PDL BioPharma, Inc. (NASDAQ:PDLI) reported earnings of 14 cents per share in the third quarter of 2017, surpassing the Zacks Consensus Estimate of 13 cents. The bottom line was also higher than the year-ago figure of 8 cents.

The company generated total revenues of $63 million in the quarter, up 17% when compared with the year-earlier figure of $53.6 million. This upside is mainly driven by rise in royalty rights — change in fair value — primarily on the back of the current period’s increase in fair value of the Depomed royalty asset. Also, increase in net product revenues contributed to a stronger top line this quarter.

Notably, the company received cash payments of $26.3 million from the royalty rights acquired from Depomed, primarily related to Glumetza, a product marketed by Valeant Pharmaceuticals International, Inc. (NYSE:VRX) . An authorized generic version of Glumetza was also launched by a Valeant subsidiary in February for which, PDL BioPharma receives 50% of the gross margin.

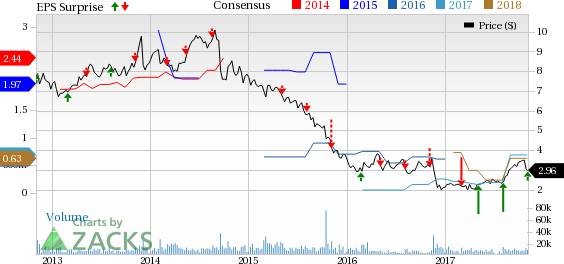

Shares of the company have outperformed the industry so far this year. The stock has surged 38.7% compared with the industry’s increase of 2.3%.

Quarter in Detail

Revenues included royalties of $1.4 million from licenses to the Queen et al. patents, which consisted of royalties earned on sales of Tysabri, net royalty payments from the acquired royalty rights and a change in fair value of the royalty rights assets of 35.4 million, interest revenues of $6.1 million and product revenues of $20.1 million (sales of Noden products — Tekturna and Tekturna HCT in the United States and leasing of the LENSAR Laser System).

Revenues of $1.4 million from the Queen et al. licenses were lower than the year-ago figure of $15 million due to recognition of a refund liability of $13.5 million for the potential overpayment amount received from Biogen (NASDAQ:BIIB) . This is related to royalties on Tysabri sales in the United States, Spain, Italy and South Africa.

Research and development (R&D) expenses for the quarter came in at $0.6 million, down 68.7% from the year-ago quarter.

General and administrative expenses escalated 61.4% to nearly $12 million from the year-ago figure.

Zacks Rank & Key Pick

PDL BioPharma carries a Zacks Rank #3 (Hold). A better-ranked stock in the health care sector is Ligand Pharmaceuticals Inc. (NASDAQ:LGND) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand’s earnings per share estimates have moved up from $3.68 to $3.70 for 2018 over the last 30 days. The company delivered positive earnings surprises in two of the trailing four quarters with an average beat of 6.19%. Share price of the company has surged 43.6% year to date.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

PDL BioPharma, Inc. (PDLI): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND): Free Stock Analysis Report

Valeant Pharmaceuticals International, Inc. (VRX): Free Stock Analysis Report

Original post