Darden Restaurants, Inc. (NYSE:DRI) reported fourth-quarter fiscal 2019 results, wherein earnings surpassed the Zacks Consensus Estimate, whereas revenues lagged the same.

Adjusted earnings of $1.76 per share beat the Zacks Consensus Estimate of $1.73. Moreover, the bottom line increased 26.6% year over year on higher revenues. Results were aided by the company’s relentless efforts to improve the basic operating factors of the business — food, service and ambiance.

Total revenues of $2,229.1 million lagged the consensus mark of $2,240 million. However, revenues increased 4.5% from the prior-year quarter. The upside was driven by the addition of 39 net restaurants and a 1.6% increase in blended comps.

Despite earnings beat and growth in revenues, shares of Darden fell 4.9% in pre-market trading. This is because the company’s sales growth across every brand deteriorated sequentially. Also, sales total sales lagged the consensus mark.

Meanwhile, the company’s shares have gained 17.6% so far this year, underperforming the industry’s 21.4% rally.

Revenues by Segments

Darden reports business under four segments — Olive Garden, LongHorn Steakhouse, Fine Dining that includes The Capital Grille and Eddie V's, and Other Business.

In the fiscal fourth quarter, the company’s legacy brands posted blended comps growth of 1.6%. In the fiscal third quarter, comps increased 2.8%.

Sales at Olive Garden were up 3.7% year over year to $1,107 million. Comps grew 2.4% at the segment, lower than the prior quarter’s comp growth of 4.3%. Traffic declined 0.4%. Pricing improved 1.6% and menu-mix increased 1.2%.

Sales at Fine Dining increased 5% to $154.6 million. Comps at The Capital Grille rose 2.9% compared with growth of 4.3% in third-quarter fiscal 2019. Further, Eddie V's posted comps growth of 2%, lower than 3.7% improvement recorded in the prior quarter.

Revenues from Other Business grew 4.9% year over year to $483.1 million. However, comps at Seasons 52 fell 1.5% in the reported quarter compared with comps decline of 1.3% in third-quarter fiscal 2019. Comps at Yard House edged down 1.4% compared with 2.1% decrease in the prior quarter. Meanwhile, comps slipped 1.9% at Bahama Breeze compared with a decline of 3.7% in the preceding quarter.

At LongHorn Steakhouse, sales rose 5.7% to $484.4 million. Comps at LongHorn Steakhouse increased 3.3%, down from comps growth of 3.8% in the fiscal third quarter. Traffic increased 0.3%. Also, pricing and menu mix grew 1.8% and 1.2%, respectively.

In the reported quarter, comps at Cheddar's decreased 3.4% compared with 2.7% decline in third-quarter fiscal 2019.

Operating Highlights & Net Income

In the fiscal fourth quarter, total operating costs and expenses increased 5% year over year to $1,999.3 million. The rise was due to an overall increase in food and beverage costs, restaurant expenses, and labor costs.

Net earnings in the fiscal fourth quarter were $208 million, up 19.2% from the year-ago level.

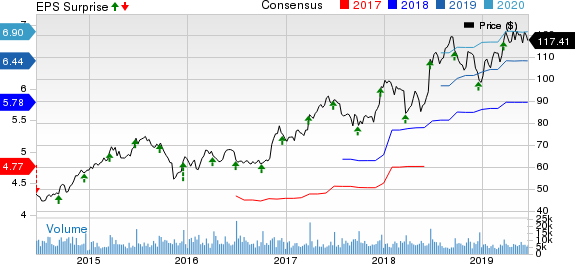

Darden Restaurants, Inc. Price, Consensus and EPS Surprise

Balance Sheet

Cash and cash equivalents as of May 26, 2019, totaled $457.3 million, up from $146.9 million as of May 27, 2018.

Inventories totaled $207.3 million at the end of the reported quarter. Goodwill, as a percentage of total assets, was 20.1% in the quarter.

Long-term debt as of May 26, 2019, was $927.7 million, up from $926.5 million as of May 27, 2018.

During the fiscal fourth quarter, the company repurchased approximately 0.4 million shares of its common stock for roughly $42 million. It still has $304 million remaining under the current $500-million repurchase authorization.

Highlights of Fiscal 2019 Results

Adjusted earnings in fiscal 2019 were $5.82, outpacing the Zacks Consensus Estimate of $5.78. Earnings also increased 19.6% year over year.

Total sales grew 5.3% to $8.51 billion, driven by the addition of 39 net new restaurants and a blended same-restaurant sales increase of 2.5%.

Fiscal 2020 Outlook

For fiscal 2020, the company expects total revenues to increase 5.3-6.3%. This will include the 2% positive synergy from the 53rd week. Comps are projected to increase 1-2%. Darden’s earnings per share are anticipated to be $6.30-$6.45.

Meanwhile, the company expects inflation to be up 2.5% in 2020. With an effective tax rate of 10-11%, total capital spending is expected to be $450-$500 million. Darden plans to open 50 gross and 44 net new restaurants in 2020.

Zacks Rank & Stocks to Consider

Darden currently has a Zacks Rank #3 (Hold). A few better-ranked stocks in the same space include Chipotle (NYSE:CMG) , Papa John’s (NASDAQ:PZZA) and Noodles & Company (NASDAQ:NDLS) . While Noodles & Company currently sports a Zacks Rank #1 (Strong Buy), Chipotle and Papa John’s carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Noodles & Company, and Chipotle’s earnings for the current year are expected to increase 700% and 43.5%, respectively. Papa John’s earnings for 2020 are expected to grow 62.8%.

Will you retire a millionaire?

One out of every six people retires a multimillionaire. Get smart tips you can do today to become one of them in a new Special Report, “7 Things You Can Do Now to Retire a Multimillionaire.”

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Noodles & Company (NDLS): Free Stock Analysis Report

Original post

Zacks Investment Research