On Aug 13, we issued an updated research report on Westport Fuel Systems Inc. (NASDAQ:WPRT) .

The Canada-based company is a developer, manufacturer and supplier of advanced alternative fuel systems and components.

In second-quarter 2019, Westport Fuel’s earnings met the Zacks Consensus Estimate but it was lower than the prior-year quarter figure. In the quarter, its revenues surpassed the Zacks Consensus Estimate and were higher than the prior-year quarter figure.

The company is well placed to meet the rising demand for fuel systems and components. Westport HPDI 2.0 offers an environment-friendly robust performance of heavy-duty trucks. This is likely to position the company favorably, with a suite of market-ready alternative fuel products across all segments of transportation.

Further, the company regularly makes acquisitions and divestments to develop technologies and an edge over non-core businesses. These divestments support its focus on the transportation sector.

However, high SG&A expenses are concerning for Westport Fuel. The rise is primarily due to restructuring activities and legal costs related to the ongoing SEC investigation. Continuous rise in expenses will likely hurt its bottom line despite top-line improvements. Moreover, the company is encountering liquidity crisis. It is witnessing losses and negative cash flow from operations.

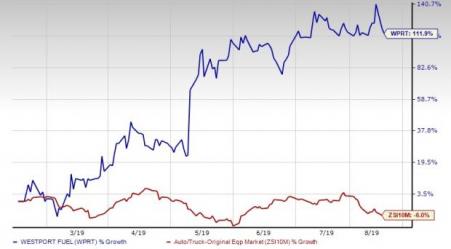

In the past six months, shares of Westport Fuel have underperformed the industry it belongs to. Shares of the company have gained 111.9% against the industry’s decline of 6%.

Zacks Rank & Other Stocks to Consider

Currently, Superior Industries carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the auto space are Fox Factory Holding Corp (NASDAQ:FOXF) , CarMax, Inc. (NYSE:KMX) and Gentex Corporation (NASDAQ:GNTX) , each currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Fox Factory has an expected long-term growth rate of 16.7%. In the past six months, shares of the company have rallied 26%.

CarMax has an expected long-term growth rate of 12.6%. In the past six months, shares of the company have gained 39.7%.

Gentex has an expected long-term growth rate of 5%. In the past six months, shares of the company have returned 38.1%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

CarMax, Inc. (KMX): Free Stock Analysis Report

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Gentex Corporation (GNTX): Free Stock Analysis Report

Westport Fuel Systems Inc. (WPRT): Free Stock Analysis Report

Original post

Zacks Investment Research