- The slope of the US yield curve has flattened significantly this year despite Fed rate hikes

- In the past this has often been a harbinger of a major economic downturn

- In this cycle the signal coming from the yield curve has probably become less reliable

Since the start of this year, the difference between the 10 year and the 2 year yield in the US has dropped about 100 basis points. This is raising concerns because past recessions have often been preceded by a significant flattening of the yield curve. This concern is even bigger when the Federal Reserve is in tightening mode because it raises the spectre of a monetary overkill. A flatter curve means that long term yields hardly react to policy rate hikes. In this respect, the Federal Reserve Bank of San Francisco’s Economic Letter this week wonders whether there is a new conundrum in the US bond market, very much like in 2004-2005.

Assessing whether there is reason to be worried is difficult because QE has biased the signal coming from the bond market by pushing down yields. Moreover, the US Treasury recently announced that it would issue less at the longer end of the curve, a decision which can contribute to a curve flattening. Interestingly, when separating the bond yield in a risk neutral yield, which reflects monetary policy anticipations, and the term premium, one notices that the risk neutral yield has moved up in sync with the federal funds rate whereas the term premium has dropped. Why do investors believe that policy will be tighter in years to come whilst accepting an increasingly negative risk premium?

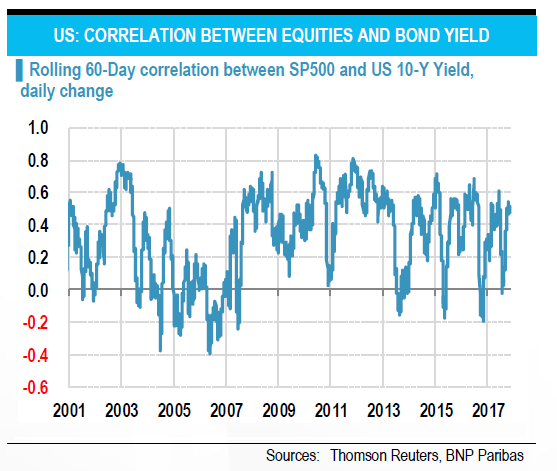

In addition to purely economic explanations like a declining inflation risk premium or a lower equilibrium rate of interest, portfolio theory also gives a possible reason. Investors might like bonds despite their low yield because bonds provide a hedge for the tail risk exposure via their equity positions. The chart shows that the rolling correlation between changes in the S&P500 and changes in treasury yields has been consistently high in recent years (as opposed to 2005-06) so the impact of an equity market decline on the performance of a diversified portfolio is cushioned by a drop in yields and hence positive bond returns. This attitude can even lead to mutually reinforcing dynamics: low yields entice investors to go for equities which pushes up their valuation which in turn supports the demand for tail risk hedges (US treasuries). This lowers yields which, on a relative basis, make high price/earnings multiples more acceptable. This leads to two conclusions: the fate of Wall Street very much depends on what happens to bond yields and, when assessing the economic outlook, we need to look at other variables than the yield curve.

by William DE VIJLDER