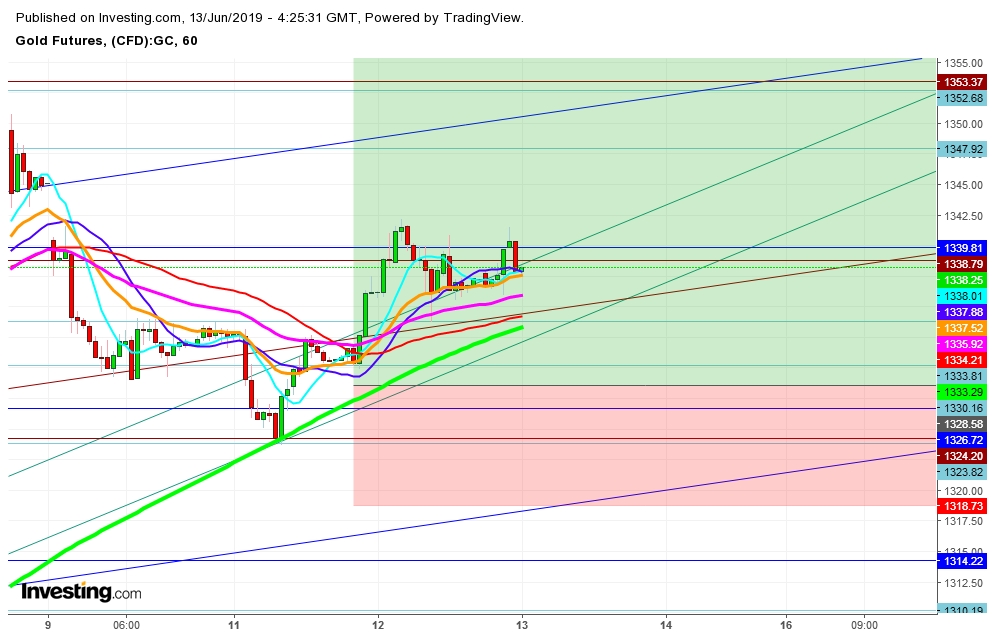

On analysis of the movements of Gold futures in different time frames, I find that the Gold futures look ready to remain on an uptrend till June 27, when the United States and China will try to make one more attempt to resolve tariff trade war tussle in Japan on June 28-29. No doubt that the growing concern over the success of the upcoming meet looks evident enough to extend bearish pressure in global equity markets; which may further result in good steady moves in Gold futures. I find that Gold futures may take a steep upward move before the weekly closing.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.