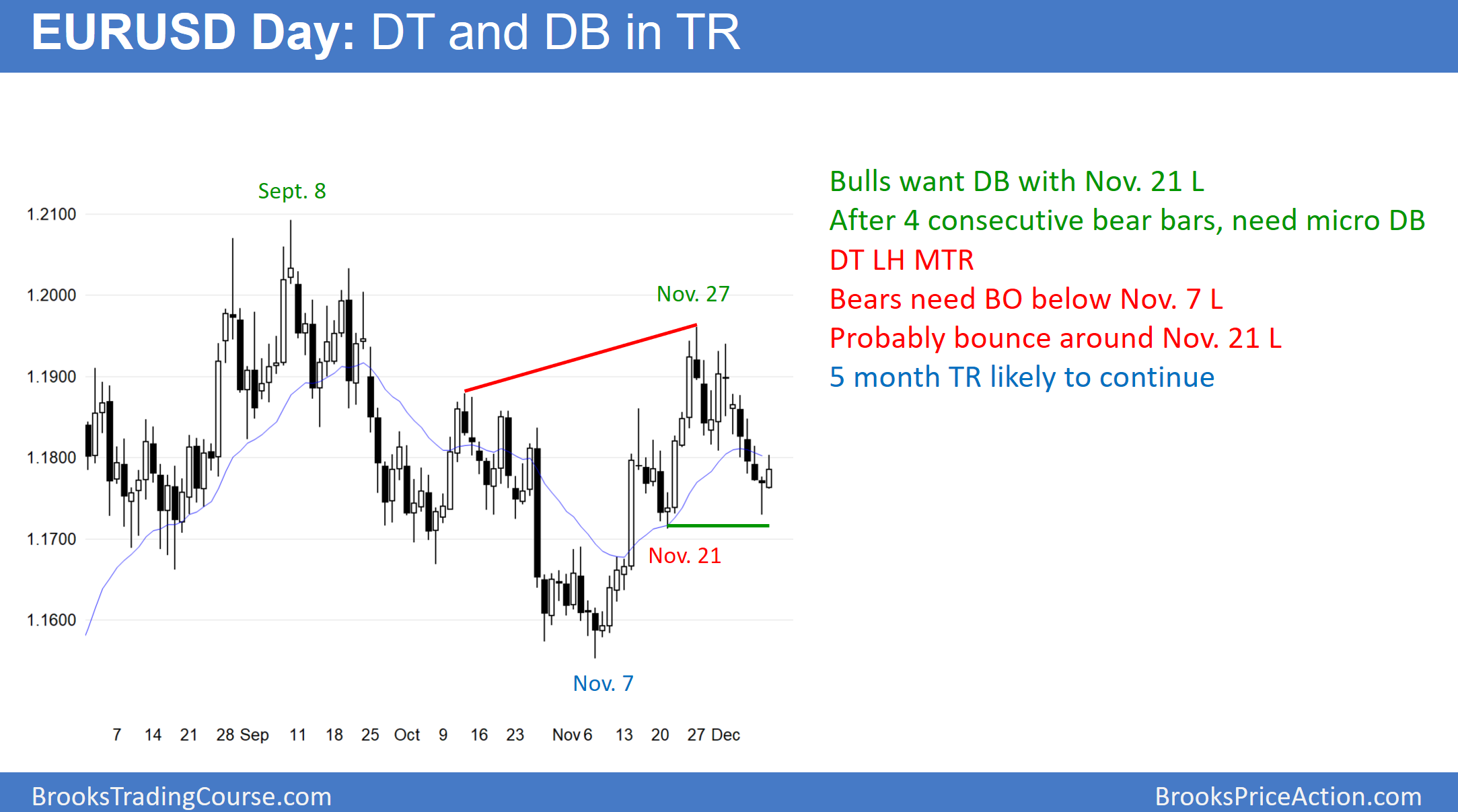

The EUR/USD daily Forex chart has had 2 legs down from a wedge rally. It is around a 50% pullback, the November 21 major higher low, and the 20-day exponential moving average. But, Friday was only a doji and it was the 6th bar without a pullback.

The bulls are trying to rally above a High 2-bull flag on the daily chart. The pullback is at support since it is around a 50% retracement, at the EMA, and just above the November 21 low. However, the 2 week bear channel is tight, there were 4 consecutive bear bars last week, and Friday was a weak buy signal bar.

While the chart is slightly more bullish than bearish over the next couple of weeks, it is still in the middle of a 5 month trading range. Consequently, the odds continue to favor sharp moves up and down that reverse rather than breakout. Hence, this selloff is most likely just another leg in the trading range.

While the odds favor at least a 150 pip bounce over the next 2 weeks, legs in trading ranges usually go past support or resistance before reversing. Therefore, the odds favor a dip below the November 21 major higher low before the next leg up begins. Furthermore, after 6 days without a pullback, the bulls will probably need at least a micro double bottom. That means the 1st small leg up will probably not get far before it tests back down.

Overnight EUR/USD

The 5-minute chart has been in a 30 pip range overnight. While the 2-week pullback in at support, it did not fall below the November 21 low. The pullback will probably have to fall a little further before the bulls will buy again. Since the November rally was strong, the odds still favor a test back up over the next few weeks. However, the bulls will probably need either a micro double bottom or one or two big bull trend days before traders believe that the bulls have again taken control.

Because the odds favor a 150 pip rally, bulls will buy pullbacks for swings and scalps. Since this 2-week selloff is more likely a pullback than a reversal into a bear trend, and now it is at support, the bears will mostly sell rallies for scalps. If they get a strong break below the November 21 major higher low, they will swing trade for a test of the bottom of the 5-month trading range around 1.1550.