Marsh & McLennan Companies, Inc. (NYSE:MMC) reported third-quarter 2017 operating earnings per share of 79 cents per share, beating the Zacks Consensus Estimate by 1.3%. Earnings improved 14% year over year.

Marsh & McLennan’s consolidated revenues were $3.34 million, up 3% year over year on an underlying basis. Revenues beat the Zacks Consensus Estimate by 0.3%.

Total operating expenses of $2.74 billion increased 7.1% year over year.

The effective tax rate in the third quarter of 2017 was 26.2% compared with 26.8% in the prior-year period.

Segment Results

Risk and Insurance Services

Revenues at the Risk and Insurance Services segment were $1.8 billion, up 3% year over year on an underlying basis. Adjusted operating income also grew 12% to $337 million from the prior-year quarter.

A unit within this segment, Marsh, reported revenues of $1.5 million, up 3% year over year on an underlying basis. Underlying revenues grew 2% year over year in international operations on 9% growth in Latin America, 7% in the Asia Pacific, partly offset by 2% decline in the underlying revenues for EMEA (Europe, Middle East and Africa).

Another unit under this segment, Guy Carpenter, displayed revenue growth of 4% year over year on an underlying basis to $270 million.

Consulting

The Consulting segment's revenues increased 2% year over year on an underlying basis to $1.6 billion. Additionally, adjusted operating income increased 7% year over year to $330 million.

A unit within this segment – Mercer – reported revenues of $1.1 billion, remained flat year over year on an underlying basis.

Another unit, Oliver Wyman Group, reported revenues of $438 million, up 7% year over year on an underlying basis.

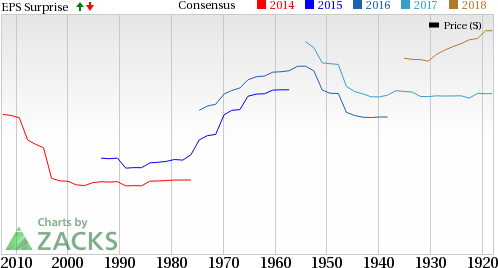

Marsh & McLennan Companies, Inc. Price, Consensus and EPS Surprise

Financial Update

Marsh & McLennan exited the quarter with cash and cash equivalents of $1.08 billion, up 5.1% from 2016 end.

As of Sep 30, 2017, Marsh & McLennan’s total assets were $19.7 million, up 8.2% from year-end 2016.

Total equity was $7.1 million, up 13.7% from year-end 2016.

Capital Deployment

The company repurchased 2.6 million shares of its common stock for $200 million in the third quarter.

Zacks Rank

Marsh & McLennan presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their third-quarter earnings so far, the bottom line at CNO Financial Group, Inc. (NYSE:CNO) , The Hartford Financial Services Group, Inc. (NYSE:HIG) and The Travelers Companies, Inc.’s (NYSE:TRV) beat their respective Zacks Consensus Estimate.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Marsh & McLennan Companies, Inc. (MMC): Free Stock Analysis Report

Hartford Financial Services Group, Inc. (The) (HIG): Free Stock Analysis Report

CNO Financial Group, Inc. (CNO): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Original post

Zacks Investment Research