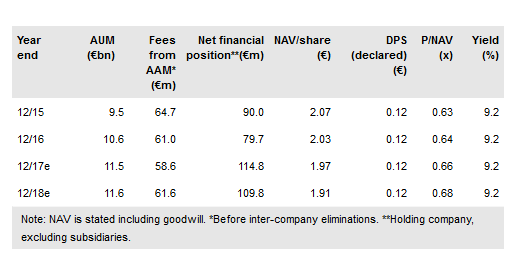

Although Q317 saw a reduction in NAV per share as a result of lower investment portfolio values, DeA Capital (SG:DEA) saw a positive acceleration in net cash flows from fund investments and a noticeable further strengthening in the net financial position. Alternative assets under management also continued to increase and our valuation of the asset management division increases, partly offsetting the investment portfolio valuation impact on our modified NAV/sum-of-the parts (SOP), which reduces to €1.87 from €1.91 previously. The share price discount to both IFRS NAV and our SOP remains attractively wide while strong cash flow underpins the high level of distributions and attractive 9.2% yield.

NAV lower but AUM growth and strong cash flow

NAV per share was €1.96 at 30 September 2017, down from €2.00 at 30 June. Assets under management (AUM) grew further in Q217, continuing the recovery that began in Q116, with real estate and private equity assets now at c €11.6bn. Negatively affecting NAV in Q3, Migros gave back some of the gains achieved earlier in the year but remains well ahead of the start of year value. Meanwhile, reimbursements from fund holdings exceeded cash calls by c €10m in the quarter, lifting the holding company net financial position to €67.7m or €0.26 per share. DeA’s share of fund distributions already approved for Q4 is €26.5m and we expect €23.8m to be received from the recently completed further sale of a 7.3% stake in Migros (c €12.0m) and completion of the agreed Sigla sale (€11.8m).

To read the entire report Please click on the pdf File Below: