SUPERVALU INC (NYSE:SVU) reported better-than-expected sales and earnings in second-quarter fiscal 2018.

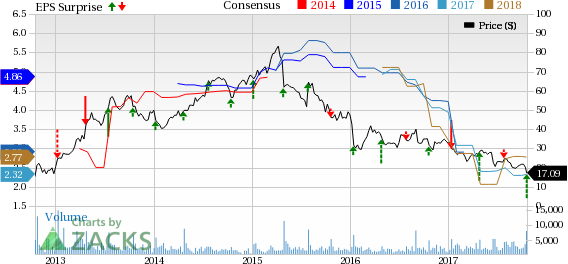

The company reported adjusted earnings per share of 46 cents that surpassed the Zacks Consensus Estimate of 35 cents and the year-ago earnings of 21 cents. Robust earnings were driven by higher sales in the Wholesale business and the benefits from the completed acquisition of Unified Grocers in June.

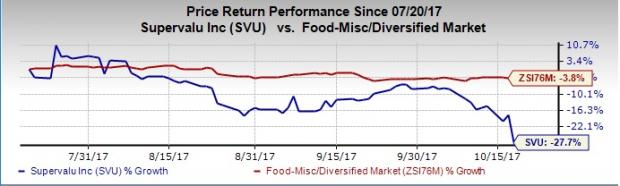

Though the company reported a strong second quarter, its share performance has been unimpressive due to negative surprises reported in two of the past four quarters. In fact, the Zacks Rank #3 (Hold) company’s shares have underperformed the industry over the last three months. The stock has lost 27.7% in the last three months, wider than the industry’s decline of 3.8%.

Quarter in Detail

SUPERVALU’s net sales rose 35% year over year to $3,800 million. Also, the top line surpassed the Zacks Consensus Estimate of 3,758 million. This upside was backed by increased sales witnessed at the Wholesale segment, but were hurt by decline in Retail net sales.

Gross profit for the quarter amounted $428 million that depicted 8% growth from the prior year. However, margin contracted 280 basis points to 11.3%, owing to store closing costs and changes in business segment mix. Wholesale segment accounted for a large portion of the total sales and gross profit during the quarter.

During the quarter, SUPERVALU’s operating loss was of $7 million, as compared with the operating earnings of $58 million in the prior-year period. This was caused by higher selling and administrative expenses.

Segment Details

Wholesale: Net sales at Wholesale business grew 58% year over year to $2.74 billion, mainly driven by the revenues from Unified Grocers business. Additionally, the segment also gained from sales to new customers and stores. These were partially offset by reduced military sales and stores that no longer receive supplies from SUPERVALU. Also, the segment’s operating income totaled $61 million, up from $58 million in the year-ago quarter.

Retail: Net sales at Retail slipped 1.1% to $1.02 billion. This decrease represents store closures and unfavorable identical store sales of 3.5%, partly mitigated by sales from acquired and new outlets.

In fact, we note that this leading grocery dealer is witnessing sluggish sales in the retail business due to competitive pressures. This is the tenth consecutive quarter of sales decline of the retail segment.

Further, the segment reported operating loss of $58 million, wider than the operating loss of $12 million in the year-ago quarter. The downside was driven by lower sales and reduced gross margin owing to enhanced promotional activities.

Corporate: During the second quarter, fees earned under services agreements were down 2.4% to $40 million. Further, the segment delivered operating loss of $10 million, as against operating income of $12 million delivered in the year-ago quarter.

Financial Update

The company’s cash and cash equivalents stood at $209 million as of Sep 9 compared to $252 million as of Jun 17.

Long-term debt was $1,601 million and total stockholders’ equity totaled $373 million as of Sep 9, compared with long-term debt of $1,282 billion and stockholders’ equity of $397 million as of Jun 17.

Further, the company’s year-to-date net cash flows from operating activities of continuing operations amounted $116 million, as compared with $208 million in the previous year.

Outlook

For fiscal 2018, management continues to expect adjusted EBITDA, including Unified Grocers of $475-$495 million.

We commend SUPERVALU’s efforts to develop the wholesale operations, primarily through adding new customers, retaining and developing business with existing customers and acquisitions. In fact, the acquisition of Unified Grocers has yielded positive results and is expected to radically boost the company’s wholesale segment, alongside offering new growth opportunities across multiple geographies. It also recently announced a definitive merger agreement to acquire Associated Grocers for approximately $180 million. The company has also been working hard toward achieving a turnaround in its retail segment, reduce costs and increase operating efficiency.

Looking for More? Check These Three Consumer Staple Stocks

Investors interested in the same sector may also consider stocks such as McCormick & Company, Inc (NYSE:MKC) flaunting a Zacks Rank #1(Strong Buy), Constellation Brands, Inc (NYSE:STZ) and The Estée Lauder Companies Inc (NYSE:EL) each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

McCormick delivered an average positive earnings surprise of 4.1% in the trailing four quarters. It has a long-term earnings growth rate of 9.4%.

Constellation Brands delivered an average positive earnings surprise of 13.6% in the trailing four quarters. It has a long-term earnings growth rate of 14.8%.

Estée Lauder delivered an average positive earnings surprise of 13.7% in the trailing four quarters. It has a long-term earnings growth rate of 12.1%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Constellation Brands Inc (STZ): Free Stock Analysis Report

Estee Lauder Companies, Inc. (The) (EL): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

SuperValu Inc. (SVU): Free Stock Analysis Report

Original post

Zacks Investment Research