Copper Non-Commercial Speculator Positions:

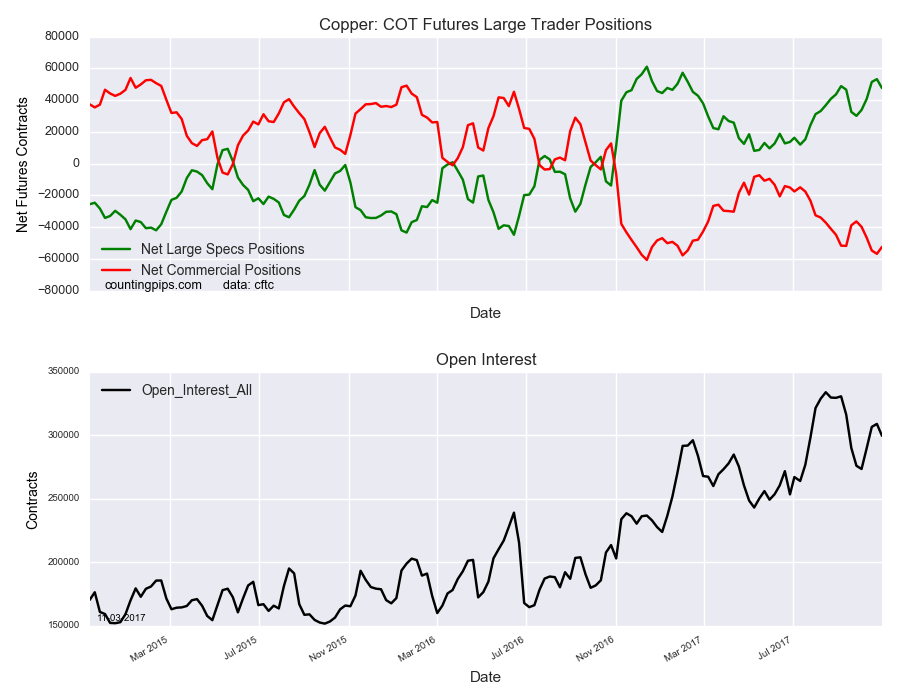

Large speculators cut back on their net positions in the Copper futures markets this week following a four week streak of gains, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Copper futures, traded by large speculators and hedge funds, totaled a net position of 47,593 contracts in the data reported through Tuesday October 31st. This was a weekly fall of -5,659 contracts from the previous week which had a total of 53,252 net contracts.

Speculative positions maintain a strong bullish standing and had risen to the best level since January 31st (+57,276 net contracts) before this week’s decline.

Copper Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -52,443 contracts on the week. This was a weekly increase of 4,364 contracts from the total net of -56,807 contracts reported the previous week.

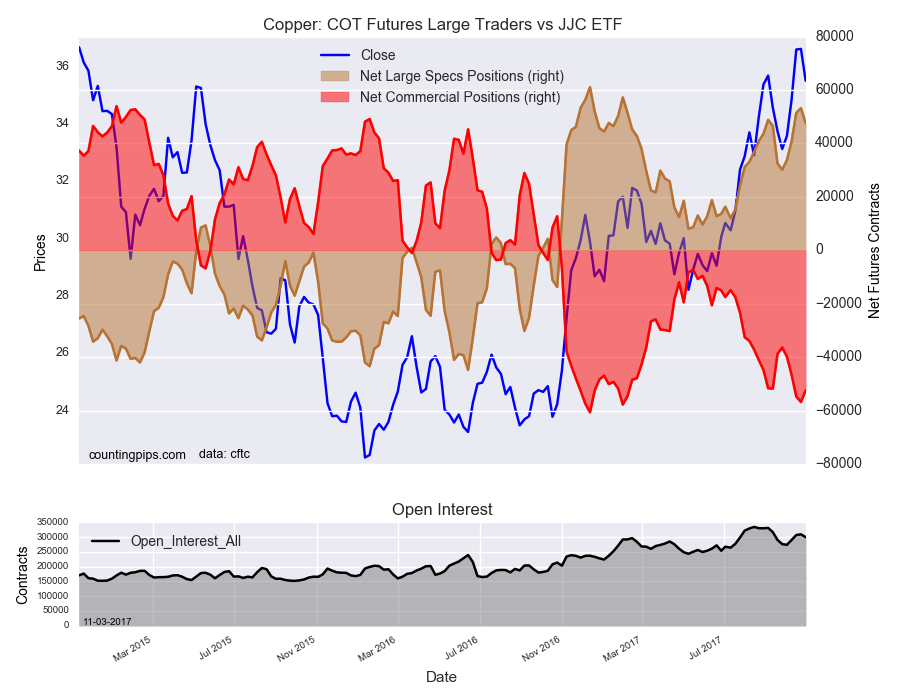

iPath Bloomberg Copper Subindex Total Return Exp 22 Oct 2037 (NYSE:JJC) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the JJC iPath Bloomber Copper ETN, which tracks the price of copper, closed at approximately $35.51 which was a shortfall of $-1.11 from the previous close of $36.62, according to unofficial market data.