Follow-Through Buying Likely

I will update around 6:55 a.m.

Pre-Open Market Analysis

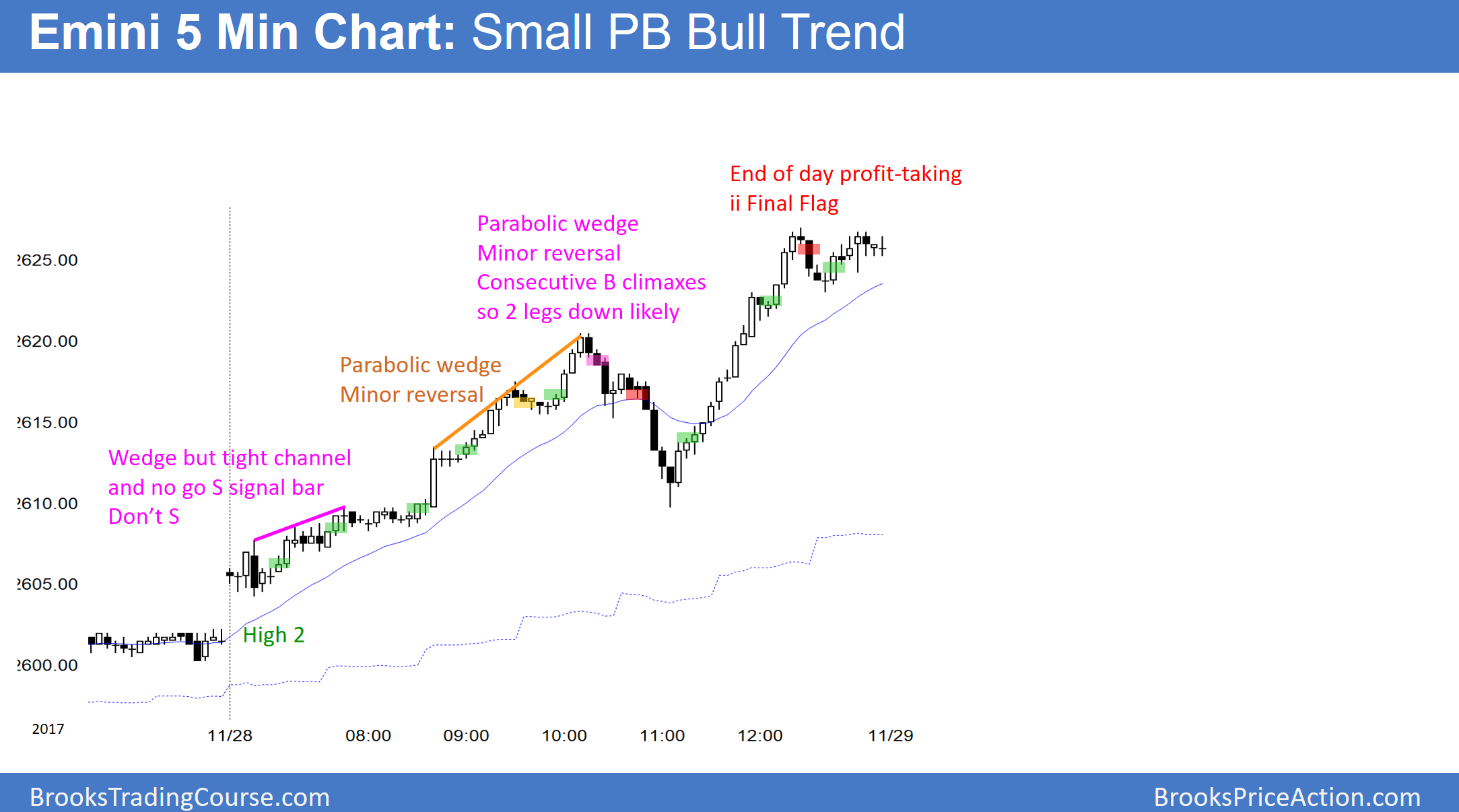

Yesterday was a very strong bull trend day that broke above the wedge top on the Emini's daily chart. The rally was strong enough so that bulls will buy the 1st pullback on the daily chart.

Since yesterday was climactic, there is a 50% chance of follow-through buying in the 1st 2 hours. There is also a 75% chance of at least 2 hours of sideways to down trading beginning by the end of the 2nd hour.

Overnight Emini Globex Trading

The Emini is up 2 points in the Globex market. Today might therefore gap up. The bulls want consecutive strong bull days. They have a 25% chance of success. At a minimum, they want a close above the open. This would create a bull body on the daily chart and represent follow-through buying. Therefore, if the Emini is below the open in the final hour, traders should look for a late rally back to the open.

The bears want a bear body at a minimum. They would see that as a sign that yesterday’s breakout failed. Furthermore, they want a big bear trend day that totally reverses yesterday’s rally. The odds of that are about 20%.

Most likely, today will be a trading range day. There is a 50% chance of follow-through buying in the 1st 2 hours. However, the Emini would then likely either enter a tight range or reverse back to the open.

If there is a gap up, it will probably be small. In addition, it will probably close withing the 1st hour and be meaningless. The most important information that traders will get today is whether there will be at least minimum follow-through buying. If so, the odds would favor at least a small 2nd leg up.

Yesterday’s rally was so exceptionally strong that the odds favor higher prices over the next week or two. Yet, when a rally is unusually strong, there is an increased chance that it is an exhaustive buy climax that can lead to a trend reversal.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.