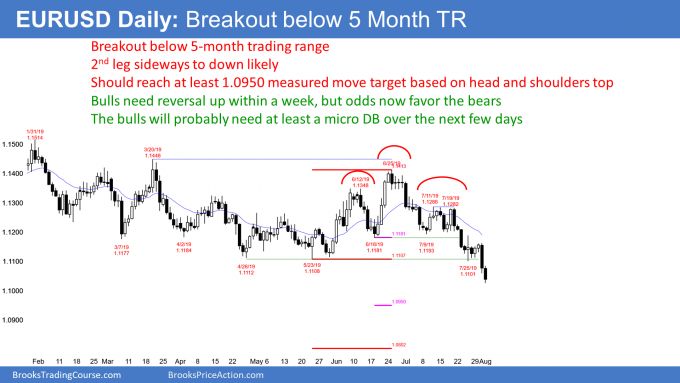

The EUR/USD daily Forex chart had a big bear trend bar yesterday and it closed far below the 5 month trading range. That is a Bear Surprise Bar, which typically has at least a small 2nd leg sideways to down. This is therefore likely to be a successful bear breakout. Success means at least a couple legs down to a measured move target.

Yesterday could be a measuring gap. A measured move down based on the height of the 5 month trading range is 1.0802. The measured move target based on the July 23 breakout below the head and shoulders top is at 1.0950.

If today remains a big bear trend day and it closes near its low, the probability of reaching the lower target goes up. But if today closes above its midpoint, the probability of reaching the lower target will be less.

Can The Bear Breakout Fail?

Traders have to remember that the opposite of what is likely always has at least a 40% chance of happening. Therefore, there is a 40% chance that this breakout will fail.

For example, if the daily chart goes sideways for a few days and forms a micro double bottom, the bears will begin to take profits. If the profit taking is strong, traders will conclude that the bears are giving up and that the bulls are taking control. The result could be a failed breakout and a reversal up to the middle or top of the 5 month range over the next couple months.

The bulls want today to close above the midpoint. If they can get today to close at the high, it would reduce the chance of a successful breakout on the daily chart. While a 2nd leg would still be likely, it would probably be smaller. Furthermore, it might be more sideways rather than down.

Overnight EUR/USD Trading

The EUR/USD 5 minute chart sold off strongly late yesterday after the FOMC announcement. That was a spike down. The selling continued since then in a bear channel. This is a Spike and Channel Bear Trend.

A channel is a weaker bear trend. Bears are beginning to wait for rallies before selling. They are no longer willing to sell at the low.

Traders expect the channel to transition into a trading range today. Once it becomes a trading range, the bulls will look for reversals up. The channel has been broad enough for the bulls to make several 10 pip scalps overnight.

While the bulls would like a major trend reversal up, the best they probably can get today is a rally to the start of the channel at around 1.1060.