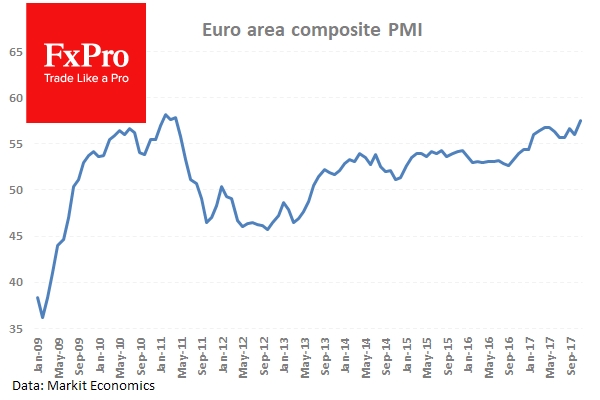

Data released on Thursday from Markit Economics showed eurozone’s thriving economy powered ahead in November, with new manufacturing orders reaching 17-year highs and a resilient labour market that has shown steady growth. The data suggests that eurozone businesses experienced their best month in almost 7 years, with the main indicators of demand, output, employment and inflation at multi-year highs.

The data signals that Q4 GDP growth is likely to surpass expectations, with an annualized growth that could reach 3%. Services and Manufacturing businesses reported better-than-expected activity in November, with a strong performance from Germany helping to push the manufacturing sub-index to its second-highest level on record. As a result, EUR has seen demand, helping push it to near-monthly highs.

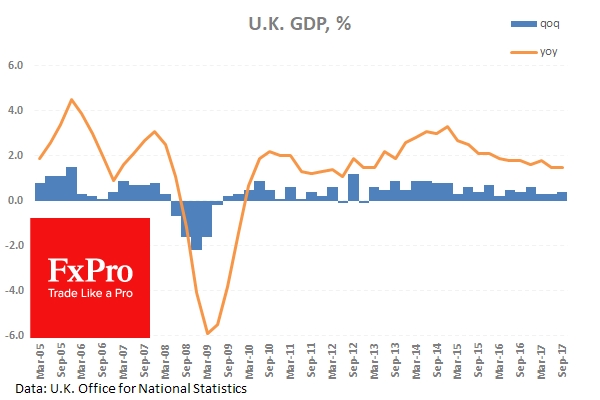

More positive data came out of the UK as the Office for National Statistics (ONS) released GDP (for July to September) growing by 0.4%, a slight improvement on the 0.3% growth in Q1 and Q2. Additionally, consumer spending showed resiliency, bouncing back to 0.6% from 0.2% in Q2, regardless of the persistent squeeze on individual finances from higher inflation and poor wage growth. GBP has remained firm against USD throughout November and traded near to 2-month highs on Thursday.

EURUSD is little changed overnight, currently trading around 1.1842.

USDJPY is 0.25% higher in early Friday trading at around 111.48, after hitting a 2-month low on Thursday.

GBPUSD is 0.1% lower in early session trading at around 1.3293.

Gold is unchanged overnight, trading at around $1,290.50.

WTI is currently trading at around $58.45.

Major data releases for today:

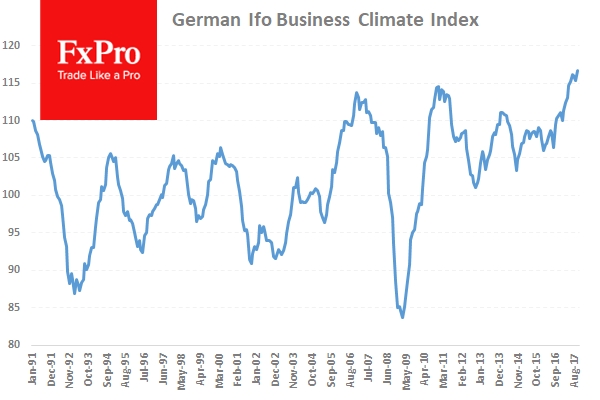

At 09:00 GMT, the CESifo Group will release German IFO – Business Climate, Current Assessment & Expectations for November. As an indicator for current business conditions in Germany, the markets will be keen to see if the political instability is affecting sentiment. Business Climate is forecast at 116.5 (prev. 116.7), Current Assessment 125.0 (prev. 124.8) and Expectations 108.9 (prev. 109.1). If the actual data is worse than expected we are likely to see EUR volatility.

At 12:30 GMT, European Central Bank Vice President Vitor Constancio is scheduled to speak.

At 14:45 GMT, Markit Economics will release US Manufacturing PMI, Composite PMI and Services PMI for November. Manufacturing PMI is expected to improve to 54.8 (from 54.6) and Services to improve to 55.5 (from 55.3). The US economy has shown robustness of late and the markets will be expecting positive PMI data. If the data misses expectations USD is likely to experience selling pressure.

At 18:15 GMT, ECB Executive Board Member Benoit Coeure is scheduled to speak.