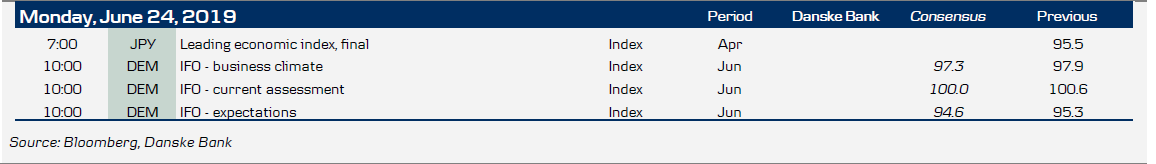

Market movers today

We start the week with the German Ifo index for June. After PMIs last week signalled further improvement in the German manufacturing sector, it will be interesting to see whether this message is also borne out in today's Ifo reading. In light of the trade war re-escalation, we see scope for further downside in the Ifo business expectations in the coming months. Near term, the economic outlook remains clouded by many external risks, as we also outlined in Germany - In the crosswinds of trade war , 14 June 2019.

Later this week, the much-awaited Trump-Xi meeting at the G20 summit will be in focus, while the change in central banks' tune remains the talk of the town in financial markets. Here, a range of Fed speakers during the week will be interesting to listen to, especially after Friday's weak US June PMI figures.

Selected market news

The US is planning more sanctions against Iran in order to force the country back to the negotiating table and agree on a deal to ensure Iran never requires nuclear weapons. US Secretary of State Michael Pompeo will visit Saudi Arabia and the UAE to discuss a global coalition against Iran. Iran has already seen a sharp drop in oil production following the first round of US sanctions, which has tightened world oil supply. New sanctions are therefore likely to be felt primarily in Iran and to a lesser extent in the rest of the world. Brent is trading above USD65/bbl. However, we reckon this is more a function of the recent recovery in risk sentiment and weakening of the USD with the outlook for upcoming rate cuts in the US.

Overall, June PMIs out of the euro area and US disappointed on Friday. In the euro area, the manufacturing, service and composite PMIs rose compared to May, but the manufacturing PMI, which tends to be the focus of the market, rose less than expected by consensus. In the US, the manufacturing, service and composite PMIs dropped compared to May and disappointed consensus expectations - the market was looking a rise in the service PMI.

On Friday, the Minneapolis Fed's Kashkari said he argued for a 50bp rate cut at last week's FOMC meeting. Kashkari is currently not a voting member and thus had limited what he had to say at the meeting. Nevertheless, the USD sold off on a broad basis on Friday following his comments, as the market is raising the odds the Fed could cut by as much as 50bp at the next meeting in July. In addition, it is worth noting that Kashkari is also advocating that the Fed commit not raise rates again before core inflation is above 2%, as he highlights concerns about lacklustre inflation expectations.

Fixed income markets

Last week, 10Y German government bond yields broke through -30bp, while 10Y US Treasury yields tested 2% and the 10Y spread between Italy and Germany tested 240bp after being close to 290bp at the end of May. These moves in global bond yields combined with lower credit spreads such as ITRAX main and crossover continue to indicate that “too much money is still chasing too few assets”. This is also reflected in the strong performance in our local markets, where Scandinavian covered bonds have performed given a solid spread tightening and the DGB 0.25% 11/29 – Bund 0.25% 02/29 reached its lowest level since 2015, where the spread was negative. We expect more of the same this week, even though there is not that much key economic data due and the key event is the G20 meeting at the end of the week. Even in the case of some form of trade deal between the US and China, the global central banks are on the verge of easing again, and this would be supportive for spread trades as well as flatter curves in the EU.

FX markets

The USD continued to weaken on Friday on the back of weaker US PMIs and dovish comments by the Fed’s Kashkari (see front page), with EUR/USD climbing above the 1.1370 level. IMM positioning data shows that investors have started to scale back their stretched long positions in USD and reduce their short positions in the CHF, EUR and JPY (see IMM Positioning Update, 23 June). As the market is assuming some probability of the Fed delivering a 50bp cut in July, weak US and global macro figures along with lack of progress in trade talks is needed to sustain current USD weakness.

Broader-based dollar weakness has also contributed to sending oil and the NOK higher. From a technical perspective, we think it is very important that USD/NOK on Friday closed below the 200D moving average, which has acted as a key support level over the past year. We still favour more NOK strength and especially pencil in more USD/NOK. The AUD could finally see some tailwinds this week. While most currencies have not lagged the rally against the USD, the Aussie dollar has stayed behind. Should the G20 Trump-Xi meeting turn out slightly positive, we think the AUD would be in for a positive surprise vs both the EUR and USD. Similarly, we think broad USD weakening will continue to support JPY strength vs the USD.

A quiet week ahead of us on the data front, with the SEK likely to be influenced by last week’s dovish communication from both the ECB and Fed. On one hand, this might lend some support to the SEK in the crosses, as seen in USD/SEK at the end of last week. On the other hand, the dovish tilts are likely to influence the Riksbank in the same direction, thus limiting the scope for a substantial SEK-revival. Most likely we will see limited movements in anticipation of the Riksbank next week.

Key figures and events