For the 24 hours to 23:00 GMT, the GBP rose 0.45% against the USD and closed at 1.3414, on hopes that Britain and the European Union moved closer to a Brexit deal.

In economic news, UK’s mortgage approvals dropped to a level of 64.6K in October, falling to a more than one-year low level. Mortgage approvals had registered a revised reading of 66.1K in the prior month, while markets were expecting for a drop to a level of 65.0K. Moreover, the nation’s net consumer credit advanced £1.45 billion in October, less than market expectations for a rise of £1.50 billion. In the prior month, net consumer credit had registered a revised rise of £1.48 billion.

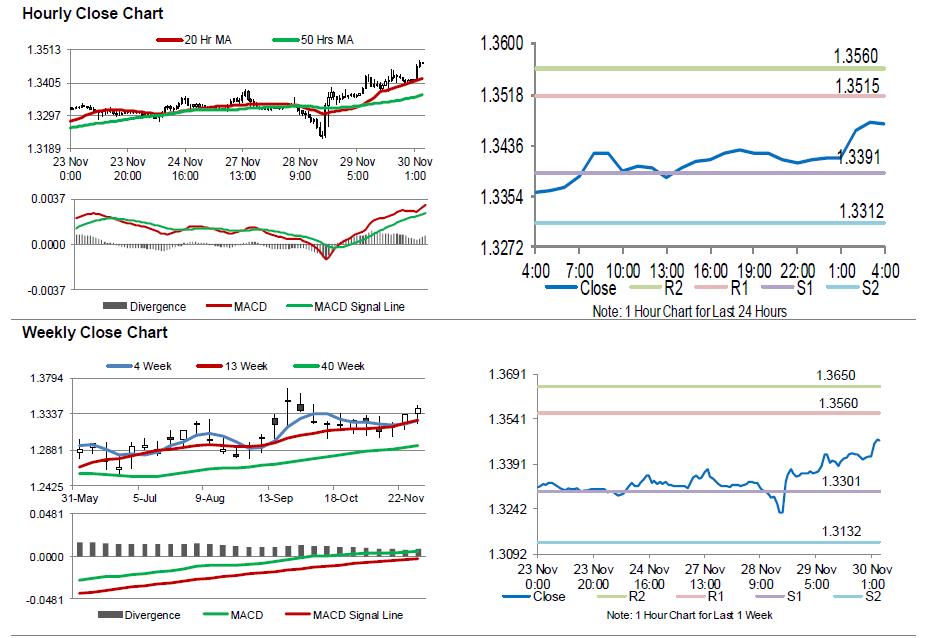

In the Asian session, at GMT0400, the pair is trading at 1.3471, with the GBP trading 0.42% higher against the USD from yesterday’s close.

Overnight data indicated that the nation’s GfK consumer confidence index eased to a 4-month low level of -12.0 in November, as households turned gloomy about the nation’s economic outlook. The index had recorded a level of -10.0 in the prior month, while investors had envisaged for a fall to a level of -11.0.

The pair is expected to find support at 1.3391, and a fall through could take it to the next support level of 1.3312. The pair is expected to find its first resistance at 1.3515, and a rise through could take it to the next resistance level of 1.356.

Going ahead, trades would focus on UK’s Nationwide house prices for November, due to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.