Air Products and Chemicals, Inc. (NYSE:APD) is slated to release third-quarter fiscal 2019 results ahead of the bell on Jul 25. While currency is expected remain a headwind, the company is likely to continue to gain from higher volumes, pricing as well as productivity initiatives in the quarter.

The industrial gases giant beat the Zacks Consensus Estimate for earnings in two of the trailing four quarters while missed once and delivered in-line results on the other occasion. In this timeframe, the company delivered an average positive surprise of around 1.9%.

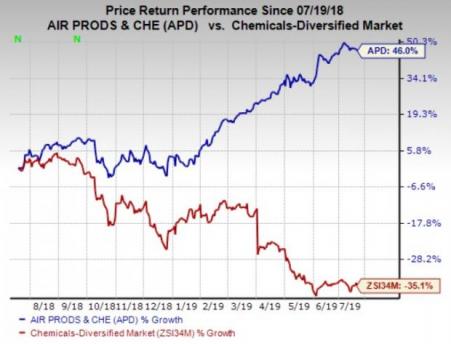

Air Products has outperformed the industry it belongs to over a year. The company’s shares have popped 46% compared with roughly 35.1% decline recorded by the industry.

What Do the Estimates Say?

The Zacks Consensus Estimate for revenues for Air Products for the fiscal third quarter is currently pegged at $2,293 million, suggesting a rise of roughly 1.5% year over year.

The Zacks Consensus Estimate for revenues for the company’s Industrial Gases — Americas segment is currently pegged at $1,001 million, calling for an increase of 5.5% year over year. The consensus mark for the segment’s operating income is pegged at $261 million, indicating growth of 10.1% year over year.

The Zacks Consensus Estimate for revenues in the Industrial Gases — Asia segment is pegged at $706 million, implying an 13.1% rise year over year. Operating income in the segment is projected at $227 million, reflecting a year-over-year increase of 22%.

The Zacks Consensus Estimate for revenues in the Industrial Gases — EMEA segment stands at $523 million, reflecting a decline of 6.8% year over year. The Zacks Consensus Estimate for operating income is pegged at $127 million, which indicates a rise of roughly 6.7% year over year.

The consensus mark for revenues in the Industrial Gases — Global segment is pegged at $69 million, which shows a decline of 31.7% year over year. The same for the segment’s operating income stands at $1.62 million, which indicates a drop of 92% year over year.

Some Factors at Play

Air Products, in April, said that it expects adjusted earnings for the fiscal third quarter in the band of $2.10-$2.15 per share, which indicates 8-10% rise year over year.

Air Products’ investments in high-return projects, business deals and acquisitions are expected to drive its results. Air Products also remains committed to boost productivity to improve its cost structure. The company is seeing positive impact of its productivity actions and expects to benefit from additional productivity and cost improvement programs.

Moreover, Air Products gained from higher pricing in the fiscal second quarter and the momentum is expected to continue in the third quarter. The company’s productivity and pricing actions are expected to support margins in the to-be-reported quarter. New projects are also expected to drive volumes in the quarter. In particular, the Lu'An syngas project in China is likely to continue driving volumes in the Asia business.

However, Air Products is exposed to headwind from unfavorable currency movements due to strengthening of the U.S. dollar vis-à-vis all major currencies. Currency is expected to remain a headwind in the fiscal third quarter, impacting the company’s sales and margins. Moreover, lower activity from the Jazan project in Saudi Arabia is expected to affect results in the Global segment.

Zacks Model

Our proven model does not show that Air Products is likely to beat estimates this quarter. That is because a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below:

Earnings ESP: Earnings ESP for Air Products is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at $2.14. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Air Products currently carries a Zacks Rank #2, which when combined with a 0.00% ESP, makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 (Sell) or #5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they too have the right combination of elements to post an earnings beat this quarter:

Arconic Inc. (NYSE:ARNC) has an Earnings ESP of +0.83% and carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Barrick Gold Corporation (NYSE:GOLD) has an Earnings ESP of +13.51% and carries a Zacks Rank #2.

AK Steel Holding Corporation (NYSE:AKS) has an Earnings ESP of +71.43% and carries a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

Arconic Inc. (ARNC): Free Stock Analysis Report

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

Original post