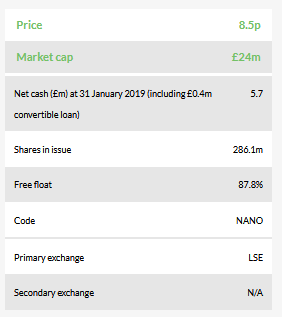

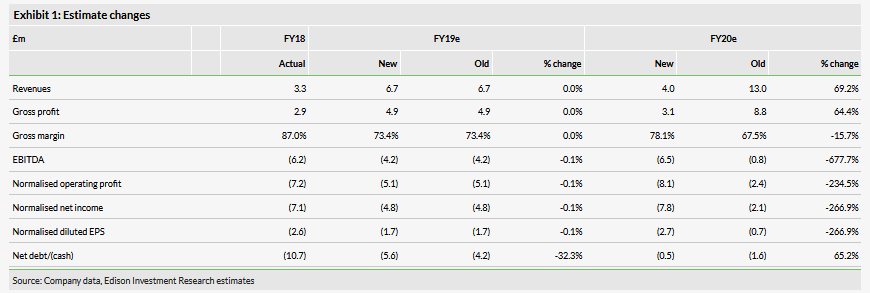

Nanoco Group's (LON:NANON) announcement that its project with the major US customer will not continue when the current contract expires in December 2019 is clearly a severe setback and we have therefore cut our FY20 estimates substantially. We note though that the customer’s decision relates to a change in strategy rather than issues with the performance of Nanoco’s materials or services. The company has a strong IP base and state-of-the-art manufacturing facility with an estimated 12 months of cash to explore new commercial options including with its US customer. Following Friday’s share price drop, the £20m market capitalisation appears to assign little value to these assets.

Major customer changes path

The decision not to extend the current contract means that Nanoco’s major US client will not progress to volume production in the foreseeable future. The company has stated that the decision is wholly unconnected to the performance of the materials or Nanoco’s service delivery. Industry newsflow suggests the client may have opted for an alternative architecture for the component potentially deploying quantum dots. Nanoco is exploring alternative use cases for the technology with a number of customers and supply chain partners, including the major US customer, and continues to work with other customers on deployment of quantum dots in other applications including display and medical imaging.

