To be a smart contrarian you need to have the confidence to dive into unloved areas of the market and sort through the rummage in search of asymmetric opportunities.

Our team at Macro Ops has been digging deep and has finally “struck oil” in the energy market.

The popular narrative driving oil’s bear market over the last 3 years has consisted of two core ideas:

- Fracking has caused the supply of oil to explode.

- The adoption of electric vehicles is killing a huge source of oil demand.

Combine increased supply with decreased demand and of course you’re going to get a drop in prices.

Though this remains the popular narrative, the latest underlying data is telling a different story. And as always investors are slow to react, creating an opportunity for us.

First off, the market is overstating oil’s supply growth.

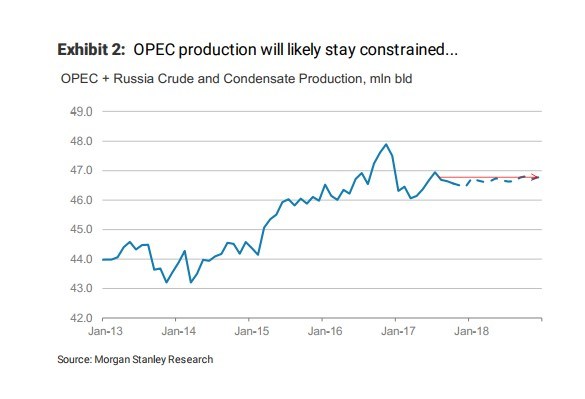

OPEC’s recent decision to extend their current output agreement means production will hold steady into the end of 2018.

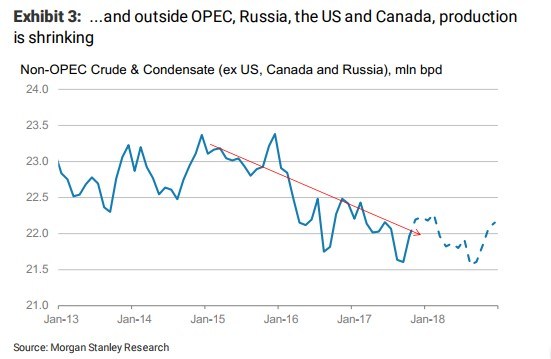

And production outside OPEC, Russia, and the US and Canada has been shrinking. Over the last year aggregate production as fallen by 0.3 mb/d. It’s expected this number will fall by another 0.1 mb/d in 2018 as well.

This puts pressure on US frackers to pick up the slack. For them to fill the gap they’ll need to grow their output by 20% in 2018.

But what we’re finding is that shale productivity growth is slowing at an alarming rate. This is because frackers have already pulled the easy oil from their tier 1 properties they’re now having to move on to less productive fields.

