BoE: One-off rate hike, or the start of a hiking cycle?

- Today, all eyes will be on the Bank of England rate decision. The forecast is for the Bank to raise its benchmark interest rate by 25bps, something that is almost fully priced in at this stage (88% probability). This is a “Super Thursday” meeting, meaning that besides the rate decision and the meeting minutes, we will also receive the quarterly Inflation Report with updated forecasts, which Governor Carney will present at a press conference.

- Given that a hike today appears to be a done-deal, if the Bank acts as expected, then attention will probably fall on any signals regarding whether this is a one-off move or whether it will be followed by more rate increases. Importantly, the market has fully factored in another rate hike by August next year. Therefore, in order for the pound to strengthen notably after this meeting, the BoE would need to deliver a rate hike and signal its intention to hike at least twice in 2018, which we think is very aggressive and rather unlikely to materialize. As such, we see the case for a sell-the-fact reaction in GBP at this event, with any signals that future hikes will be gradual and data-dependent likely to weigh on the currency.

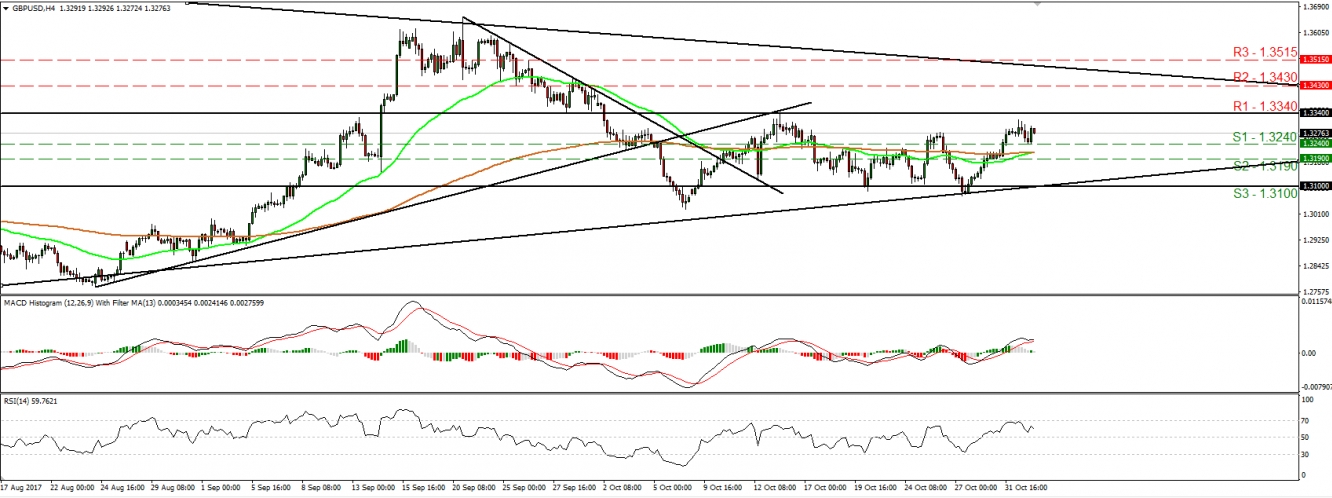

- GBP/USD slid somewhat yesterday after it hit resistance marginally below the 1.3340 (R1) barrier. However, it found support at 1.3240 (S1) and then it recovered somewhat. The rate continues to trade in a sideways manner between 1.3100 (S3) and 1.3340 (R1) and thus, we believe that the short-term outlook remains flat. For the pair to surge and break above 1.3340 (R1), as we already noted, the BoE has to raise interest rates today and signal more than one hikes in 2018. Anything less than that could bring the pound under selling interest. The pair could tumble back below 1.3240 (S1), initially aiming for our next support of 1.3190 (S2).

FOMC stands pat; Tax bill and new Fed Chair in focus

- The FOMC kept its policy unchanged yesterday, while the accompanying statement contained no major deviations in language from the previous one. As such, the reaction in USD was muted on the decision, though the currency did weaken in the following hours, perhaps due to reports that Trump is set to nominate Jerome Powell as the next Chair of the Fed today. Powell is currently considered the clear favorite by betting markets, with John Taylor being the underdog. This implies that if Powell is indeed nominated, the reaction in USD may be negative, but not major. On the other hand, a Taylor nomination would be a big surprise, and given that he is perceived as a hawk on policy, it could trigger a large positive reaction in USD. The last scenario is the one where Powell is chosen as Chair with Taylor proposed as Vice-Chair, which we think could still prove positive for the dollar, as a hawk would be in a leading position at the Fed.

