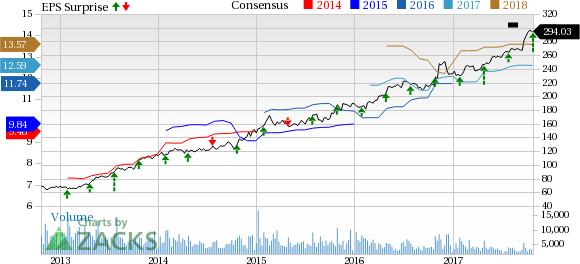

Northrop Grumman Corporation (NYSE:NOC) reported third-quarter 2017 earnings of $3.68 per share, beating the Zacks Consensus Estimate of $2.92 by 26%. Reported earnings were also up 9.9% from $3.35 recorded in the year-ago quarter.

Total Revenues

In third-quarter 2017, Northrop Grumman reported total revenues of $6.53 billion, beating the Zacks Consensus Estimate of $6.32 billion by 3.3%. Revenues also increased 6% from the year-ago figure of $6.16 billion. The revenue upside was primarily driven by increase in Aerospace Systems and Mission Systems sales.

Segmental Details

Aerospace Systems: Segment sales of $3.08 billion increased 10.8% year over year as a result of higher volumes of manned aircraft and space programs. Strong autonomous systems also benefited this segment.

Operating income also rose 7.4% to $334 million, while operating margin contracted 40 basis points (bps) to 10.8%.

Mission Systems: Segment sales increased 5.2% to $2.84 billion due to higher sales volume of Sensors and Processing as well as Advanced Capabilities systems.

Operating income improved 3.4% to $363 million, while operating margin contracted 20 bps to 12.8%.

Technology Services: Sales at the segment dipped 0.6% to $1.18 billion, driven by lower sales volume for System Modernization and Services programs.

Operating income increased 2.3% to $133 million while operating margin expanded 30 bps to 11.4%.

Operational Update

Total operating cost and expenses at the end of the quarter was $5.68 billion, up 6.6%.

Operating income during the quarter also increased 2.3% to $0.8 billion.

Financial Condition

Northrop Grumman’s cash and cash equivalents as of Sep 30, 2017 were $1.88 billion, down from $2.54 billion as of Dec 31, 2016.

Long-term debt (net of current portion) as of Sep 30, 2017, was $6.23 billion, down from $7.06 billion as of 2016 end.

Net cash flow from operating activities as of Sep 30, 2017 was $1.01 billion compared with the year-ago figure of $1.28 billion.

2017 Guidance

Northrop Grumman has raised its financial guidance for 2017. The company currently expects to generate revenues approximately $25.5 billion during 2017 compared with its earlier guidance of lower than $25 billion. On the bottom-line front, the company now expects to generate earnings in the range of $12.90-$13.10 compared with the earlier guidance range of $12.10-$12.40.

However, the company maintains its free cash flow guidance in the range of $1.8-$2 billion.

Zacks Rank

Northrop Grumman currently carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Upcoming Peer Releases

Huntington Ingalls Industries, Inc. (NYSE:HII) is expected to report third-quarter 2017 results on Nov 8. The company surpassed the Zacks Consensus Estimate in the trailing four quarters, with a positive average surprise of 8.56%. It has a solid long-term earnings growth rate of 15%.

Recent Peer Release

Lockheed Martin Corporation (NYSE:LMT) reported third-quarter 2017 earnings from continuing operations of $3.24 per share, which missed the Zacks Consensus Estimate of $3.25 by 0.3%. In the quarter, total revenues came in at $12.17 billion, which missed the Zacks Consensus Estimate of $12.83 billion by 5.1%.

Textron Inc. (NYSE:TXT) recently reported third-quarter 2017 adjusted earnings from continuing operations of 65 cents per share, beating the Zacks Consensus Estimate of 62 cents by 4.8%. Total revenues in the quarter were $3.48 billion, which missed the Zacks Consensus Estimate of $3.54 billion by 1.5%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Original post