Emini Trump Rally Awaiting Tax-Cut Vote

I will update around 6:55 a.m.

Pre-Open Market Analysis

The Emini did not react much to the FOMC rate hike yesterday. While it had a small bear body on the daily chart, it was another mostly sideways day. The current leg up has had 5 consecutive bull bars. Since this is a sign of strong bulls, there will probably be buyers below yesterday’s low. The bears will therefore probably need at least a micro double top before they can get a swing down.

The Trump tax cut bill is close to finalized. While the odds favor its passage next week, that is not certain. Furthermore, no one knows if traders will aggressively take profits before year-end.

Because of the extreme buy climaxes on the daily, weekly, and monthly charts, there is an increased chance of a 5% selloff beginning any time. However, traders want to see at least 2 consecutive big bear days before they believe it is underway. Without that, the bulls will keep buying every reversal down.

Overnight Emini Globex

The Emini is up 1 point in the Globex session. Yesterday was a sell signal bar on the daily chart and today’s open will probably not be far above yesterday’s low. This means that the odds are that today will trade below yesterday’s low to trigger the sell signal. Yet, the daily chart had 5 consecutive bull bars. Consequently, the odds are that there will be buyers below yesterday’s low. This makes a big bear trend day unlikely.

The rally has been weakening over the past few days, and it is extreme. It is therefore climactic. This makes a big bull trend day unlikely as well. Therefore, today will probably be mostly sideways again.

Yesterday’s Setups

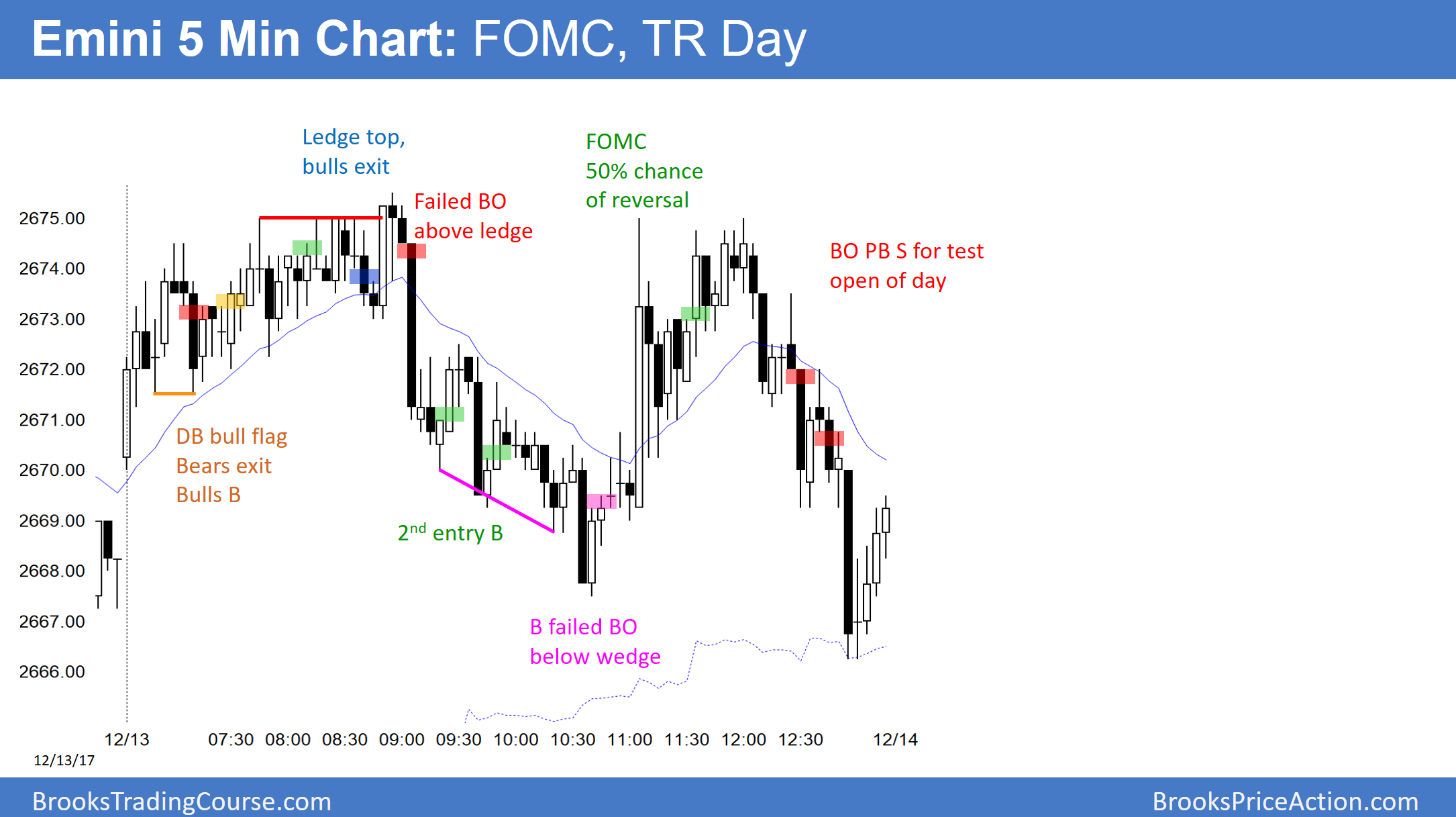

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.