Snap-on Incorporated (NYSE:SNA) is scheduled to report second-quarter 2017 results, before the opening bell on Jul 20.

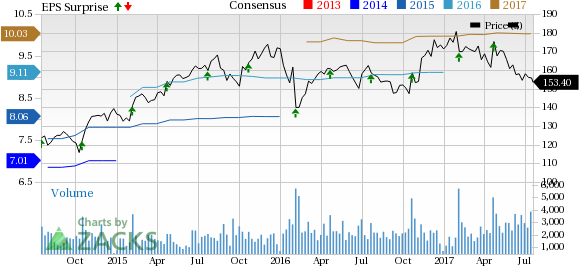

Snap-on has an outstanding earnings surprise history — it has not missed estimates in over seven years. Last quarter, the company registered a positive earnings surprise of 2.1%, generating an average positive surprise of 3.6% for the trailing four quarters.

Let's see how things are shaping up for this announcement and whether Snap-on is set to add yet another earnings beat to its long-standing winning streak.

Factors to Consider

Snap-on’s successful earnings streak reflects its consistent capability to leverage on market opportunities for augmenting growth. Encouragingly, the company has been witnessing robust prospects in most of its business lines which signal brighter days ahead. Snap-On’s broad product line adds to its strength. Additionally, the company’s financial services portfolio has been recording steady growth for the past few years.

Snap-On believes that its recent Car-O-Liner buyout will strengthen its Repair Systems & Information Group offering, enabling it to fortify its footprint in the auto and heavy-duty markets. Moving ahead, Snap-On anticipates this company will generate operating income margin comparable to the RS&I undercar equipment business.

Snap-On Incorporated Price, Consensus and EPS Surprise

Additionally, Tools Group and Repair Systems & Information segments are anticipated to act as major profit churners on the back of positive industry trends. While factors like rising penetration in emerging markets, and constant software and hardware upgrades have been fueling Tools Group’s growth, Repair Systems is gaining from business deals with independent repair shop owners and managers.

Though Snap-On’s bottom-line performance remained unaffected amid macroeconomic woes, the company is faced with multiple issues that may hurt the second-quarter results. The ongoing softness in industrial markets has significantly affected client spending, marring the company’s prospects. Also, sluggish oil and gas market activities are likely to affect the company’s top line in the quarter to be reported.

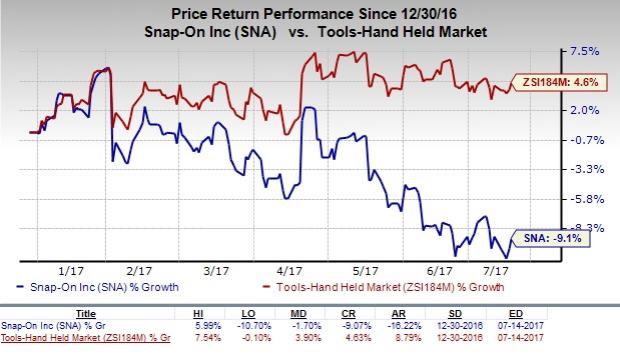

Further, persistent contraction in capital expenditure by auto dealers and intensifying used car asset quality pressure are formidable headwinds for the company. Year to date, Snap-on’s shares have declined 9.1%, grossly underperforming the Zacks categorized Tools – Handheld industry’s average positive return of 4.6%.

Moreover, foreign currency fluctuations pose a major concern as one-third of the company’s revenues are derived from its European businesses. Due to foreign currency woes, in first-quarter 2017, Commercial & Industrial Group sales declined $4.7 million, Tools Group sales decreased $3.2 million and Repair Systems & Information segment recorded a $2.9-million sales reduction. We believe currency fluctuations will remain a risk to the company’s top line in the quarter under review as well.

Earnings Whispers

Our proven model does not conclusively show that Snap-on will beat earnings estimates in this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Earnings ESP for the company is currently -0.78%. This is because the Most Accurate estimate is pegged at $2.53, lower than the Zacks Consensus Estimate of $2.55. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Snap-on has a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

Imperial Oil Limited (TO:IMO) , with an Earnings ESP of +7.69% and a Zacks Rank #3, is expected to release quarterly numbers around Jul 28. You can see the complete list of today’s Zacks #1 Rank stocks here.

Belden Inc. (NYSE:BDC) , with an Earnings ESP of +0.83% and a Zacks Rank #1, is slated to report results on Aug 2.

Caterpillar Inc. (NYSE:CAT) , with an Earnings ESP of +11.76% and a Zacks Rank #2, is expected to report quarterly numbers on Jul 25.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Belden Inc (BDC): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Imperial Oil Limited (IMO): Free Stock Analysis Report

Snap-On Incorporated (SNA): Free Stock Analysis Report

Original post

Zacks Investment Research