Steel Dynamics, Inc. (NASDAQ:STLD) has provided downbeat earnings guidance for second-quarter 2019 as it expects lower earnings in its steel operations in the quarter.

The steel producer expects earnings for the quarter in the band of 86-90 cents per share. That is a decrease from 91 cents per share recorded in the previous quarter and $1.53 per share it earned a year ago.

The company’s guidance also fell short of expectations. Analysts polled by Zacks currently expect earnings of 98 cents per share for the second quarter.

The company expects earnings from its steel operations to be lower sequentially in the second quarter mainly due to reduced profitability from the long product steel operations as shipments and metal spread fell in the quarter. Average product prices declined across the steel platform in the second quarter, the company noted. Steel Dynamics also said that inventory destocking and hesitancy in steel buying have resulted from a softening scrap pricing environment.

Profitability for the company's metals recycling platform is projected to fall sequentially in the second quarter mainly due to lower ferrous metal spread as average pricing fell through the quarter.

Steel Dynamics also expects earnings from its steel fabrication business to improve on sequential-comparison basis on the back of higher shipments and expansion of metal spread, aided by strong demand and lower steel input costs.

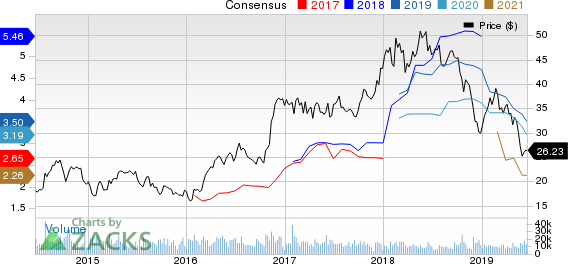

Steel Dynamics’ shares have lost 43.6% over a year, underperforming its industry’s 34.7% decline.

The company, in its first-quarter call, said that it expects domestic steel consumption to continue rising in 2019. Steel Dynamics expects North American steel consumption to witness steady growth, supported by domestic steel demand fundamentals.

Steel Dynamics is currently executing a number of projects that should add to capacity. The company is investing $1.7-$1.8 billion to build a new electric-arc-furnace flat roll steel mill in the United States that is expected to have an annual production capacity of roughly 3 million tons. It will have the capability to make the latest generation of advanced high strength steel products.

Zacks Rank & Key Picks

Steel Dynamics currently carries a Zacks Rank #5 (Strong Sell).

A few better-ranked stocks worth considering in the basic materials space include Materion Corporation (NYSE:MTRN) , Israel Chemicals Ltd. (NYSE:ICL) and Innospec Inc. (NASDAQ:IOSP) .

Materion has an expected earnings growth rate of 27.3% for the current year and carries a Zacks Rank #1 (Strong Buy). The company’s shares have gained around 17% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Israel Chemicals has an expected earnings growth rate of 13.5% for the current fiscal year and carries a Zacks Rank #2 (Buy). Its shares have gained around 9% in the past year.

Innospec has an expected earnings growth rate of 6.6% for the current year and carries a Zacks Rank #2. Its shares are up roughly 7% in the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Innospec Inc. (IOSP): Free Stock Analysis Report

Israel Chemicals Shs (ICL): Free Stock Analysis Report

Materion Corporation (MTRN): Free Stock Analysis Report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

Original post

Zacks Investment Research