Sealed Air Corporation (NYSE:SEE) recently commenced an internal investigation upon receiving two separate orders from the Securities Exchange Commission (SEC). The company’s disclosures, financial reporting, selection of audit firm and its independence are currently under SEC’s investigation.

On Jun 20, Sealed Air terminated its CFO following the completion of an internal review by the audit committee.

In response to the news, Sealed Air’s shares dropped significantly by 5% during the Jun 21 trading session. Sealed Air’s shares has declined around 2.2% as against the industry’s growth of 3.3% over the past year.

Block & Leviton LLP, a securities litigation firm, which represents many of the country’s largest institutional investors and numerous individuals in securities litigation nationwide, is investigating whether or not Sealed Air and certain of its executives violated federal securities laws.

Along with Block & Leviton, Kehoe Law Firm, P.C., The Schall Law firm, Glancy Prongay & Murray LLP and Kirby Mclnerney LLP are investigating claims against Sealed Air on behalf of its investors.

Last December, Sealed Air announced a reformation plan — Reinvent SEE Strategy — along with a fresh restructuring program, in a bid to drive growth and earnings. The strategy is focused on innovations, SG&A productivity, product-cost efficiency, channel optimization and customer-service enhancements.

It is projected to drive total annualized savings in the $215-$235 million range by the end of 2021. The company is also likely to benefit from the growing demand in fresh food and e-commerce markets, and acquisitions, over the long run.

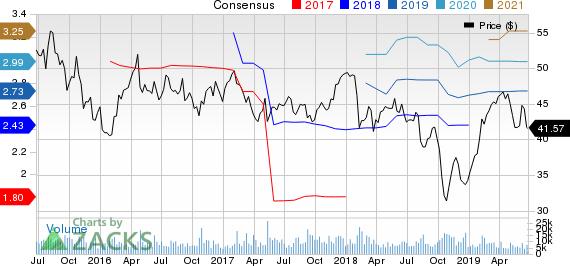

Sealed Air Corporation Price and Consensus

Zacks Rank & Stocks to Consider

Sealed Air currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Industrial Products sector are The Timken Company (NYSE:TKR) , Roper Technologies, Inc. (NYSE:ROP) and Harsco Corp. (NYSE:HSC) , each sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Timken Company has an estimated earnings growth rate of 26.5% for the ongoing year. The company’s shares have gained 15.1%, in the past year.

Roper Technologies has an expected earnings growth rate of 9.4% for the current year. The stock has appreciated 34.4% in a year’s time.

Harsco has a projected earnings growth rate of 9.1% for 2019. The company’s shares have rallied 9.7%, over the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Sealed Air Corporation (SEE): Free Stock Analysis Report

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Timken Company (The) (TKR): Free Stock Analysis Report

Harsco Corporation (HSC): Free Stock Analysis Report

Original post

Zacks Investment Research