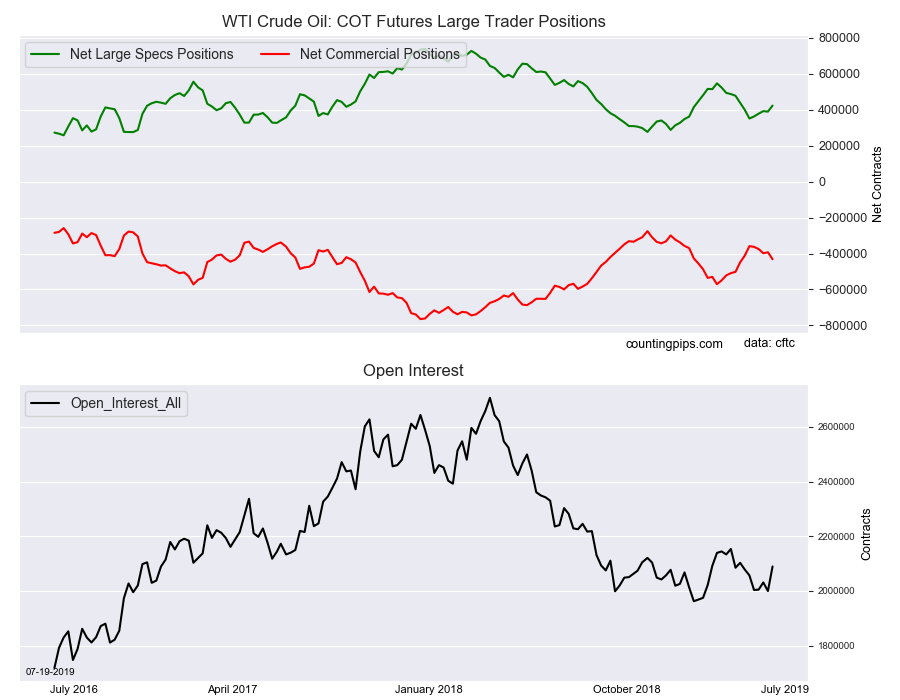

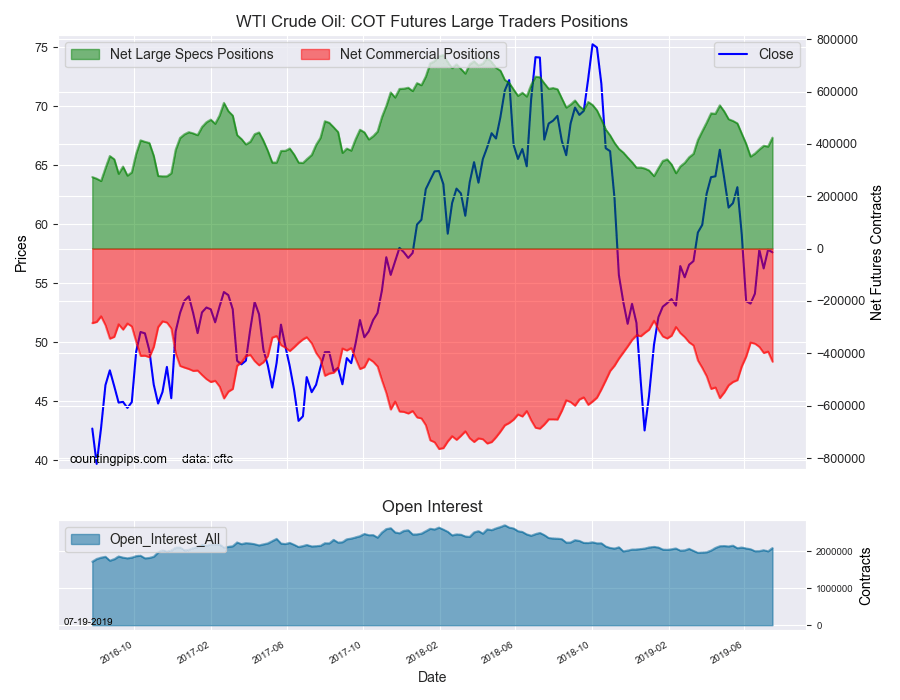

WTI Crude Oil Non-Commercial Speculator Positions:

Large energy speculators boosted their bullish net positions in the WTI Crude Oil futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 423,762 contracts in the data reported through Tuesday, July 16th. This was a weekly rise of 33,613 net contracts from the previous week which had a total of 390,149 net contracts.

The week’s net position was the result of the gross bullish position (longs) advancing by 39,788 contracts (to a weekly total of 545,484 contracts) while the gross bearish position (shorts) rose by just 6,175 contracts for the week (to a total of 121,722 contracts).

Speculative bullish positions have now gained in four out of the past five weeks and by a total of +72,107 contracts in that period. Prior to this recent streak of gains, the speculator positions had dropped for seven straight weeks and by a total of -195,704 contracts before turning around.

The current bullish standing is now back above the +400,000 net contract position for the first time since June 4th.

WTI Crude Oil Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -431,546 contracts on the week. This was a weekly decline of -38,579 contracts from the total net of -392,967 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $57.62 which was a decrease of $-0.21 from the previous close of $57.83, according to unofficial market data.