrote; "This Government has no mandate for no-deal, and the 2016 EU referendum provided no mandate for no-deal."

Technical Outlook

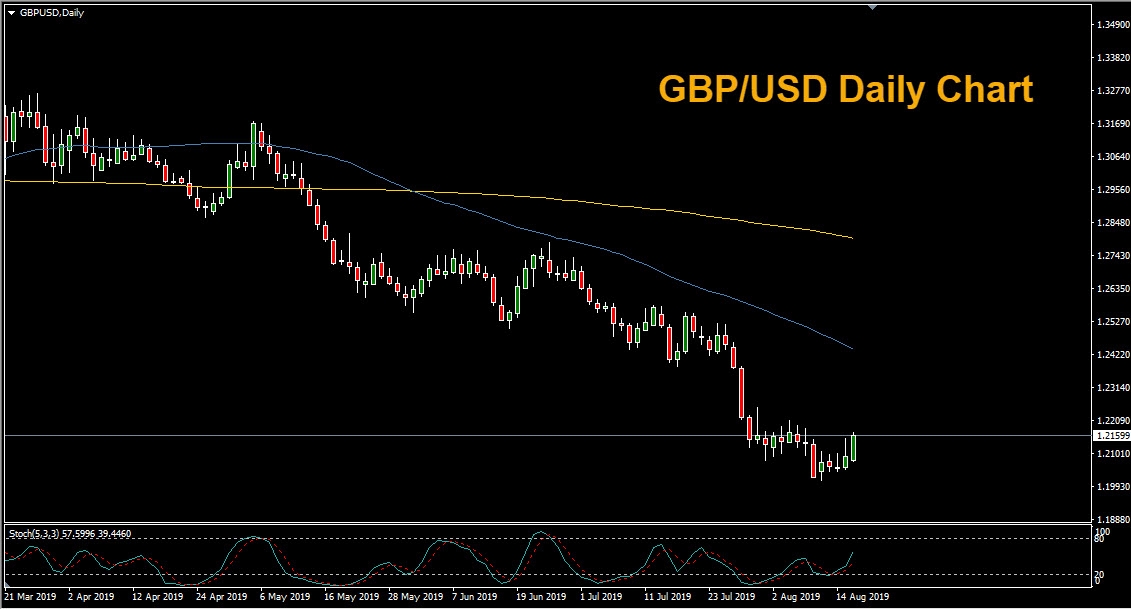

Looking at the GBP/USD daily chart we can see the ‘death cross’ (50 period simple moving average crossing the 200 period simple moving average) that took place on May 31st, ushering in the latest leg of the down move. A major shelf of support currently lies below at the January 2017 low of 1.1975 and notable resistance sits above at 1.2419, the former low from January 2019.