On December 7, the Group of Central Bank Governors and Heads of Supervision (GHOS) could announce the finalization of the Basel set of global banking reforms, delayed for one year. The compromise would see the introduction of a capital floor. Then, the risk-weighted assets (RWA) calculated under banks’ internal models will not be allowed to be lower than a share (maybe 72.5%) of the RWA calculated under the standardized approach. This single floor faces two pitfalls.

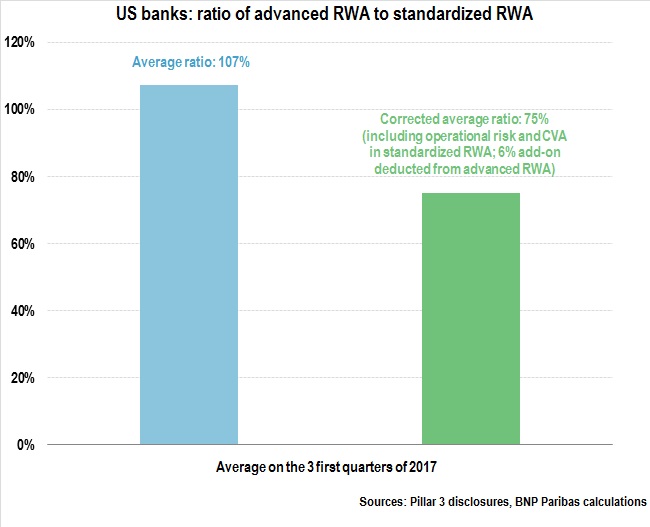

First, there is a methodologic issue. The calculation methods for floors, as suggested by the Basel Committee or applied on either side of the Atlantic, are not the same. Thus the 100% floor imposed in the US by the Collins Amendment applies to a tight calculation basis as the US standardized approach does not include RWA for operational risk in particular. This makes the US floor requirement less restrictive than it appears (on average, the ratio of advanced RWA to standardized RWA stands at 75% after correction). Without revision in the definition of the US floor and without the implementation of other new requirements around banks’ trading books (FRTB) in the US, any harmonization or comparison effort would be vain.

Second, there are huge differences in the relative role of banks in credit intermediation and in terms of the intensity of risk on banks’ balance sheets. Indeed, the internal models for valuing risk are not exempt from imperfections and have to be checked by supervisors. However, the leverage ratio already plays the safety-net role that the floor is intended to fulfill; with the same disadvantage, penalizing “good” risk in favor of “bad”.

by Céline CHOULET