- Besides the Fed chief decision, the other major event in the US today will be the release of the highly-anticipated tax bill. We expect market focus to fall mainly on two areas: how low and how quickly the corporate tax will be reduced, and whether the plan will include a one-time repatriation of corporate cash held abroad at a reduced rate. If the proposed rates on these subjects are relatively low (around 20% for corporate tax and 10% for repatriation), then both US stocks and the USD could surge, we think.

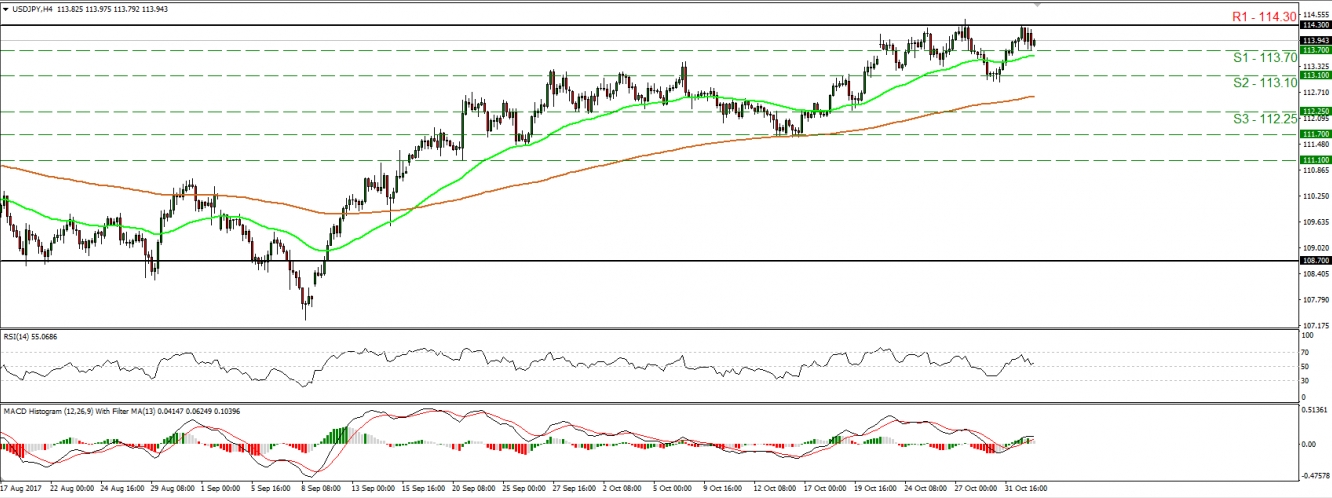

- USD/JPY slid during the Asian morning after it hit resistance once again at the key territory of 114.30 (R1). However, the retreat was stopped fractionally above 113.70 (S1). The move confirms the validity of the 114.30 (R1) zone as the upper bound of the wide sideways range that’s been containing the price action since the 15th of March. A tax bill including a notable reduction in the corporate tax and a repatriation of corporate cash at a reduced rate may help the dollar strengthen again. A Taylor nomination as Fed Chair, or at least as Vice Chair, could add more fuel to that. A clear close above 114.30 (R1) would signal the upside exit of the aforementioned sideways range and may turn the medium-term outlook somewhat positive. On the other hand, the combination of Powell as Fed Chief with a disappointing tax bill, could encourage the bears to drive the battle below 113.70 (S2). Such a dip may initially aim for our next support level of 113.10 (S2).

As for the rest of today’s highlights:

- In the UK, the construction PMI for October is due out, but this release could pass unnoticed ahead of the BoE.

- Besides BoE Governor Carney, Fed Chair candidate Jerome Powell and New York Fed President William Dudley will speak.

GBP/USD

Support: 1.3240 (S1), 1.3190 (S2), 1.3100 (S3)

Resistance: 1.3340 (R1), 1.3430 (R2), 1.3515 (R3)

USD/JPY

Support: 113.70 (S1), 113.10 (S2), 112.25 (S3)

Resistance: 114.30 (R1), 114.85 (R2), 115.40 (R3)