Ciena Corporation (NYSE:CIEN) is set to report fiscal fourth-quarter 2017 results on Dec 7.

Last quarter, the company reported non-GAAP earnings of 51 cents, which increased 21.4% on a year-over-year basis and beat the Zacks Consensus Estimate of 49 cents.

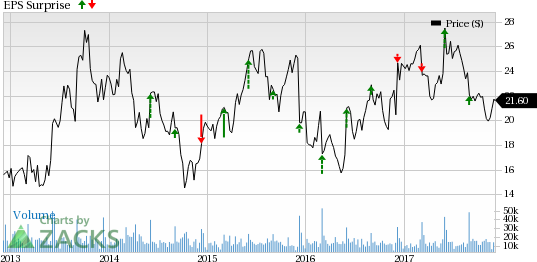

Notably, the company has a mixed earnings surprise track record. It has beaten estimates twice in the trailing four quarters and missed it on the other two occasions, delivering an average positive surprise of 2.75%.

Revenues of $728.7 million increased 8.7% year over year and beat the consensus mark of $726.9 million.

Although shares of Ciena have lost 11.5% of its value year to date, it fared better than the industry to which it belongs. The industry declined 23.1% in the same time frame.

Let's see how things are shaping up for this announcement.

Key Factors

Ciena’s diversified product portfolio is helping it to expand its customer base. The high demand for its products is evident from the successful sale of its new products to existing and customers.

The company’s stackable data center interconnect platform, WaveServer is trending well. Given the good adoption rate of WaveServer, the company maintains its expectation of $100 million revenues from the platform in the current fiscal.

Ciena is also anticipated to witness high growth in the APAC zone, especially in India. The company also expects stabilized growth in EMEA and CALA zones.

We believe its newly launched 400 gig per wavelength chip, Wavelogic AI, will have an impact on global sales in the soon-to-be-reported quarter.

However, Ciena competes against much larger players in the networking industry such as Cisco (NASDAQ:CSCO) and Ericsson (BS:ERICAs), which is a major obstacle for the company.

Customer concentration has also been a major concern for Ciena. In the last reported quarter, two customers Verizon Communications Inc. (NYSE:VZ) and AT&T Inc. (NYSE:T) accounted for about 28% of revenues.

In the North American market, softness in orders from a few regional service providers will remain an overhang. Besides, uncertainty related to government business and macroeconomic volatility is a headwind.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or #5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Ciena has an Earnings ESP of +2.3% but it carries a Zacks Rank #5 (Strong Sell). Therefore, the company is unlikely to deliver a positive surprise this quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Ciena Corporation (CIEN): Free Stock Analysis Report

Original post