Time Inc. (NYSE:TIME) is slated to report third-quarter 2017 results on Nov 9, before the opening bell. The question lingering in investors’ minds is whether this leading media company will be able to deliver positive earnings surprise in the soon-to-be reported quarter.

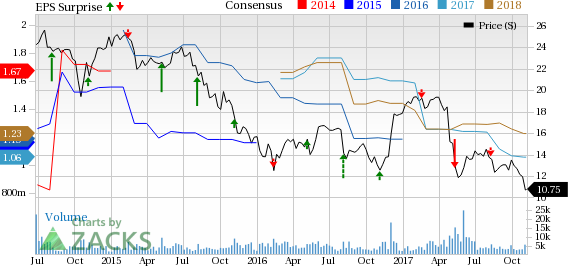

The company’s earnings have lagged the Zacks Consensus Estimate in three of the trailing four quarters, with an average miss of 25.3%.

Let’s see how things are shaping up prior to this announcement.

Which Way are Estimates Treading?

In order to get a clear picture of what analysts are thinking about the company right before earnings release, let’s have a look at the earnings estimate revisions. The Zacks Consensus Estimate for the third quarter has moved down by 3 cents to 30 cents in the past 30 days and is also a penny down from the year-ago quarter.

Further, analysts polled by Zacks expect revenues of $700 million, down 6.7% from the prior-year quarter.

Factors Influencing this Quarter

Apart from a weak earnings surprise history, Time’s revenues have been declining for a while now. In fact, the top line decreased 8% and 10% in the first and second quarters of 2017, respectively. Also, the same lagged the Zacks Consensus Estimate for the last five quarters. While, advertising revenues were down 12% during the second quarter, Print and other advertising revenues fell 17% and digital advertising revenues dipped 2%.

Nevertheless, the company is targeting adjacent revenue opportunities that comprise Live Media, SI Play, e-commerce and various other products. In fact, through acquisitions of Bizrate Insights — an online survey and subscription marketing company — and Adelphic — a provider of programmatic advertising platform – Time is expanding its digital presence. Also, these acquisitions are likely to boost its revenues in the near term.

Meanwhile, this media company is concentrating on customization of data to aid advertisers target audience more effectively. In this regard, it acquired the assets of Viant, an ad tech company. Also, Time’s Transformation Program remains encouraging.

What the Zacks Model Unveils?

Our proven model does not show that Time is likely to beat earnings estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Time has an Earnings ESP of +3.33% as the Most Accurate estimate of 31 cents is pegged higher than the Zacks Consensus Estimate of 30 cents. However, the company carries a Zacks Rank #4 (Sell).

As it is we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

News Corporation (NASDAQ:NWSA) has an ESP of +3.70% and has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

MSG Networks Inc. (NYSE:MSGN) has an Earnings ESP of +0.31% and a Zacks Rank #3.

DISH Network Corporation (NASDAQ:DISH) has an ESP of +1.68% and carries a Zacks Rank #3.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

DISH Network Corporation (DISH): Free Stock Analysis Report

MSG Networks Inc. (MSGN): Free Stock Analysis Report

News Corporation (NWSA): Free Stock Analysis Report

Time Inc. (TIME): Free Stock Analysis Report

Original post

Zacks Investment Research