- The Swiss National Bank (SNB) today effectively kept its policy measures unchanged amid a technical adjustment of its target interest rate.

- We see a real risk that the market will test the SNB’s willingness to pursue its inflation target given its constrained toolbox and let EUR/CHF test 1.11 again.

- More broadly, SNB could prove an interesting lab for what happens in the FX sphere when a central bank risks its credibility by inaction.

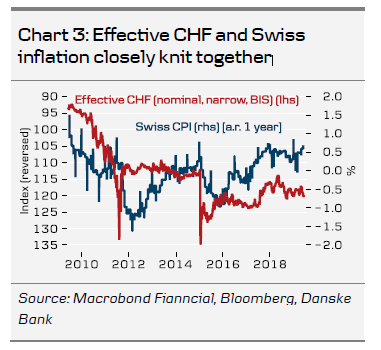

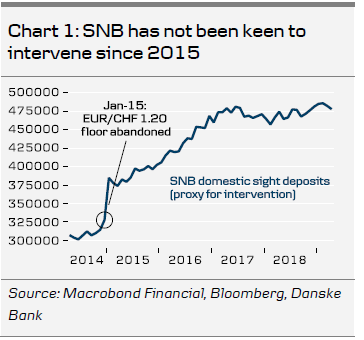

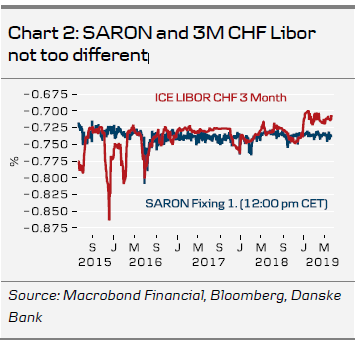

This morning the SNB effectively kept an unchanged policy stance despite a technical adjustment of its target policy rate. It kept key rates at -0.75% and the vital currency statement was left little changed. Following recent dovish messages from a range of central banks – notably the Fed – and upward pressure on the effective CHF, the SNB might have opted to strengthen its willingness to curb CHF strength but it did not: the statement simply reiterated that CHF is ‘highly valued’ and that intervention is an option. Thus, there was no reinforcement of ability or will on behalf of the SNB to curb CHF strength; the SNB has not intervened on a wider scale since abandoning the floor early in 2015 (Chart 1). It upped the conditional inflation forecast a little near term but revised it lower for 2021. With Swiss CPI growth hovering at a mere 0.6% y/y, it leaves us with a central bank that can only really count on currency weakness to re-establish credibility on its inflation target. In this respect, it was a little relevant sideshow that the SNB introduced a new policy target rate – the so-called SNB policy rate. The shift in target has been underway for a while given the uncertainty regarding the future of Libor rates and the new SNB policy rate is currently set equal to the rate of sight deposits (at which banks place excess liquidity) at -0.75%. Henceforth, the SNB aims to keep the SARON rate close to its new target rate, which is close to the previously targeted 3M (NYSE:MMM) Libor (Chart 2).

On a broader note, we now expect the Fed to fade seriously the USD carry momentum by delivering three cuts in H2, which is likely to put USD on a weakening path near term, not least vis-à-vis a range of European currencies including CHF (see FX Forecast Update - Fed blink puts USD on weakening path, 13 June. While for an extended period ECB easing has been the key SNB headache (this is unlikely to go away any time soon), Fed cuts are now set to add to that pain. In our view, these are likely to go hand in hand with dire risk sentiment, as the global macro picture is set to stay fragile into H2 (and we have not even mentioned Italy debt risks yet). Together, we believe this will make it very difficult for the SNB to steer CHF weaker unless Thomas Jordan and company show their hand, i.e. intervention comes into play. In our view, there is a good chance that EUR/CHF will test year lows near term. However, should the market start to eye 1.10, we believe the SNB is likely to step in. Will it be enough? In the end, it depends on the relative belief in the market of the ability of the ECB versus the SNB to bring inflation back to target. Both have bad records on this but the ECB has proved its creativity when it comes to unconventional policies, while the SNB revealed its distaste for balance sheet expansion in 2015. This suggests asymmetric (downside) risks to our 1-3M target of 1.12. How the SNB and CHF play it out near term could prove important lessons for the ECB and EUR if Mario Draghi and company stick to the status quo on policy.