Spanish telecom giant, Telefonica (MC:TEF) S.A. (NYSE:T) , reported impressive financial results in the third quarter of 2017. Both the top line and the bottom line grew year over year.

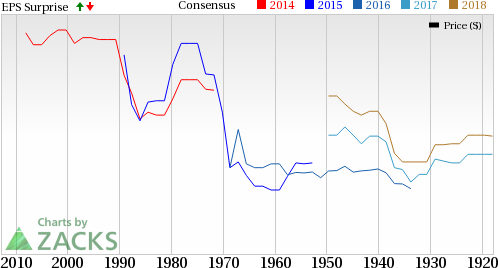

Quarterly net income was €839 million (approximately $986 million), reflecting a decline of 10.2% year over year. However, third-quarter earnings per ADR (American Depository Receipt) came in at 23 cents, up 9.5% year over year.

Telefonica registered revenues of €12,754 million (roughly $14,983 million) in the reported quarter, increasing 2.7% year over year.

Operating income before depreciation and amortization (OIBDA) came in at €4,095 million ($4,811.6 million), declining 1.9% year over year. Quarterly OIBDA margin was 32.1% compared with 31.9% in the year-ago quarter. Operating income was €1,773 million (around $2,083.3 million) in the reported quarter, reflecting an increase of 3.2% year over year.

Segmental Detail

Telefonica Latin America: Revenues in Brazil decreased 0.5% on a reported basis but increased 1.2% on an organic basis to €2,935 million ($3,448.6 million). In the Hispano-American markets, revenues declined 4.7% on a reported basis but grew 16.1% on an organic basis to €2,981 million ($3,502.7 million). OIBDA margin in Brazil and the Hispano-American markets was 34.9% and 29.6% compared with the year-ago figures of 33.2% and 31%, respectively. In Brazil, Telefonica operates through its subsidiary Telefonica Brasil SA (NYSE:VIV) .

Telefonica Europe: In Spain, revenues decreased 0.3% on both a reported basis and an organic basis to €3,184 million (approximately $3,741.2 million). OIBDA margin in Spain was 41% compared with 42.3% in the year-ago quarter.

Revenues from Telefonica Deutschland dipped 1.3% to €1,850 million ($2,173.8 million) on both reported and organic basis. OIBDA margin in Deutschland was 24.7% compared with 24.3% in the year-ago quarter.

Revenues from Telefonica UK were down 4.4% on reported basis but increased 1.1% on organic basis to €1,602 million ($1,882.4 million). OIBDA margin in the UK was 25.7% compared with 27.3% in the year-ago quarter.

Telixus revenues were €177 million (about $208 million), up 5.3% on a reported basis and 7.5% on an organic basis.

Subscriber Statistics

As of Sep 30, 2017, total customer access lines were approximately 339.8431 million, down 1.2% year over year. Notably, in the Latin American markets, Telefonica competes with large global telecom operators like AT&T, Inc. (NYSE:T) and America Movil S.A.B. de C.V. (NYSE:AMX) . While Telefonica and AT&T currently carry a Zacks Rank #4 (Sell), America Movil carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

On a year-over-year basis, mobile access decreased 0.8% to 272.7427 million customers. Total Internet and data access dropped 0.2% to 21.6967 million users. Pay-TV access totaled 8.3758 million, down 0.2% year over year. LTE customer count was 88.9787 million, surging 55.2% year over year, and representing 34.6% of total mobile accesses. FTTx/cable access was 10.5118 million, up a substantial 20.8% year over year. Broadband access was 21.2438 million, inching down 0.1% year over year.

Liquidity and Cash Flow

Telefonica ended the third quarter of 2017 with cash and cash equivalents of €3,696 million (around $4,342.8 million) compared with €3,736 million (roughly $4,034.9 million) at the end of 2016. The company exited the reported quarter with a total debt of about €57,408 million (about $67,454.4 million) compared with €74,554 million ($80,518 million) recorded at the end of 2016.

In the first nine months of 2017, Telefonica generated €11,898 million (around $13,980.2 million) of cash from operations, increasing 4.3% year over year. Free cash flow in the reported period was €3,068 million (approximately $3,604.9 million), surging 48% year over year.

Outlook for 2017

Telefonica expects revenues to grow more than 1.5% year over year. OIBDA margin will expand 0.01% and capital expenditure will be around 16% of total revenue.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

AT&T Inc. (T): Free Stock Analysis Report

Telefonica SA (TEF): Free Stock Analysis Report

America Movil, S.A.B. de C.V. (AMX): Free Stock Analysis Report

Telefonica Brasil S.A. (VIV): Free Stock Analysis Report

Original post