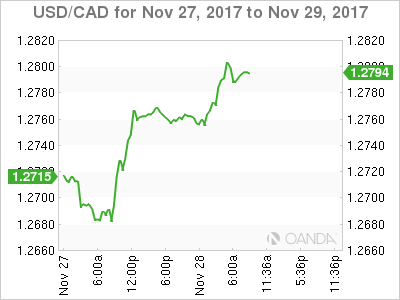

The Canadian dollar has posted slight gains in the Tuesday session. Currently, USD/CAD is trading at 1.2794, up 0.19% on the day. On the release front, Canada releases two inflation reports, and BoC Governor Stephen Poloz holds a press conference about the Financial System Review. The US will release CB Consumer Confidence, with an estimate of 123.9 points. Fed Chair Designate Jerome Powell will testify at his confirmation hearing before the Senate Banking Committee. On Wednesday, the US publishes Preliminary GDP and Pending Home Sales and Janet Yellen will testify before a congressional committee.

The spotlight is on Jerome Powell, who is replacing Janet Yellen at the helm of the Federal Reserve. Investors will learn a bit more about Powell, who testifies before the Senate Banking Committee on Tuesday for his confirmation hearing. Powell is widely expected to maintain Janet Yellen’s cautious monetary stance, which has been marked by small, incremental rate hikes. Powell inherits an economy that is in excellent shape, but persistently low inflation remains a nagging problem. Fed policymakers have differing views on what to do about inflation, with some members proposing that the Fed drop its 2 percent target, in favor of a “gradually rising path” for prices. The Fed remains confounded by low inflation and wage growth, despite a labor market that is at full capacity. Still, the Fed will likely pull the rate trigger next month, and could raise rates up to 3 more times in 2018 if the economy continues to expand at its current pace.

The Canadian dollar remains under pressure, as oil prices have dipped lower. As well, weak retail sales reports for September missed their estimates and this continues to weigh on the currency. Core Retail Sales improved to 0.3%, but this was well off the forecast of 0.9%. Retail Sales came in at 0.1%, compared to an estimate of 0.9%. Investors will be keenly following the Bank of Canada, which releases its semi-annual Financial System Review.

USD/CAD Fundamentals

Tuesday (November 28)

- 8:30 Canadian RMPI

- 8:30 Canadian IPPI

- 8:30 US Goods Trade Balance. Estimate -65.0B

- 8:30 US Preliminary Wholesale Inventories. Estimate 0.5%

- 9:00 US HPI. Estimate 0.6%

- 9:00 S&P/CS Composite-20 HPI. Estimate 6.0%

- 9:15 US FOMC Member William Dudley Speaks

- 9:45 US Fed Chair Designate Jerome Powell Speaks

- 10:00 US CB Consumer Confidence. Estimate 123.9

- 10:00 US Richmond Manufacturing Index. Estimate 14

- 10:15 US FOMC Member Patrick Harker Speaks

- 15:45 US Treasury Secretary Steven Mnuchin Speaks

Wednesday (November 29)

- 8:30 US Preliminary GDP. Estimate 3.3%

- 10:00 US Fed Chair Janet Yellen Testifies

- 10:00 US Pending Home Sales. Estimate 1.1%

- 11:30 BOC Governor Stephen Poloz Speaks

*All release times are GMT

*Key events are in bold

USD/CAD for Tuesday, November 28, 2017

USD/CAD, November 28 at 8:10 EDT

Open: 1.2769 High: 1.2807 Low: 1.2754 Close: 1.2794

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2532 | 1.2630 | 1.2757 | 1.2860 | 1.3015 | 1.3165 |

USD/CAD was flat in the Asian session and has edged higher in European trade

- 12757 was tested earlier in support

- 1.2860 is the next resistance line

- Current range: 1.2757 to 1.2860

Further levels in both directions:

- Below: 1.2757, 1.2630, 1.2532 and 1.2432

- Above: 1.2860, 1.3015 and 1.3165

OANDA’s Open Positions Ratio

USD/CAD ratio is almost unchanged in the Tuesday session. Currently, long positions have a majority (55%), indicative of trader bias towards USD/CAD continuing to move higher.