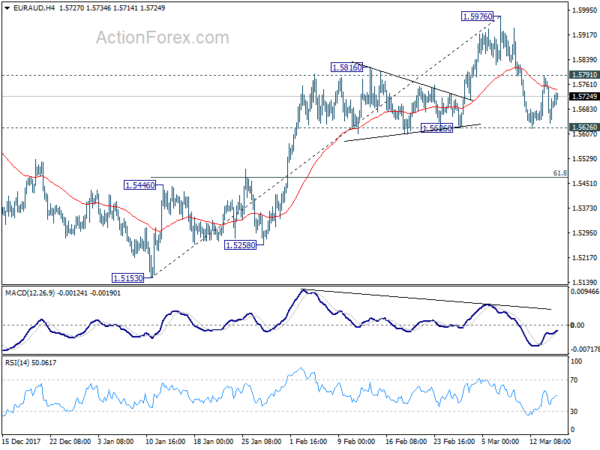

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5630; (P) 1.5706; (R1) 1.5773;

Intraday bias in EUR/AUD remains neutral at this point. On the downside, decisive break of 1.5626 near term support will firstly resume the fall from 1.5976. Secondly, that will also raise the odds of larger reversal. Deeper fall should then be seen to 61.8% retracement of 1.5153 to 1.5976 at 1.5467 and below. However, on the upside, break of 1.5787 minor resistance will indicate completion of the pull back from 1.5976. And, intraday bias will be turned back to the upside for retesting 1.5976 high instead.

In the bigger picture, change of medium term reversal is increasing with EUR/AUD just missing double projection target. They are 61.8% projection of 1.4421 to 1.5770 from 1.5153 at 1.5987, and 100% projection of 1.3624 to 1.5226 from 1.4421at 1.6023. Also, bearish divergence condition remains in daily MACD. Break of 1.5626 support will add to this bearish case and target 1.5153 key support for confirmation. Nonetheless, before that happens, as long as 1.5153 support holds, medium term rise from 1.3624 could still extend to retest 1.6587 high.

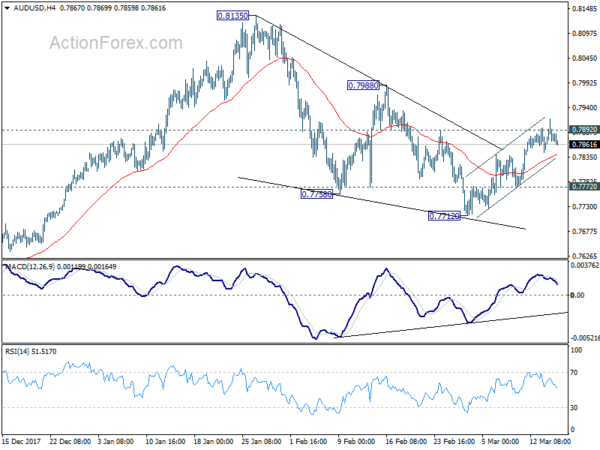

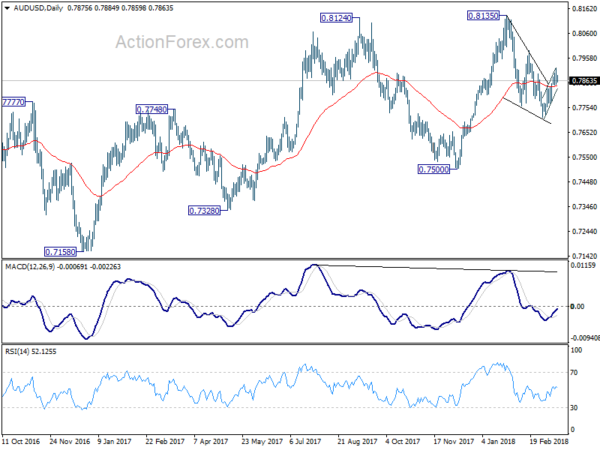

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7847; (P) 0.7881; (R1) 0.7912;

AUD/USD lost momentum after failing to stay above 0.7892 resistance. Intraday bias is turned neutral first. We’re slightly favoring the case that corrective pull back from 0.8135 has completed with three waves down to 0.7712. Further rise is expected as long as 0.7772 minor support holds. Above 0.7892 again will target 0.7988 resistance. Decisive break there will bring larger rally resumption. Nonetheless, on the downside. On the downside, below 0.7772 will turn bias to the downside for 0.7712. Break there will resume whole fall from 0.8135.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed.