The greenback firmed further on Friday closing in the green. The dollar was supported by retail sales data which beat estimates. Retail sales grew 0.5% in May, up from a revised 0.3% in the month before.

Core retail sales advanced 0.5% as well, matching estimates and grew at the same pace as a revised 0.5% increase in the month before. Industrial production was also higher at 0.4%, up from a revised 0.4% decline in the month before.

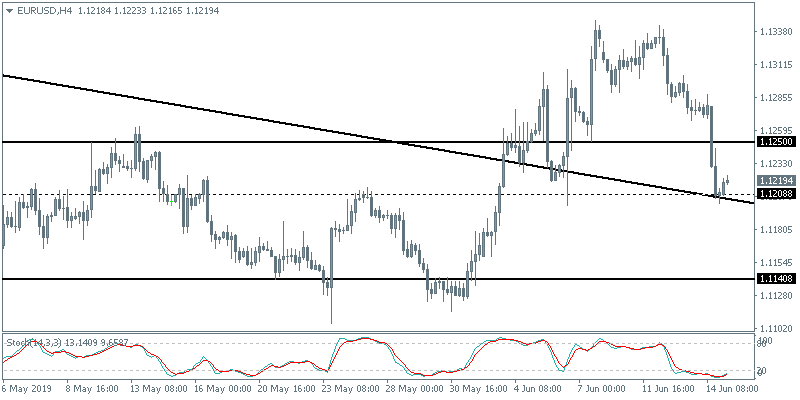

Euro Slips on Dollar Strength

The euro posted strong losses on Friday, extending the declines for three consecutive days. The International Monetary Fund said that growth outlook for the eurozone remains precarious. Meanwhile, economic data from the eurozone was sparse on Friday.

France's final inflation data showed consumer prices rising just 0.1% on the month while Germany’s wholesale price index rose at a slower pace of 0.3%.

EUR/USD Back at Support – What’s Next?

The declines in the common currency sent the EURUSD down to test the support area of 1.1208. This coincides with the minor horizontal support and the rising trend line.

Assuming that the EUR/USD is retesting the trend line, we could see some rebound off this level. However, the common currency will need to break out above the 1.1250 level to confirm the upside bias.

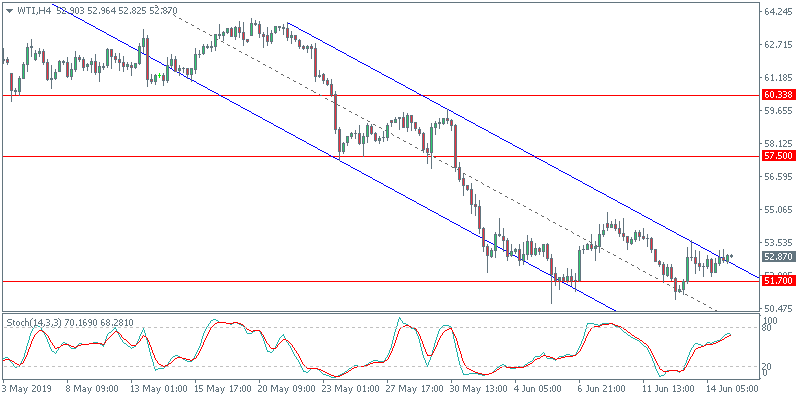

Oil Subdued as Middle-East Tensions Remain

Crude oil prices were seen trading largely muted on Friday. This came as the US squarely blamed Iran for the attacks on two oil tankers. Despite the headlines that support oil prices, crude oil closed the week down over 2%. Oil traders will, of course, be closely watching the developments in the Straits of Hormuz. Data from EIA also did not help oil prices much as the administration gave a gloomy outlook on demand.

WTI Forming a Descending Triangle

The failure to break the support level at 51.70 has led oil prices to rebound. This has formed a lower high as a result, leading to a descending triangle pattern. If the support is tested once again, there is scope for oil to break down lower. This puts the downside in oil toward the 50.00 handle. Alternately, if there is an upside breakout, then the breach of the trend line should confirm the upside bias. 57.50 remains the upside target.

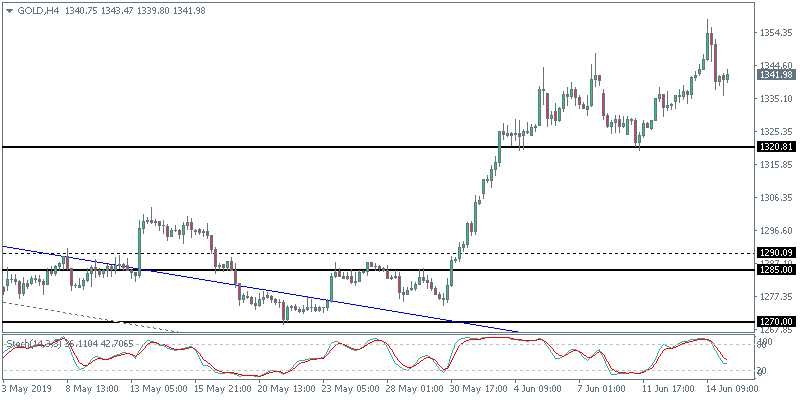

Gold Retreats After Testing Fresh 2019 Highs

The precious metal continued to enjoy its stellar run as price rallied to test fresh 2019 highs of 1358 on the day. Price, however, retreated intraday to close with a doji. The gains in gold prices come about amid the global narratives as well as the Fed meeting due this week. Various central banks have switched course, taking a dovish stance on monetary policy.

Will XAU/USD Correct Lower?

The precious metal closed on Friday with a doji pattern. We expect to see price drifting lower, which could see a retest of the 1320 level. Testing this level for support on a firm note will establish the upside bias. But, there is a risk of a steeper correction if the support fails. To the upside, the gains are likely to be limited to the 1350 handle for the short term.