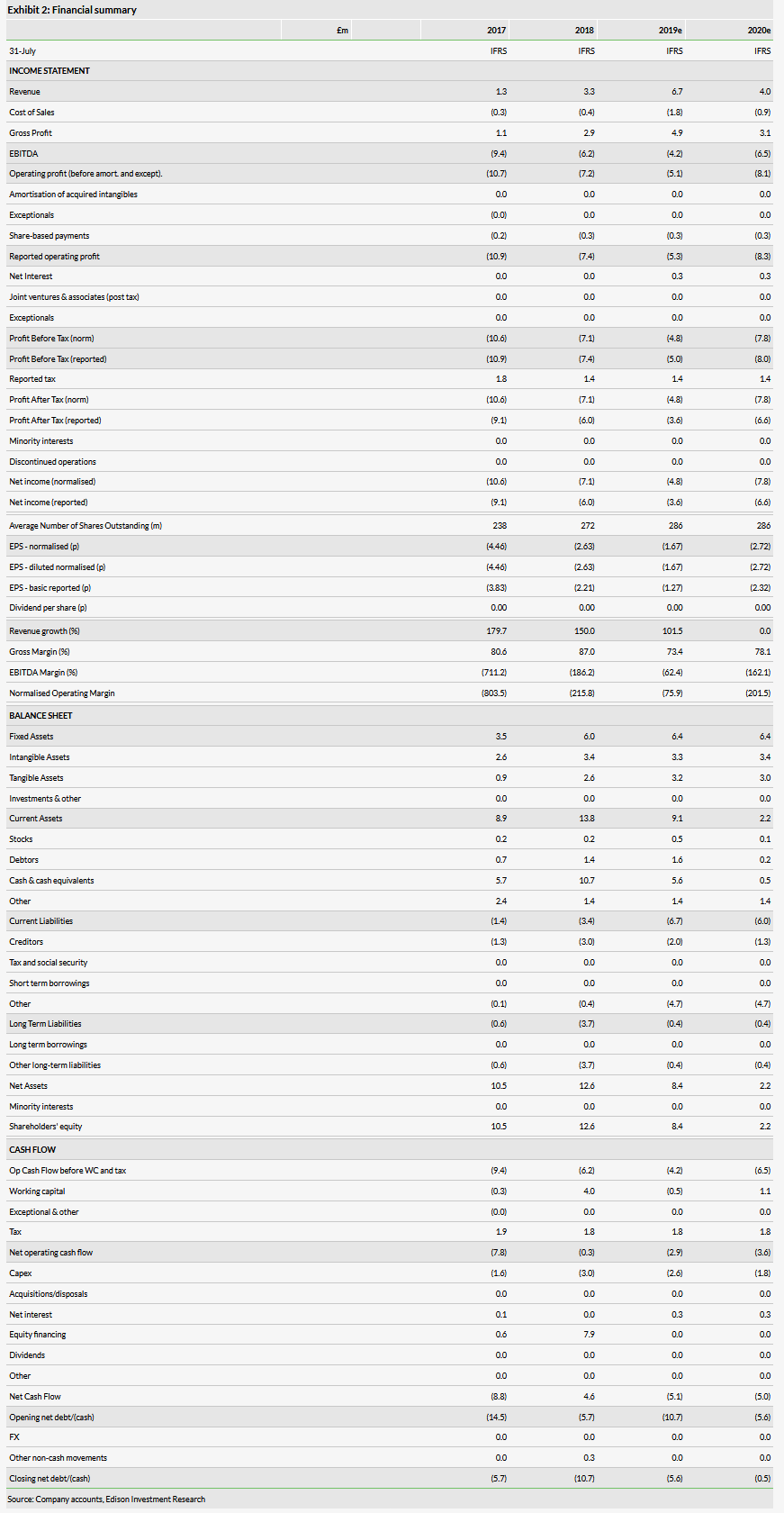

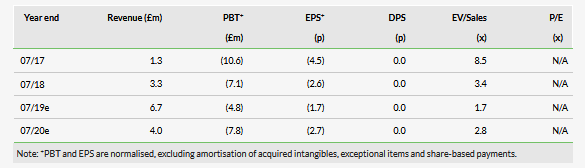

Estimate changes

Our FY19 revenue forecast is not affected by this development. We have cut our FY20 revenues to £4.0m (from £13m), which are backed by contracts, primarily from the major US partner. With a fixed cost base of just under £10m, management expects cash balances to be c £6m at end December 2019. On this basis, we estimate that current cash balances will last until summer next year, giving the company a year to explore commercial and strategic options.

Valuation: Share price fall does not reflect IP value

The development is clearly a major blow to Nanoco’s prospects. However, we have previously highlighted that development activity in quantum dots appears to be accelerating across a number of applications and this view has not changed. The company is the largest IP holder in this field with c 750 patents and now has a new, nearly fully commissioned manufacturing facility able to output significant volumes of nanomaterials. The recent 74% share price drop values the business at a mere £24m market capitalisation, which we believe takes scant recognition of the company’s IP and asset base.

Business description

Nanoco Group is a global leader in the development and manufacture of cadmium-free quantum dots and other nanomaterials. Its platform includes c 700 patents and specialist manufacturing lines. Focus applications are advanced electronics, displays, lighting and bio-imaging.

Estimate changes

Our estimates changes are displayed below.

Our revenue estimates include only the minimum commitments from the company’s tier one customer. These are service revenues, whereas our previous estimates included product revenues as well. As a consequence, our estimates show FY20 gross margin increasing.

We have also modified the FY19 cash flow to reflect the £1.4m cash paid by the US customer during H119 towards equipping a dedicated facility for electronic nanomaterials.

Valuation

As a reference point for the potential value of the assets, we note that Samsung (KS:005930) acquired the IP of quantum dot competitor QD Vision (with a reported 250 patents) for $70m in 2016. Prior to the acquisition, QD Vision had been struggling with its products not gaining acceptance.