May trading newsflow causes us to lower earnings estimates significantly. Improvements to operational performance and further de-leveraging are firmly on management’s agenda and the disposal of the construction fibres operation will help in the latter regard. Metrics point to attractions for deep-value investors.

Tough trading continues in the first four months

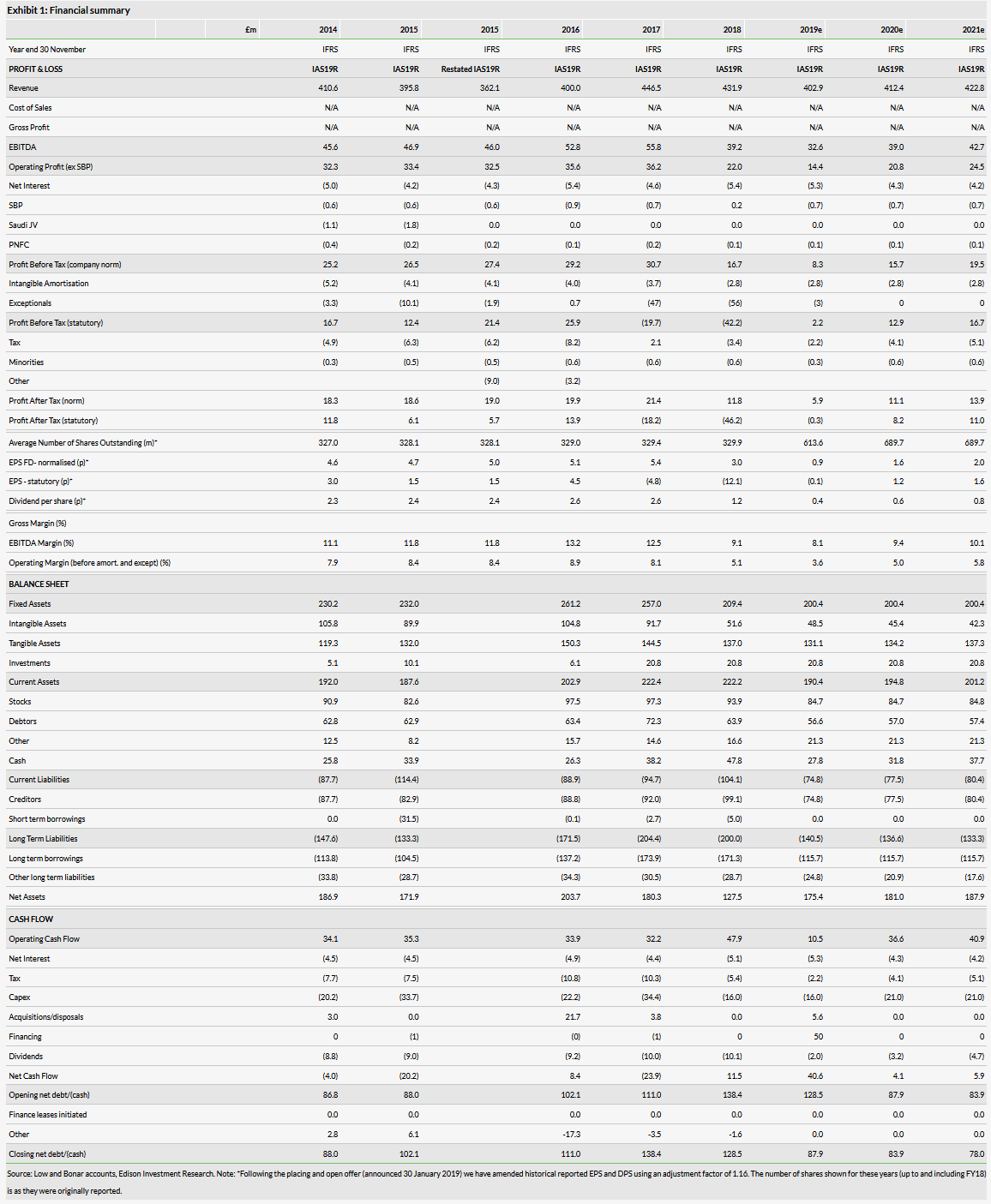

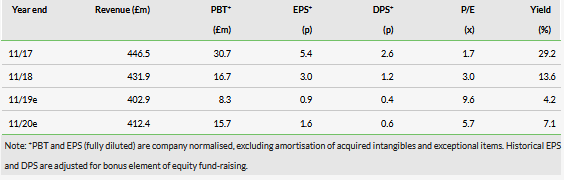

Many of the subsector trends from the end of the prior year have continued in FY19. The 20 May update specifically referenced softness in automotive and flooring demand – in the US and China – while European roofing markets remain competitive. Progress is evident with previously highlighted internal manufacturing issues at Coated Technical Textiles, although this is not yet translating to improved sales. Taken together, overall volumes have been below management expectations including a lower than expected rate of improvement in Q2 so far. H119 earnings are flagged as materially lower than last year (£9m reported EBIT). Low & Bonar’s trading year has a natural H2 bias; we have set our H219 estimates slightly below the prior year, leaving a lower FY19 outturn overall. At group level, we have lowered FY19 PBT expectations by around half, taking a more conservative view on the rate of recovery thereafter (with FY20 and FY21 reduced by around a quarter and 17% respectively). Adjusting for reduced capex and dividend outflows, this re-setting of our estimates has no material impact on net debt.

Disposal proceeds to lower net debt

The proposed disposal of Construction Fibres (for £5.6m; announced 3 June, due to complete around 1 July) is the first step in exiting Civil Engineering activities. The transaction is broadly neutral in P&L terms (with net interest benefits offsetting low-level profitability foregone) and brings our expected year-end net debt down to c £88m (or c 2.7x our FY19e EBITDA). Discussions over the sale of the larger Needle-Punched Non-Woven operations are said to be ongoing.

Valuation: Markers of value

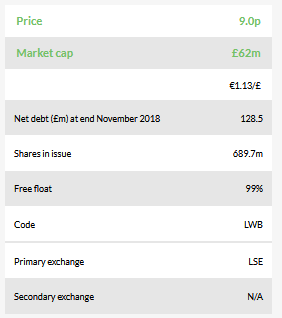

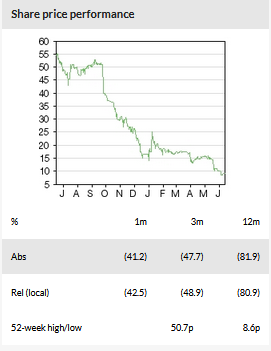

Sentiment has been weighed down by downgrades and the share price is close to its low for the year. While market conditions remain soft in places, financial risk was reduced by the February equity raise. It should reduce further if flagged CE disposals complete, as management expects, during the current financial year. The FY19 P/E and EV/EBITDA (adjusted for pensions cash) multiples are now 9.6x and 5.3x, respectively. Other markers of value include EV sitting at 0.37x revenue and a projected 25p end FY19 NAV (ie a c 65% discount).

Business description

Low & Bonar PLC (LON:LWB), (BE:LWB) produces specialist performance materials for a variety of end-markets by combining polymers with specialty additives and pigments. FY18 business units were: Building & Industrial (21% of FY18 revenue), Civil Engineering (18%), Coated Technical Textiles (32%), and Interiors & Transportation (29%). From FY19 Building & Industrial and Interiors & Transportation will be combined as the Colbond division.