Forex Daily Technical Overview 17 Oct 2017

GBP/USD Intraday: under pressure.

Pivot: 1.3290

Our preference: short positions below 1.3290 with targets at 1.3220 & 1.3180 in extension.

Alternative scenario: above 1.3290 look for further upside with 1.3325 & 1.3350 as targets.

Comment: as long as the resistance at 1.3290 is not surpassed, the risk of the break below 1.3220 remains high.

Supports and resistances:

1.3350

1.3325

1.3290

1.3259 Last

1.3220

1.3180

1.3150

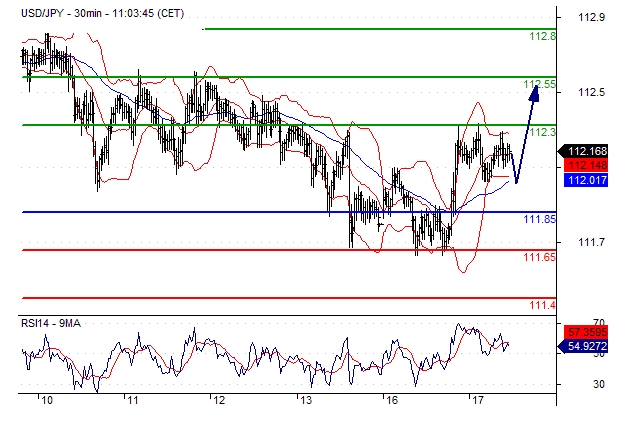

USD/JPY Intraday: the upside prevails.

Pivot: 111.85

Our preference: long positions above 111.85 with targets at 112.30 & 112.55 in extension.

Alternative scenario: below 111.85 look for further downside with 111.65 & 111.40 as targets.

Comment: the RSI shows upside momentum.

Supports and resistances:

112.80

112.55

112.30

112.10 Last

111.85

111.65

111.40

EUR/USD Intraday: the downside prevails.

Pivot: 1.1800

Our preference: short positions below 1.1800 with targets at 1.1740 & 1.1715 in extension.

Alternative scenario: above 1.1800 look for further upside with 1.1815 & 1.1835 as targets.

Comment: the RSI is bearish and calls for further downside.

Supports and resistances:

1.1835

1.1815

1.1800

1.1765 Last

1.1740

1.1715

1.1695

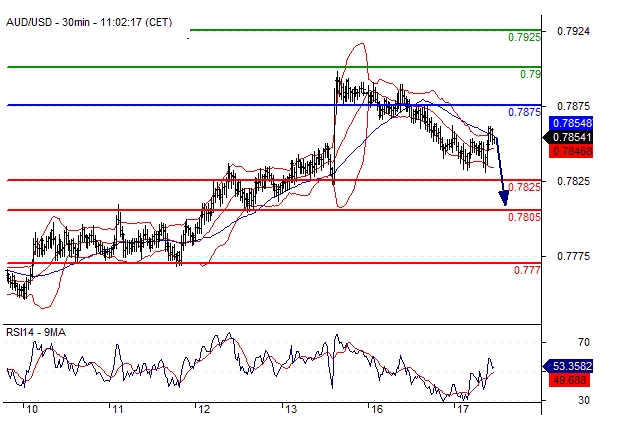

AUD/USD Intraday: consolidation.

Pivot: 0.7875

Our preference: short positions below 0.7875 with targets at 0.7825 & 0.7805 in extension.

Alternative scenario: above 0.7875 look for further upside with 0.7900 & 0.7925 as targets.

Comment: as long as 0.7875 is resistance, look for choppy price action with a bearish bias.

Supports and resistances:

0.7925

0.7900

0.7875

0.7850 Last

0.7825

0.7805

0.7770

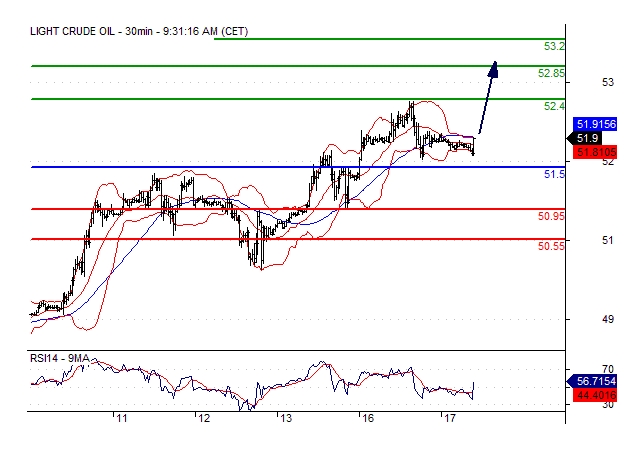

Crude Oil WTI Futures (X7) Intraday: the bias remains bullish.

Pivot: 51.50

Our preference: long positions above 51.50 with targets at 52.40 & 52.85 in extension.

Alternative scenario: below 51.50 look for further downside with 50.95 & 50.55 as targets.

Comment: the RSI is mixed with a bullish bias.

Supports and resistances:

53.20

52.85

52.40

51.90 Last

51.50

50.95

50.55

Gold spot Intraday: under pressure.

Pivot: 1296.00

Our preference: short positions below 1296.00 with targets at 1284.00 & 1282.00 in extension.

Alternative scenario: above 1296.00 look for further upside with 1300.00 & 1306.00 as targets.

Comment: the RSI is bearish and calls for further downside.

Supports and resistances:

1306.00

1300.00

1296.00

1290.40 Last

1284.00

1282.00

1279.50