EPR Properties (NYSE:EPR) is scheduled to report third-quarter 2017 results on Nov 8, after the closing bell.

In the prior quarter, this real estate investment trust (“REIT”) delivered a positive surprise of 4.03% in terms of funds from operations (“FFO”) per share.

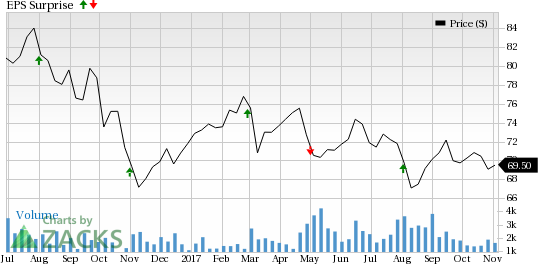

Over the trailing four quarters, the company surpassed estimates on three occasions and missed in the other. This resulted in an average positive surprise of 0.78%. The graph below depicts the surprise history of the company:

EPR Properties Price and EPS Surprise

Note: The EPS numbers presented in the above chart represent funds from operations (“FFO”) per share.

However, EPR Properties has lost 3.1% of its value year to date versus 6.6% rally of its industry.

Let’s see how things have shaped up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that EPR Properties is likely to beat estimates because it has the right combination of two key ingredients. A stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) to beat estimates, and EPR Properties has the right mix.

Zacks ESP: The Earnings ESP, which represents the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +0.93%. This is a major indicator of a likely positive surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: EPR Properties carries a Zacks Rank #3.

The combination of EPR Properties’ favorable Zacks Rank and positive ESP makes us reasonably confident of a positive surprise this season.

Conversely, we caution against stocks with Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

What's Driving the Better-Than-Expected Earnings?

EPR Properties is a specialty REIT that focuses on investments in properties across three primary market segments — Entertainment, Recreation and Education. It is expected to benefit from its strategic investment in each of its segments and a diversified tenant base in the to-be-reported quarter. Improving economy and upbeat consumer confidence are likely to drive the company’s performance.

Particularly, growth in the millennial generation is likely to drive the Entertainment segment as millennials constitute the major chunk of frequent moviegoers. Notably, over time, this group has grown considerably. In addition, the renovation works and new food and beverage concepts introduced in megaplex theatres are aimed at improving customer experience and are likely to improve attendance and enhance revenues in the quarter.

The Recreation segment too promises a decent performance, led by solid demand for properties amid an economic recovery backed by job growth. Notably, during the second quarter, the company substantially expanded its portfolio of ski properties and attractions with casino lifestyle properties transaction.

Further, investments in the Education segment are likely to boost its performance. The company is expected to experience growth in enrollment as there is a healthy demand for quality education and associated facilities amid modest supply.

Over the past seven days, the Zacks Consensus Estimate for third-quarter FFO per share remained unchanged at $1.29.

Other Stocks That Warrant a Look

Here are a few other stocks in the REIT sector that you may want to consider, as our model shows that they have the right combination of elements to report a positive surprise this quarter:

Lexington Realty Trust (NYSE:LXP) , slated to release third-quarter results on Nov 7, has an Earnings ESP of +2.34% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

RLJ Lodging Trust (NYSE:RLJ) , set to release third-quarter figures on Nov 8, has an Earnings ESP of +1.35% and a Zacks Rank of 3.

Farmland Partners Inc. (NYSE:FPI) , likely to release third-quarter earnings on Nov 8, has an Earnings ESP of +28.00% and a Zacks Rank of 3.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

EPR Properties (EPR): Free Stock Analysis Report

RLJ Lodging Trust (RLJ): Free Stock Analysis Report

Lexington Realty Trust (LXP): Free Stock Analysis Report

Farmland Partners Inc. (FPI): Free Stock Analysis Report

Original post

Zacks Investment Research