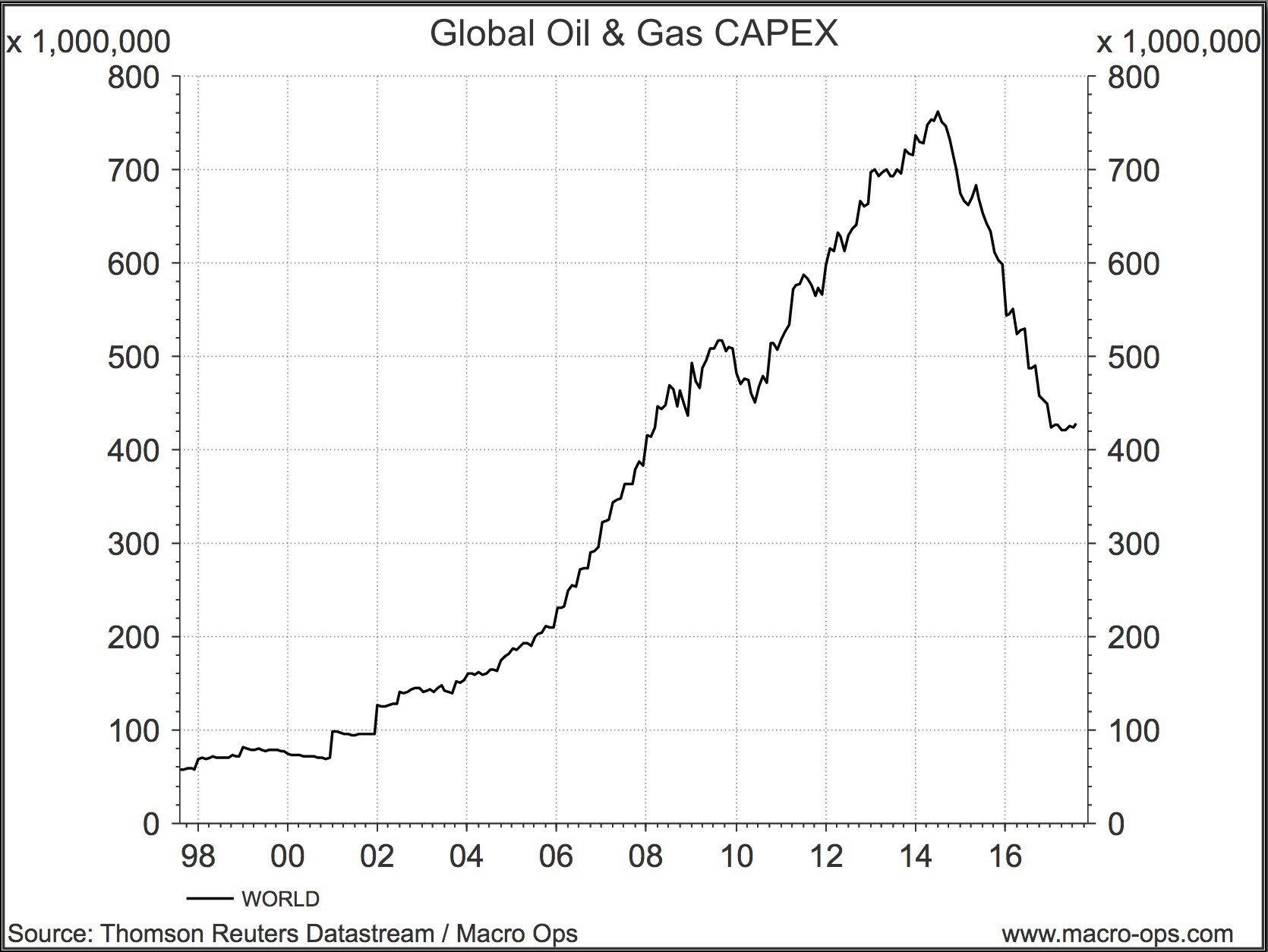

In addition, oil companies in the US and the rest of the world have significantly cut their CAPEX over the last 3 years.

Global oil and gas investment, as a percentage of GDP, has collapsed from a cycle high of 0.9% in 2014 to just 0.4% today.

That means CAPEX into future capacity is now less than half of what it was just a few years ago. This makes it one of the largest capex reductions in the global oil and gas space, in history.

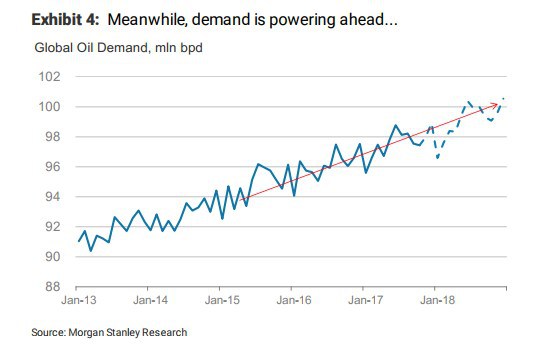

At the same time, global oil demand is increasing.

And this will only accelerate as we progress further into the “Overheat” phase of the business cycle where commodity prices shoot higher.

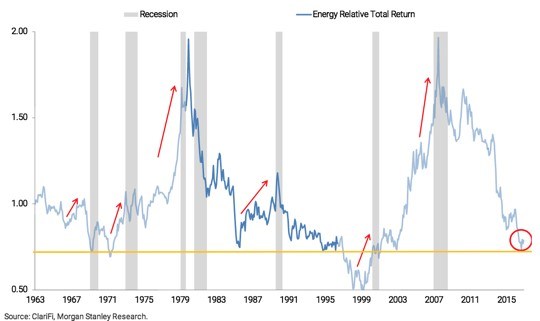

You can see how well energy performs in the final years of a bull market in the chart below:

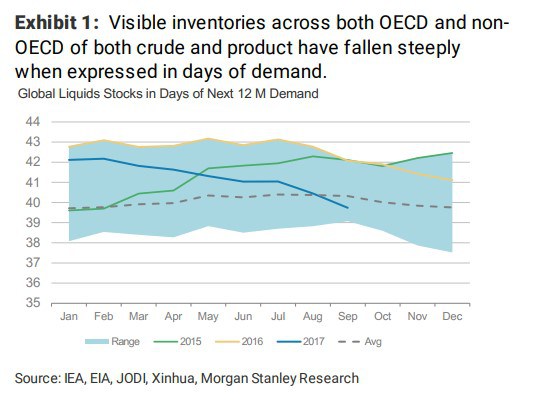

The result of this mismatch in supply and demand has caused inventories to fall drastically.

So what we have here is a market that believes there’s an ever-growing supply of oil faced with shrinking demand, when in reality, the opposite is true. Demand is growing and supply is shrinking which will cause prices rise.

As traders we’re rarely given scenarios where the market is so wrongly positioned. This is one of them.

The argument we’ve made here is just scratching the surface of our full oil thesis. In this month’s Macro Intelligence Report (MIR), we layout the evidence we’ve gathered that shows just how off the market is.

We’ll also show you exactly how we plan to play this oil reversal. We’ve got a basket of oil stocks that are primed to take off along with an options play on the commodity itself.

And we’re not just covering oil either… we also have some key information about the financial and industrial sectors of the market that you’ll want to hear.

If you’re interested in riding these macro trends with us, then subscribe to the MIR by clicking the link below and scrolling to the bottom of the page:

There’s no risk to check it out. There’s a 60-day money-back guarantee. If you don’t like what you see, and aren’t able to profit from it, then just shoot us an email and we’ll return your money right away.

Like I said, blatant contrarian opportunities like this are rare. Don’t miss your chance to take advantage.