Pfizer Inc. (NYSE:PFE) announced encouraging new data of a post-hoc analysis from a phase III study, evaluating the combination of its breast cancer drug, Ibrance (palbociclib), with Novartis' (NYSE:NVS) Femara (letrozole) for the first-line treatment of ER+, HER2- metastatic breast cancer.

Notably, data from the study will be presented at the San Antonio Breast Cancer Symposium (SABCS) on Dec 8.

Ibrance is approved in the United States for treating HR+/HER2- advanced or metastatic breast cancer in combination with an aromatase inhibitor as an initial endocrine-based therapy in postmenopausal women. It is also approved to be used with AstraZeneca's (NYSE:AZN) Faslodex in women with disease progression following the endocrine therapy. Presently, Ibrance is approved in more than 75 countries.

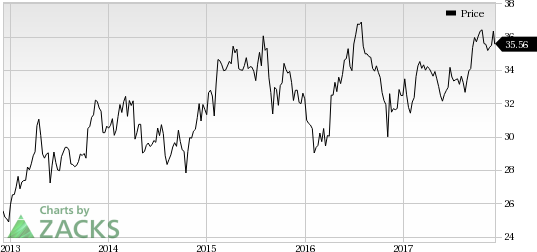

Pfizer’s shares are up 9.9% so far this year, comparing unfavorably with the industry’s return of 16.5%.

In the PALOMA-2 study, it was seen that a combination of Ibrance and Femara led to an improvement in progression-free survival (PFS) or the time before recurrence of tumor growth by more than a year compared with Femara plus placebo. In other words, the study showed that the median PFS for women treated with Ibrance plus Femara was 27.6 months compared with 14.5 months for the Femara-placebo combination arm, thereby indicating a 44% reduction in the risk of disease progression.

PALOMA-2 had enrolled 666 women in all from 186 global sites across 17 countries. The updated results and the safety profile from the post-hoc analysis are consistent with the primary data from the PALOMA-2 study, reported last November.

We remind investors that Ibrance in combination with Femara was cleared in the United States under an accelerated approval in February 2015 for treatment of HR+/HER2- advanced or metastatic breast cancer. In April, Pfizer received a regular approval for the drug based on data from the PALOMA-2 trial. Also, around the same time, Ibrance’s label was expanded covering a few more indications to be used in combination with any aromatase inhibitor and not just Femara.

Pfizer is exploring the possibility of expanding Ibrance into recurrent and subsequent early breast cancer as well as several non-breast cancer indications like pancreatic and head and neck cancers.

Ibrance has been generating strong sales as a key driver of the company’s top line. The drug logged sales of $2.41 billion in the first nine months of 2017, up 61% year over year. On successful label expansion, the drug should reap in more revenues.

However, in the breast cancer market, competition for Ibrance has increased with recent launches for Eli Lilly's (NYSE:LLY) Verzenio and Novartis’ Kisqali.

Zacks Rank

Pfizer carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Pfizer, Inc. (PFE): Free Stock Analysis Report

Eli Lilly and Company (LLY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

Original post

Zacks Investment Research