Noratis (DE:NUVG) remains firmly on a growth path. Accelerating development of its asset base (the stock book value was up by over half in H218 at €176m) was followed by news that fundraising options for further expansion are under review. Although this should underpin strong long-term prospects, a typical two-year lead time for asset value enhancement explains apparently measured guidance for 2019 (maintained EBIT on higher revenue). Timing was also a factor last year as H2 bias of high-margin asset sales drove a 30% rise in adjusted EBIT, more than making up for a first-half shortfall. A generous dividend policy is being maintained despite growth ambitions.

H218 delivers

As expected, H2 saw the majority of planned 2018 asset disposals (notably Frankfurt) and at a much superior y-o-y margin (gross profit 37% vs 29%). This was supplemented by a sharp increase in rental income as a result of higher levels of stock at the start of the period. Such buoyancy remedied H1 setbacks, driving a small rise in full-year adjusted EBIT and PBT in line with guidance. This allowed a dividend of €1.30, given the company’s policy of a c 50% payout (the reduction on 2017’s €1.50 was due to the May 2018 capital increase).

Continuing to invest

Guidance is for EBIT and PBT to hold steady in 2019 on higher revenue as margins normalise from last year’s high. This may seem at odds with the recent step-change in the asset base (book value up over 75% in 2018), fuelling growth prospects, but the lead time for investment projects can be at least two years. Management has maintained its intention to remain a net buyer, with 268 units acquired and 166 sold in 2019 to date (based on company releases). Noratis is considering funding options, while net debt more than doubled in 2018 to €141m.

Valuation: Long-term appeal

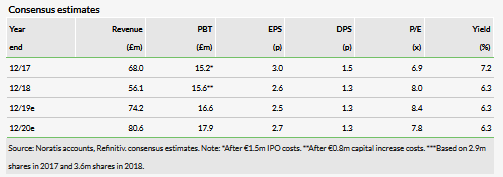

Sitting between asset holder and developer makes for difficult comparison with listed peers but Noratis is at a notable discount to RCM Beteiligungs, which has a similar model (FY18 P/E ratio of 11.8x). At 8.4x prospective P/E and with a P/BV (2018) ratio of 1.5x, the company offers an attractive yield (over 6% prospective), backed by a positive outlook and dividend commitment.

Business description

Noratis is a specialised asset developer, acquiring residential rental income-producing assets in secondary locations with optimisation potential. Investing in the asset base and improving the tenant mix creates value, which Noratis exploits during well-structured asset sales, either through individual or block sales.