Summary

-

BAE Systems PLC. (LON:BAES) is a high-quality UK-based defense company currently going through a correction due to concerns over Qatar’s spat with Saudi Arabia, possibly affecting its Eurofighter orders.

-

With increasing geopolitical tensions around the world, global defense budgets are now set to grow north of $2 trillion by the end of 2026. And weapon systems manufacturers such as BAE Systems are especially well-placed to benefit from this trend.

-

Compared to its global peers such as Lockheed Martin (NYSE:LMT) and Raytheon (NYSE:RTN), especially after its recent correction, BAE Systems is currently trading at an attractive valuation of 18.7x FY2016 P/E, providing investors with a good opportunity to gain exposure to the steadily growing defense industry.

Current Correction Due To Qatar Worries

BAE Systems PLC. (LON:BAES) is a high-quality UK-based defense company currently going through a correction due to concerns over Qatar’s spat with Saudi Arabia, possibly affecting its Eurofighter orders.

With increasing geopolitical tensions around the world, global defense budgets are now set to grow north of $2 trillion by the end of 2026. And weapon systems manufacturers such as BAE Systems are especially well-placed to benefit from this trend.

Compared to its global peers such as Lockheed Martin (NYSE:LMT) and Raytheon (NYSE:RTN), especially after its recent correction, BAE Systems is currently trading at an attractive valuation of 18.7x FY2016 P/E, providing investors with a good opportunity to gain exposure to the steadily growing defense industry.

BAE Systems is the world’s 3rd largest defense company by revenue, with main geographical exposures to the United States (39% by revenue), United Kingdom (22%) and Saudi Arabia (21%). The London-based weapon systems manufacturer produces the widely-used Eurofighter Typhoon fighter aircraft, supplying it to the air forces of the UK, Germany, Italy, Spain, Austria and even Saudi Arabia. BAE also manufactures and supports the maintenance of various weapon systems such as the Challenger 2 main battle tank for the British Army, and the Mk 45 Mod 4 Naval Gun System for the US Navy, just to list a few.

In terms of financial health, BAE Systems also looks to be in good shape. The company generates a return on invested capital of 11.51% based on FY2016 figures, significantly above its cost of capital of 8.2%, thereby generating positive value for all of its capital providers. Though BAE operates in a capital-intensive industry, prudent working capital management has kept its cash conversion cycle relatively fast at only about 30 days, contributing to its high free cash flow generation of £659 million in FY2016 (3.8% FCF yield). Balance sheet wise, BAE does take on a fair bit of debt – about £1.6 billion of net debt as of FY2016. However, it’s worth to note that the company can easily pay this off, given that its net debt is only a meager 0.8x that of its EBITDA.

Recently, the company went through a major correction (about 15% since October) due to worries that Qatar might not follow through with their letter of intent to buy 24 Eurofighter Typhoons, due to its diplomatic standoff with Saudi Arabia. The market has taken this news in bad taste, especially with the uncertainties coming out of Brexit, possibly increasing the cost of doing business for UK-based companies such as BAE. However, we think it is worth to note that Qatar only represents a small portion of overall revenues, and the 3 main revenue generators for BAE remain the US, UK and Saudi Arabian militaries, and these long-standing business relationships are unlikely to break so easily.

Global Defense Spending And Geopolitical Tensions

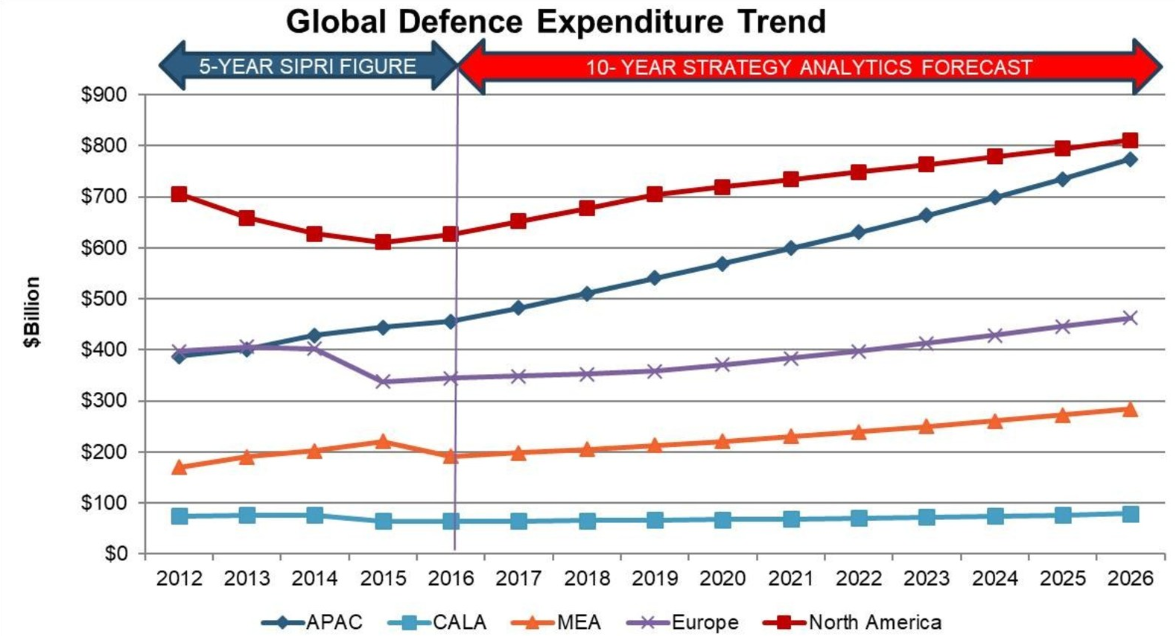

Source: Strategy Analytics Advanced Defense Systems (ADS) service report 2017

According to the Strategy Analytics Advanced Defense Systems service report, the total global defense budget is set to grow towards $2.41 trillion by 2026. From the 2016 figure of about $1.70 trillion, this represents a compounded annual growth rate (CAGR) of 3.5%, with growth led by the Asia Pacific region, followed by the Middle East and North America. This trend could be explained by the increasing geopolitical tensions between nations, with examples such as the current saga between the United States & North Korea, and the constant conflicts in the Middle-East. Being one of the leading defense players in the market, with a track record of producing many state-of-the-art defense technologies, BAE is well-placed to secure incremental contract wins from the militaries of these regions.

Attractive Valuations Vs. Global Peers

After the recent correction, BAE systems currently trade at a valuation of 18.7x FY2016 P/E, with a projected EPS growth rate in the region of 45%~50% for FY2017, according to Bloomberg. Taken on face value, this represents an attractive valuation given that many of BAE’s global peers trade at much higher valuations with lower growth prospects. Lockheed Martin, the world’s largest defense company, and its American peer Raytheon, trade at 25x ~ 27x historical P/E, with high single-digit projected growth rates. Compared to these large-cap American players, we think BAE Systems offer greater value at current market prices, providing an opportunity for investors to gain exposure to the steadily growing defense industry.

Disclosure: We have no positions in any stock mentioned above.